Let’s chat Engagement

Retain clients with proven engagement tools.

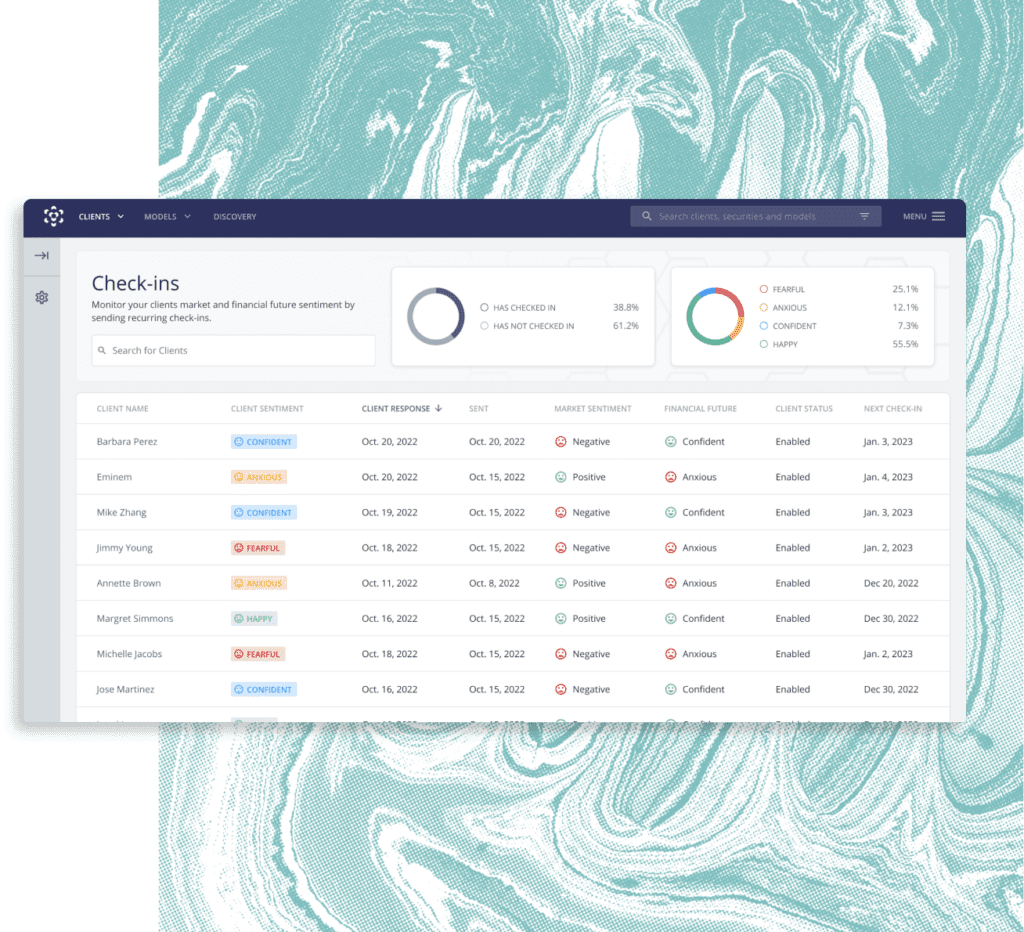

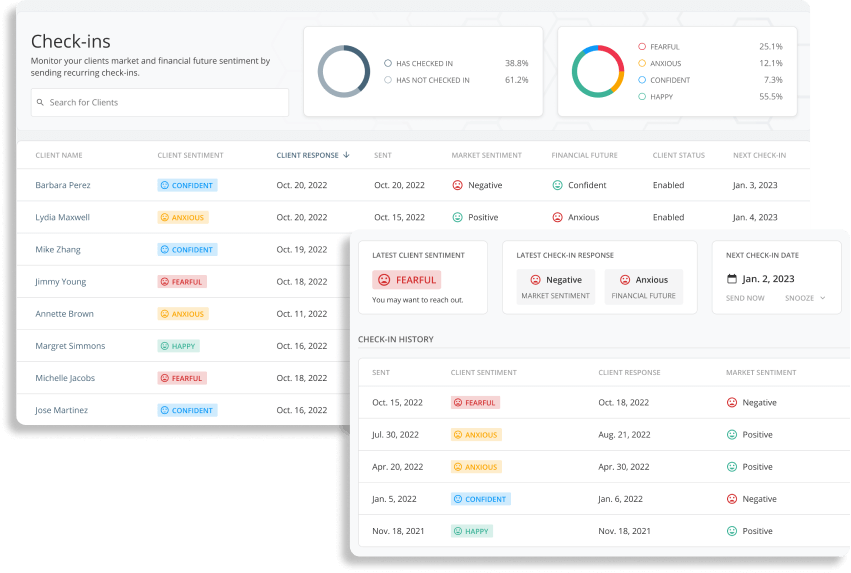

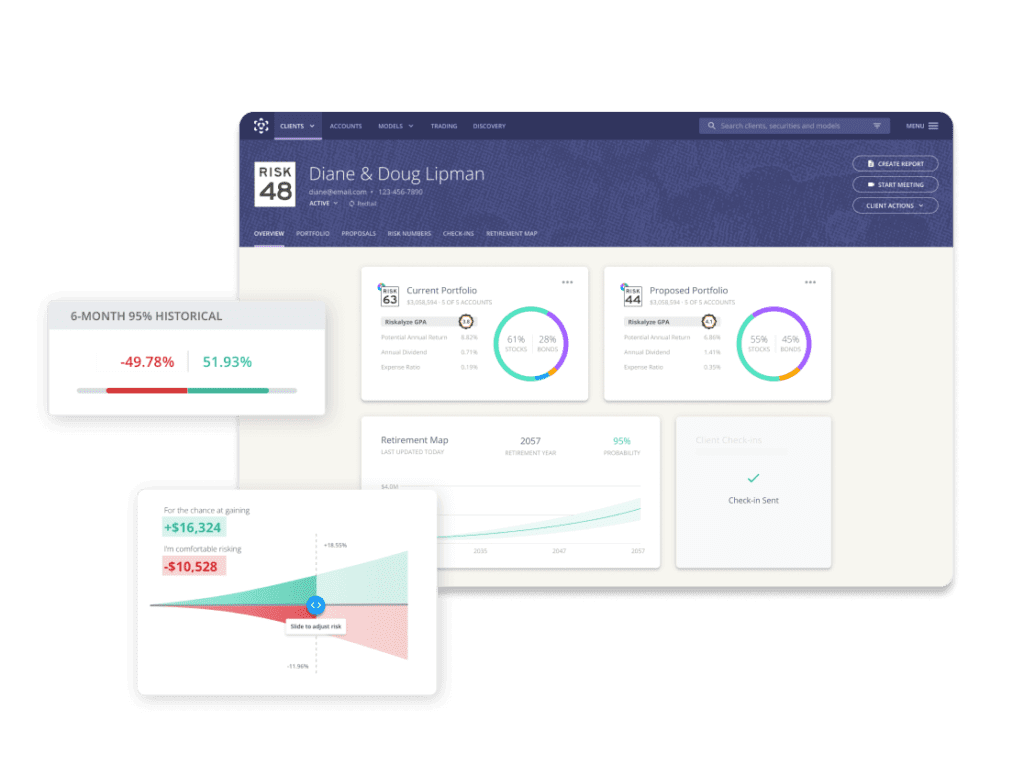

Now, advisors can build a strong foundation with clients and get early warning signals when their psychology needs a little care. With powerful engagement tools like Check-ins, Stress Tests, and Scenarios, your team can always keep their finger on the pulse of client sentiment.

-

Financial Advisors

Gone are the days of guessing which clients are worried or stressed about their portfolio. Advisors can automate monthly or quarterly Check-ins to take the pulse of clients and know when someone might need a little extra care.

