Advisors love pinpointing a client’s risk tolerance and demonstrating alignment between their risk capacity and portfolio risk. It’s why they’ve delivered millions of Risk Numbers® to empower clients to invest fearlessly.

But every now and then, we still hear a familiar question:

“Can I print your Risk Tolerance Questionnaire?”

And we get it. Especially if you’ve been providing solid investment advice for decades, you’ve likely spent most of that time handing clients a physical risk tolerance questionnaire (RTQ) with ten questions on it. You reach behind you and open a cabinet that has your files, grab a piece of paper, and slide it across the desk. It’s almost become muscle memory. The investor checks a few boxes like “If your portfolio were a car, which kind of car would it be?” and a few other questions that nudge results based on market sentiment and time horizon, and boom. They’re ‘moderately conservative.’

But advisors have since embraced a more quantitative and objective approach. One that is built upon academic research and a Nobel Prize-winning framework called Prospect Theory. Risk Assessments in Nitrogen aren’t just a piece of paper you can grab from a file folder and hand to a client.

In fact, it’s not a piece of paper at all; it’s a dynamic engine.

So, if you’re wondering whether you can print Nitrogen’s Risk Questionnaire, the short answer is no—but the long answer is a lot more interesting.

Let’s get into it.

So, what would happen if I tried to print it?

