By: Dane Kurtz

Senior Product Manager – Trading, Nitrogen

It’s hard truth time. Most tax loss harvesting tools do little more than send glorified desktop notifications. Think about it for a minute.

If you use any of the existing rules-based rebalancers, you already know it’s a stretch to say that the technology even does any true tax loss harvesting.

Instead, you do all the work of identifying harvesting opportunities, calculating which ones make sense, and then the software sends you down a ten-step process.

Basically, these legacy tools are just fancy alerts to warn you against buying the wrong security during a wash sale window.

Human beings make roughly 35,000 decisions a day. As an advisor, if you manage 100 taxable accounts, and you have to identify losses one account and one position at a time, how can you possibly take advantage of harvesting losses at the right moment? And how do you make sure you don’t miss a switchback, and let the market get away from you?

Shouldn’t software exist to solve problems like these? We think it should—and those are the types of solutions we try to bring to advisors.

When we set out to build a tax loss harvesting solution, we started from scratch with four qualities in mind:

- Easy to Use

- Automated

- Increased Efficiency

- Low Cost

Sounds great, right? Here’s what it looks like.

4 Ways Nitrogen Simplifies Tax Loss Harvesting

Let’s look at tax loss harvesting in Nitrogen according to those four criteria we established.

1. Easy to Use

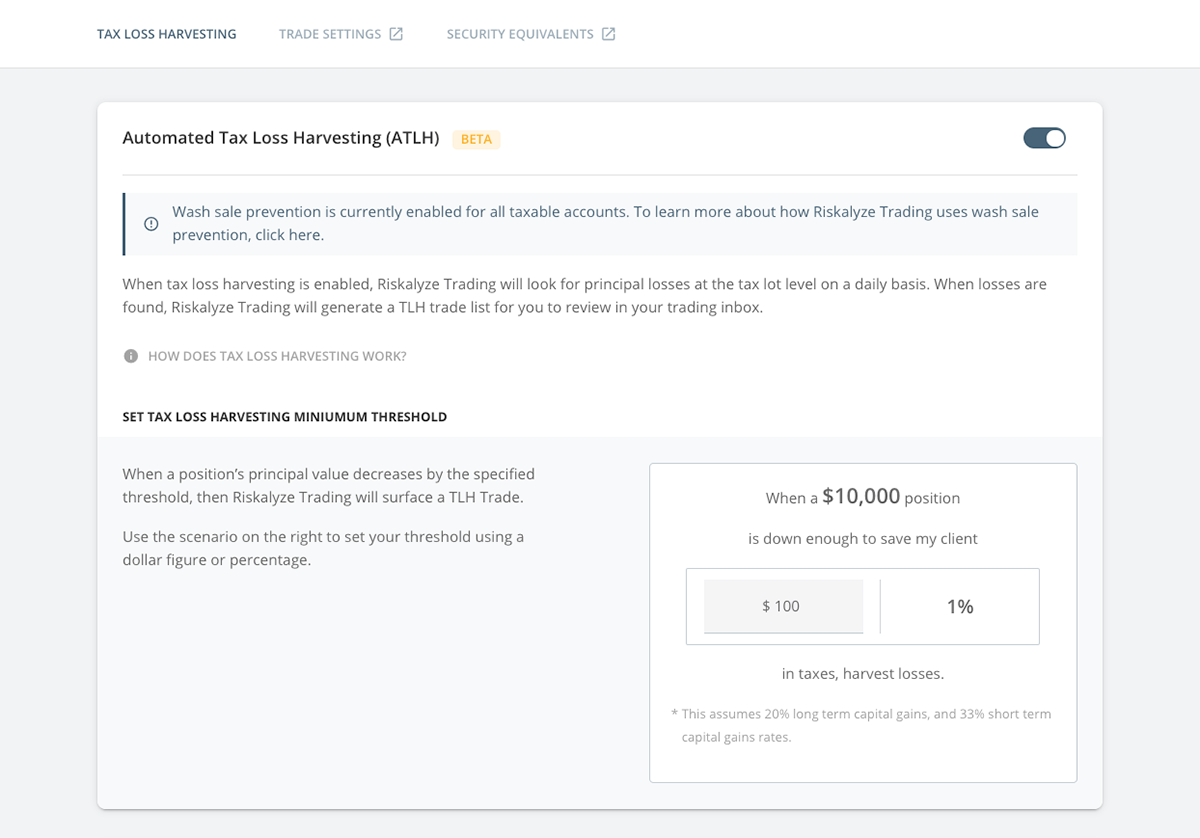

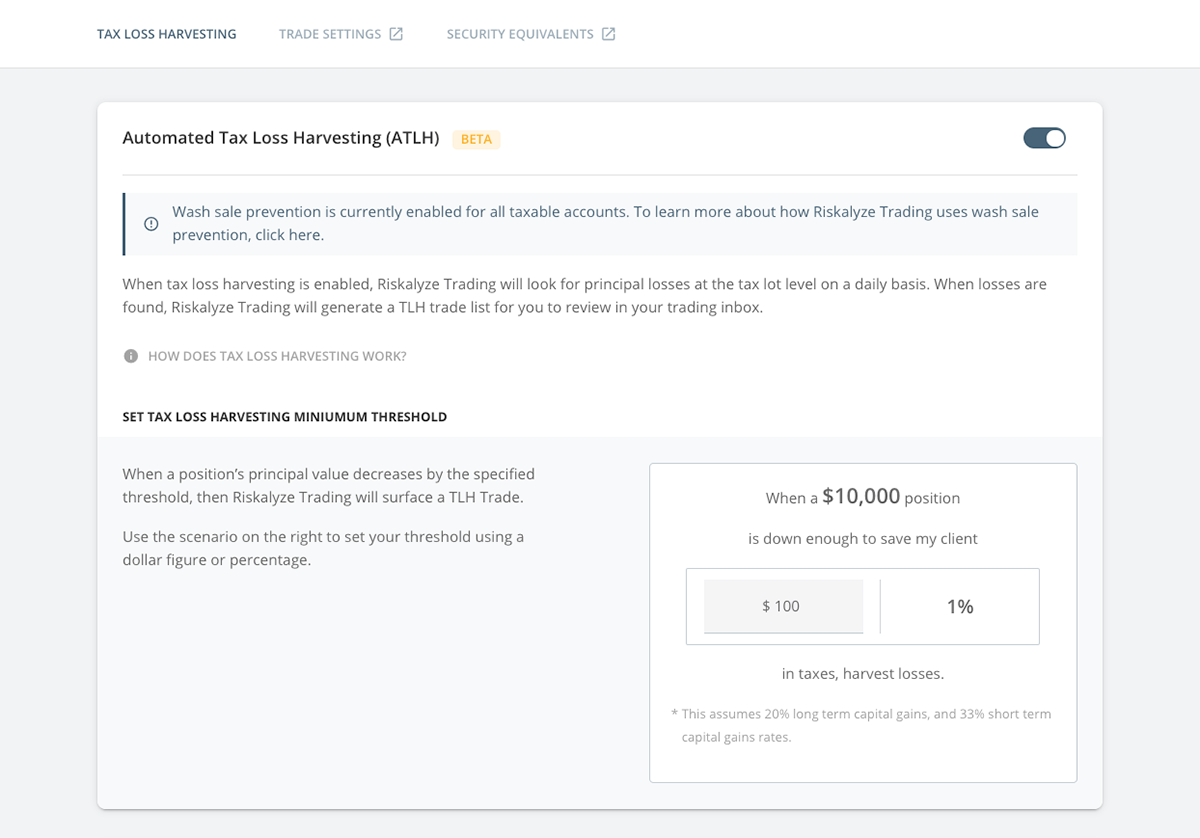

First up, it’s easy to use.If you’re already a Nitrogen Trading user, all you’ll have to do is turn “Automated Tax Loss Harvesting” to “On.”

