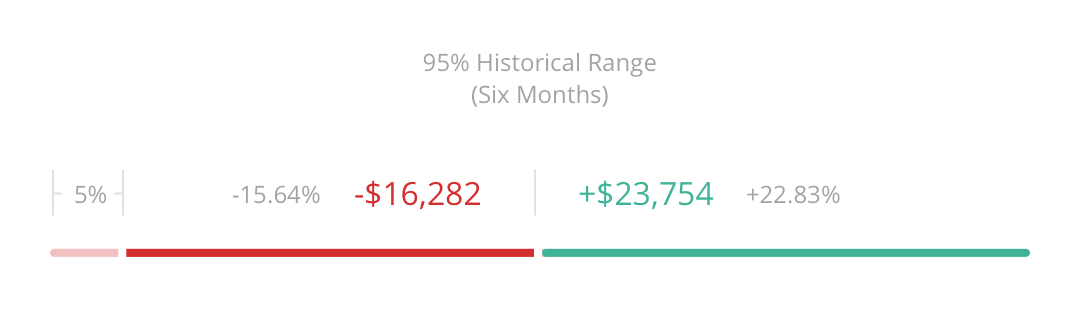

If there’s a common question that advisors raise when they first see Nitrogen, it’s this: why do you measure a client’s comfort zone and a portfolio’s 95% Historical Range using a six-month timeframe?

If there’s a common question that advisors raise when they first see Nitrogen, it’s this: why do you measure a client’s comfort zone and a portfolio’s 95% Historical Range using a six-month timeframe?Let’s tackle a few of the most common questions and fears about the six-month range.

Q: Won’t the six-month range cause the client to be reactive and nearsighted about their portfolio? I’ve been trying to get them to think long-term.

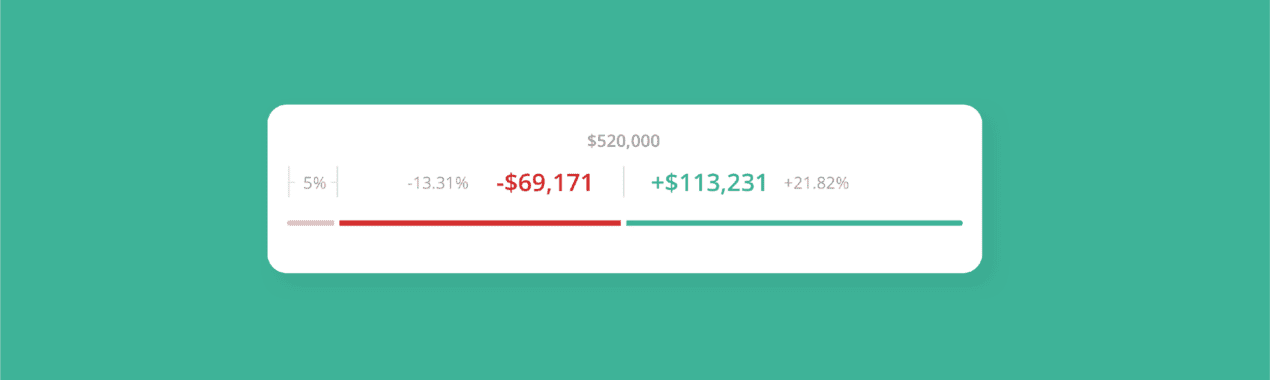

A: If you use the 95% Historical Range to promise performance — something no advisor should do! — that might be a problem. But the idea is to use the analytic to give the client some semblance of what “normal” is for the portfolio you’ve built for them, and set expectations you can consistently achieve.

“As you know, there is about 5% of the risk that we can’t quantify for you, the ‘black swan’ type events we saw in 2008 are a good example. My job as your advisor is to control the 95% of the risk that we can quantify. So, six months from now, we’ll take a look at your portfolio, and if it’s anywhere between X% and Y%, that would be totally normal for this portfolio.”

Q: Why not one year? Isn’t everything else we do in our industry on an annual basis?

A: Nitrogen incorporates decades of behavioral economics research, and everything we’ve seen and experienced ourselves has confirmed that one year is just too long for a client to “hang in there” if they are in the midst of volatile markets and worried about their downside risk. These clients need a shorter timeframe than one year to keep them invested for the long term.

Q: I don’t think it’s important for the client to know a six-month historical range for their portfolio. They should just see that this portfolio leads to retirement in 20 years and that should be good enough.

A: It is said that a journey of a thousand miles begins with one step, but it’s also true that nobody invests for twenty years towards retirement. Psychologically, your clients are investing for a large number of much shorter time periods. And the short-term decisions they make along the way will have a profound long-term impact.

Put another way, one cannot travel to a destination without knowing where they are starting from, and how they’re going to get there. What good is an itinerary from Los Angeles to New York without the knowledge that the traveler is psychologically unable to board an airplane?

Far too many advisors respond to that kind of client by effectively saying “look, everybody flies and you’ll just need to get on the plane.” Effective advisors are able to show the client their tradeoffs. Traveling to New York by train is possible; it’ll just take a lot longer to get there. Or perhaps the client can proactively accept more risk than they wanted. Either way, you’ve now created invaluable alignment between you, your client and their portfolio.

As one advisor put it recently, “Nitrogen informs today’s decisions within the context of a long-term plan.” Join the movement and turn your clients into fearless investors — we’d love to help.