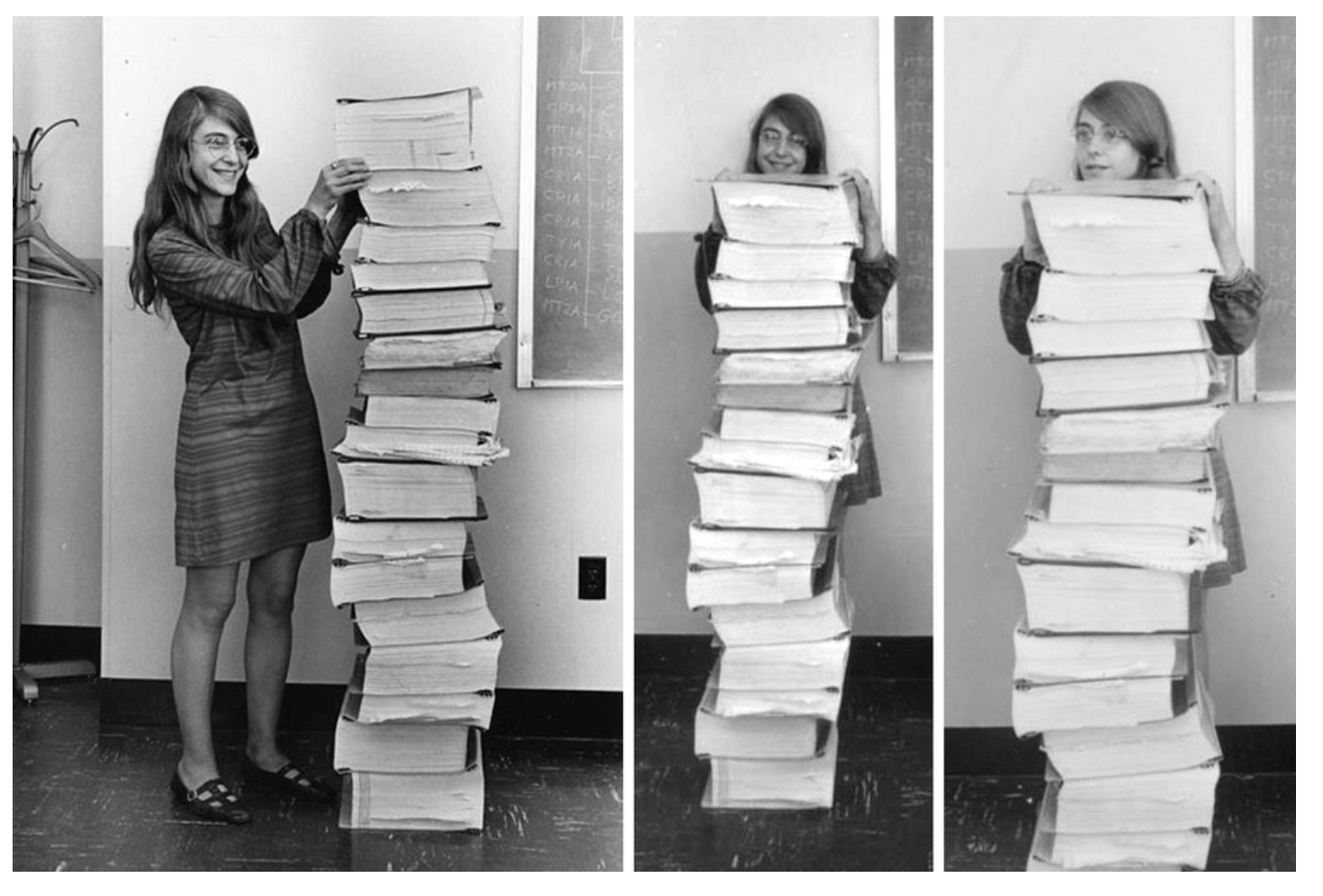

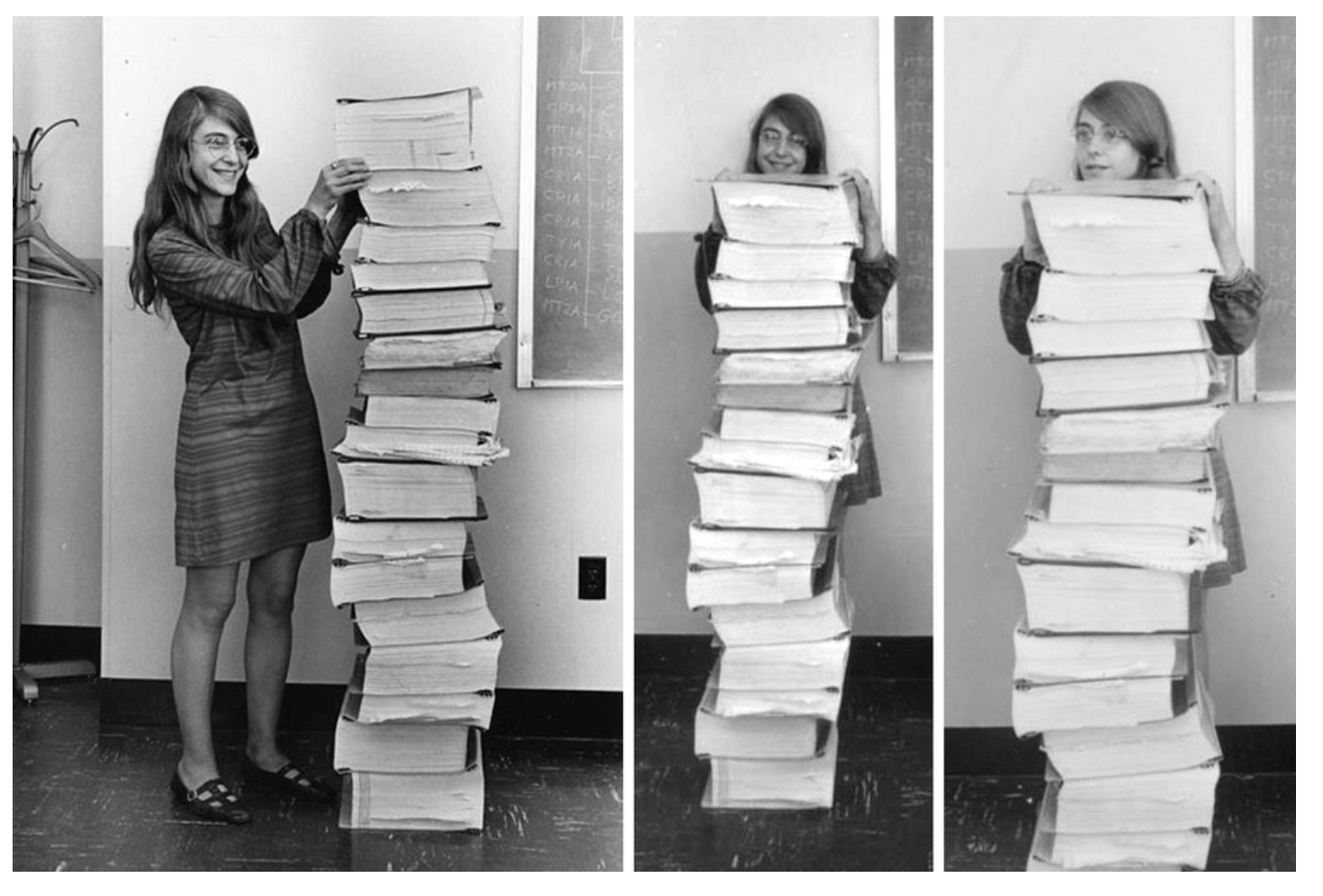

Well, here was our hypothesis: if you tried to have a printed version of Nitrogen’s risk tolerance questionnaire on hand, you wouldn’t just have a single piece of paper in the file cabinet behind you. You’d end up looking more like Margaret Hamilton, the computer scientist who wrote the software that originally took America to the moon.

(Image Source: MIT)

(Image Source: MIT)

But the reality is that your stack of paper would be much, much higher.

Here’s why.

Risk Assessments must be based on real dollar amounts.

If there’s one thing we’ve discovered about risk tolerance, it’s this: it can only be accurately measured with assessments that use real dollar amounts that are relevant to that investor. Your client can’t just find their own Risk Number by playing around with Warren Buffet’s money. Our risk assessment methodology was built upon a Nobel Prize-winning framework and then validated by third party academics — and clients want to do it the right way.

Risk Assessments must be dynamic.

A robust risk tolerance questionnaire needs to test prior assumptions and nudge them for accuracy, and Nitrogen does so intelligently. Each question is based upon the math of the prior questions. Those calculations are made in the cloud, and trying to do them on paper would put you into quite the obnoxious game of “choose your next stack of paper.”

So, here’s how that math plays out.

And seeing as we’re big fans of math, we decided to have a little fun with it.

If each questionnaire starts with a relevant dollar amount, that gives us quite a few starting places to print. Since there aren’t any restrictions on the total-dollar input, let’s cap it using the richest person in the world for this exercise.

That means we’ve got as many variables as there are integers from 1 to Bezos (Bz).

And we’re just getting started.

Now we arrive at the interactive module that kicks off the measurement of the client’s comfort zone. This slider has 158 gradations, so our variables are already racking up to 158*Bz.