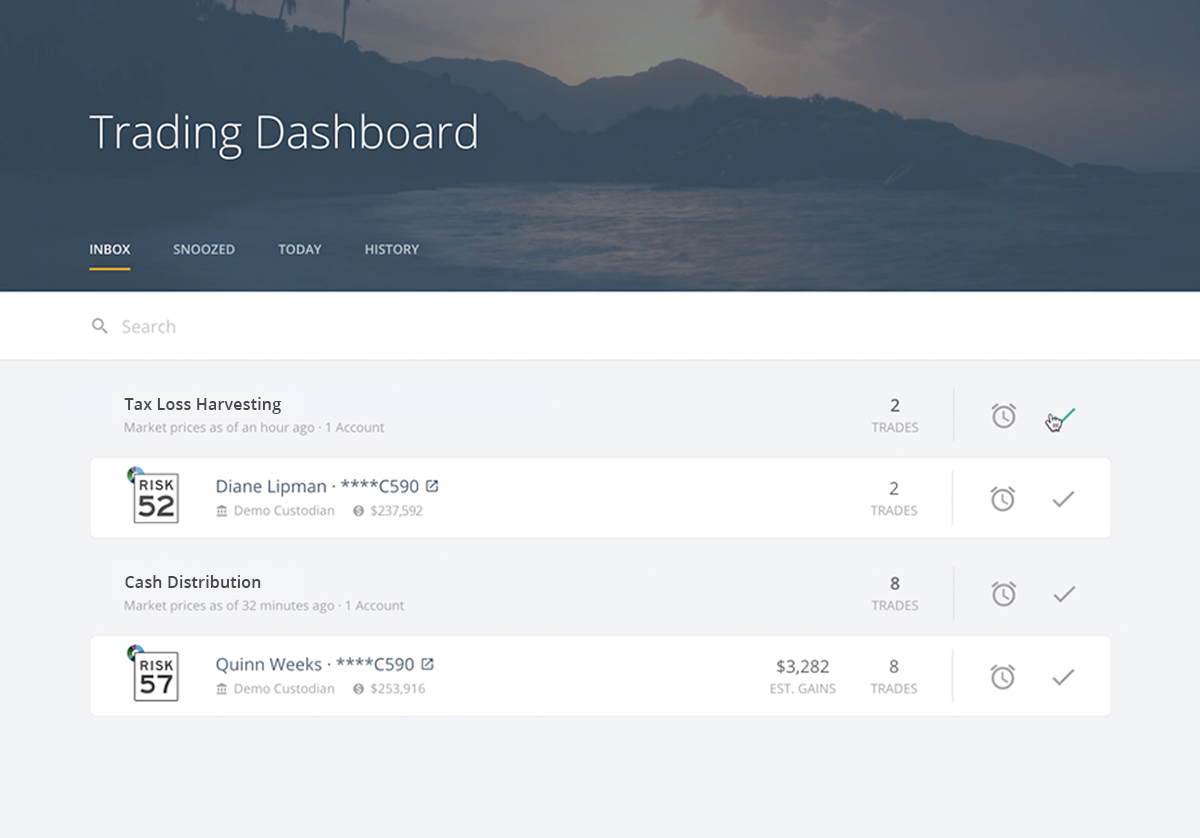

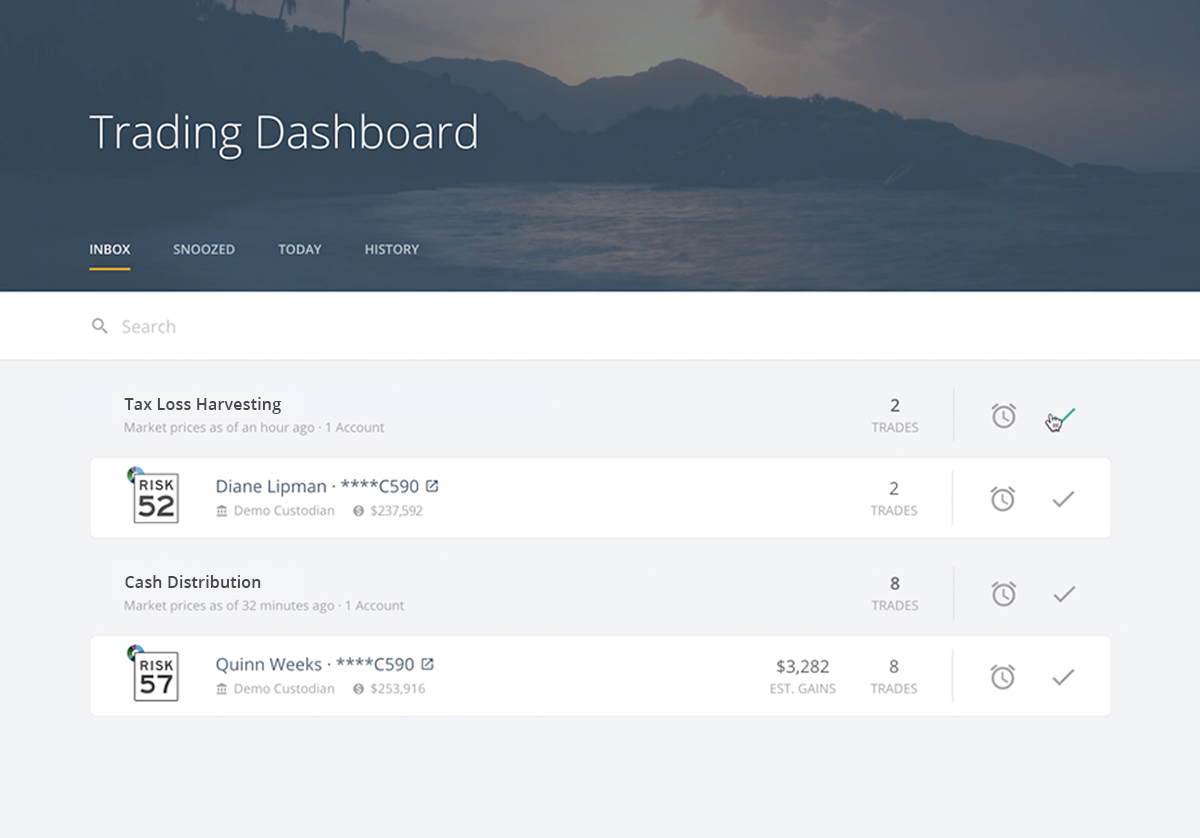

Right away, the engine will start proactively scanning your book of business for opportunities to put on your trading dashboard and generate tax alpha for your clients.