-

Clients & Prospects

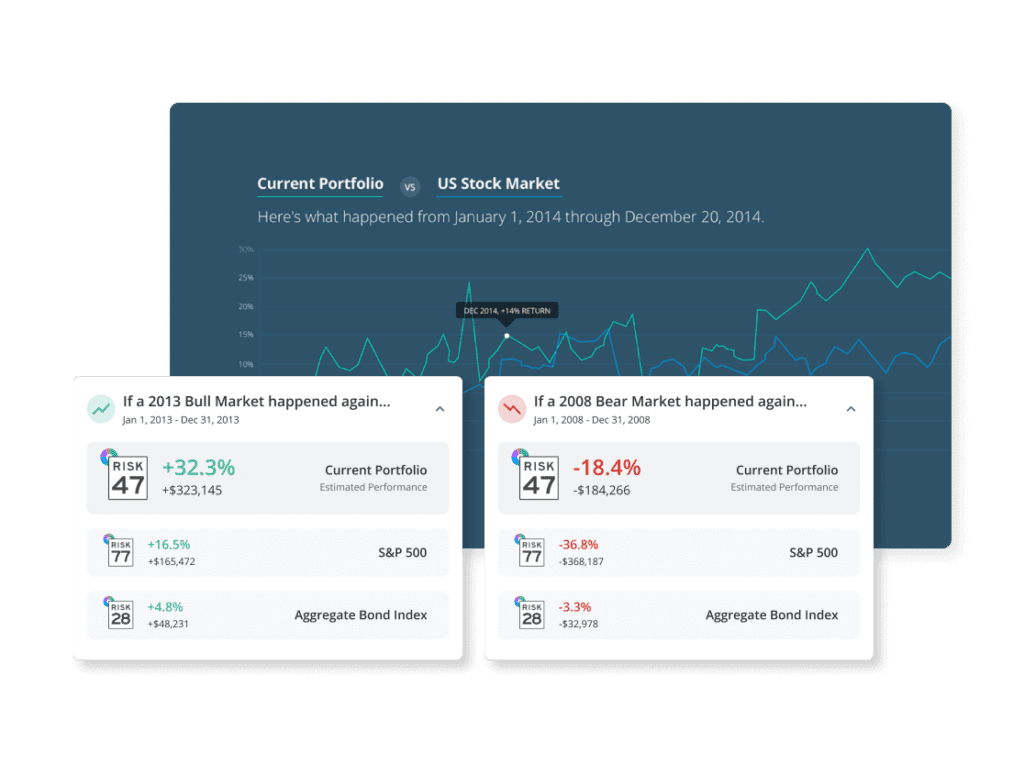

Leverage Stress Tests and Scenarios to help clients understand what is ‘normal’ for their portfolio. Now you can string these events together to create a portfolio narrative that settles the question once and for all… “Why is the market beating my portfolio?”

-

Firm Executives

Give your team the client engagement tools needed to grow and retain their book of business. With the Nitrogen, you can rest assured knowing your firm has exactly what they need to keep clients’ minds at ease during market downturns.

Benefits of a

Client Engagement Solution

Have the tools and resources to know when a client might need your team’s attention.

Illustrate what is ‘normal’ for a portfolio so clients stay fearless in down markets.

Reassure your clients that you’ve got their best interests in mind.

Request a demo

See for yourself how the Nitrogen Client Engagement Platform can help your firm grow your assets, increase client satisfaction, and protect your business.

Engage with Clients and Prospects

Create a roadmap for your clients with Nitrogen — your go-to interface where assembling reports isn’t just intuitive, it’s powerful and flexible.

Check-in emails build a strong foundation to support your message between client reviews and give you an early warning signal when client psychology needs care.

Run portfolios through historical events like the 2008 Financial Crisis or 2013 Bull Market to help clients understand what it means to control risk or beat the market.

A POWERFUL TOOL FOR FIRMS

See how firms are driving

growth with Nitrogen

Acorn Wealth Advisors use detailed portfolio stats in Nitrogen to simplify complex concepts and enhance client trust.

When unexpected events like COVID-19 impact the world we live in, this Marine Corps veteran turned financial advisor believes that educating every day, hard-working people about their finances can mitigate fears and help protect their investments.

Discover how P.J. has won clients faster and retained them for longer with Nitrogen.

Trusted by the best brands in wealth management

Thousands of wealth management firms and financial advisors have propelled their success with Nitrogen.