The series of dynamic gamble/guarantee scenarios that follow bring us to a whopping 966 trillion paths through the Risk Assessment. That means you better get ready to have 1,962,788,100,000,000 pieces of paper on hand. That’s almost two quadrillion!

So, how high is this stack of paper shaping up to be?

To uncover that, we had to do our research on something quite foreign to a software company: paper.

Now, we could go with cardstock here — but that feels a bit like cheating and would certainly be a waste of resources. We’re going to print this thing out on standard paper weight, which clocks in at about 1/10th of a millimeter (0.0039 inches).

So, let’s print it out. Drumroll please…

We’re looking at a stack of paper 1.312 astronomical units high (an astronomical unit is the approximate distance between the Earth and the Sun).

Yep, if you were to print the Risk Assessment in Nitrogen, your stack of paper would make it all the way to the Sun.

Now, don’t get too far ahead of us. There are a few problems with this:

- Believe it or not, there aren’t enough resources on planet earth to support this demand for parchment.

- If there were, current prices would put your toner bill upwards of $155 Trillion, which isn’t going to fit nicely on your next ADV update.

- Once you get within a few million miles of the sun, your risk tolerance questionnaire will burst into flames and be about as useful as the old subjective RTQs of the past.

To us, it’s pretty clear why a dynamic, software-based risk tolerance questionnaire is superior to the old-school pen and paper method. There’s simply no possible way to get the amount of depth offered by a dynamic questionnaire when you use a single sheet of paper to measure risk.

That depth of analysis isn’t just for show; it leads to confidence and quantitative evidence that you know your client, you know what they need, and you’ve put them in the right risk tolerance to support their desired investment outcomes.

And an investment philosophy guided by risk isn’t one that’s driven by fear. In fact, it’s quite the opposite.

Want to see how quantifying risk tolerance leads to fearless investing? Click here to schedule a demo of the Risk Alignment Platform built upon the world’s #1 risk tolerance questionnaire.