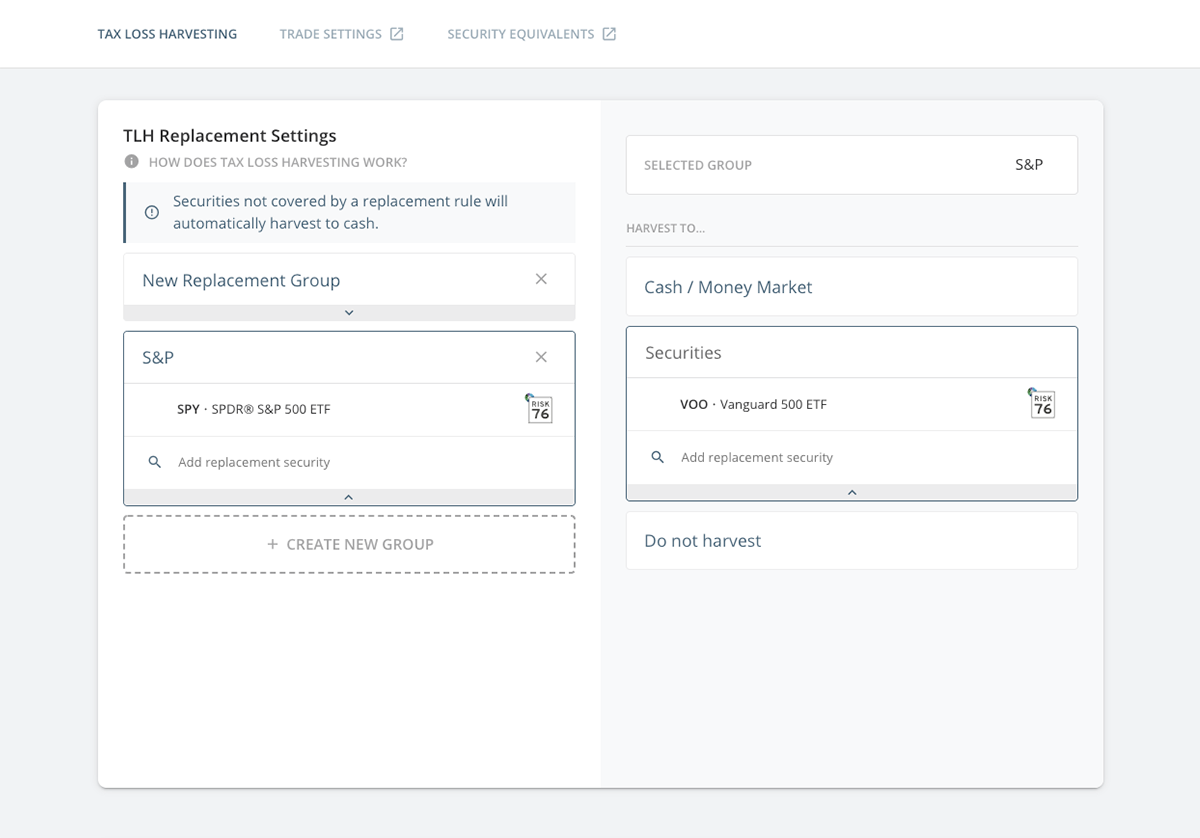

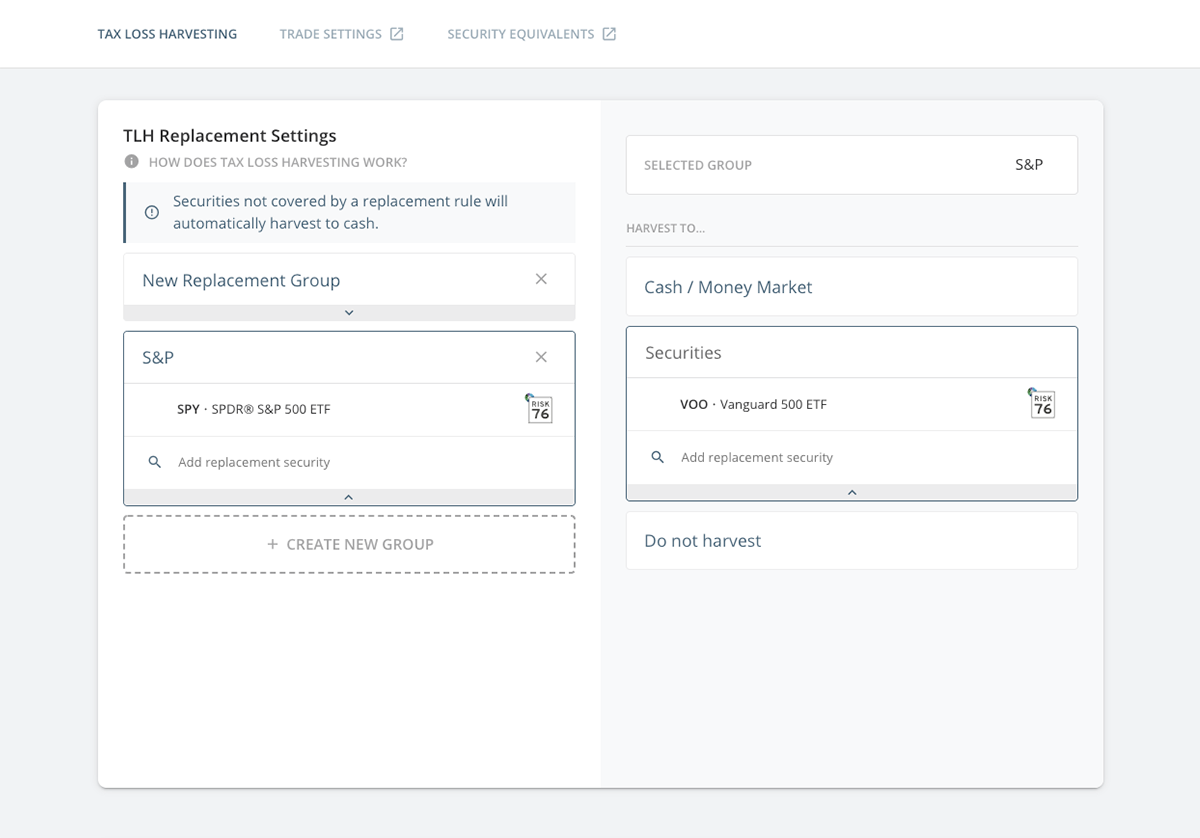

Even though it’s easy to use, it’s also powerful. You can set up automated replacements at the Risk Number level. So if you have a security in a portfolio right now that’s in the Risk 65 to Risk 85 range, you can choose a replacement security for it in that same exact range. The system will replace securities automatically based on your choices.

That’s nearly all the configuration you need to do to get started. It’s that simple.

2. Automation

The second criteria is automation—because the other rebalancers out there aren’t really truly automated, right?

If you’ve got a portfolio where an asset experiences a loss, most rebalancers, at best, will tell you to harvest into cash and then buy back into the asset 31 days later. Buying an alternate position is a manual process, and it’s difficult to get the client to their target allocation later.

With Automated Tax Loss Harvesting, buying into a parallel position and maintaining market exposure is super simple using those replacements we already set up. You barely even have to think about it.

3. Increased Efficiency

Now, what about increased efficiency? Automated Tax Loss Harvesting isn’t just more efficient for advisors—it’s way more efficient for your client’s wallet too.If we use our automation example of buying a replacement security instead of selling to cash, you can help clients navigate turbulent times by keeping them in the market instead of going all the way out—and potentially increase their rate of return as a result.

Once the 31 day period is over and you want to buy back into the original security you sold, Nitrogen will automate the process of gradually moving an account back to its target—without generating taxes your client doesn’t want to pay.

You can get rid of the sticky notes and 3×5 notecards littering your desk and close down your spreadsheet program. Automated Tax Loss Harvesting just works.

In short, it’s the perfect balance of risk alpha and tax alpha.

4. Low Cost

If you’re already a Nitrogen Trading user, these new features are ready to go on your Trading dashboard and won’t cost you a dime.If you’re worried about switching over to new Nitrogen Trading, don’t worry.

We’ve got a team of dedicated onboarding managers and we include comprehensive training to make the transition as easy as possible.

The New Era of Trading is Here

Here’s the bottom line: We believe you deserve to be your clients’ tax superhero, and generating tax alpha through intelligent trading optimization will help you get there.

Download our Tax Intelligent Trading white paper to go deeper into the math behind the new Nitrogen Trading engine. Click here to get your copy.