Retirement Maps is Moving to Nominal Dollars

Retirement Maps is transitioning to nominal dollars to provide a clearer view of how inflation impacts income needs over time. Learn how this update, along with the new ‘Income by Source’ feature, enhances your retirement planning by offering more accurate projections and consistent visuals.

Currently, Retirement Maps uses an adjusted inflation rate to present all dollar values in today’s prices (real dollars). To help provide more detailed information on income needs, Nitrogen is introducing a new feature called “Income by Source,” which will also help show how assets will meet income needs in the decumulation phase. This feature displays values in nominal terms, as it’s important to illustrate for clients how inflation can cause income needs to grow over time. To maintain consistency across retirement features, Retirement Maps will be updated to use nominal dollars.

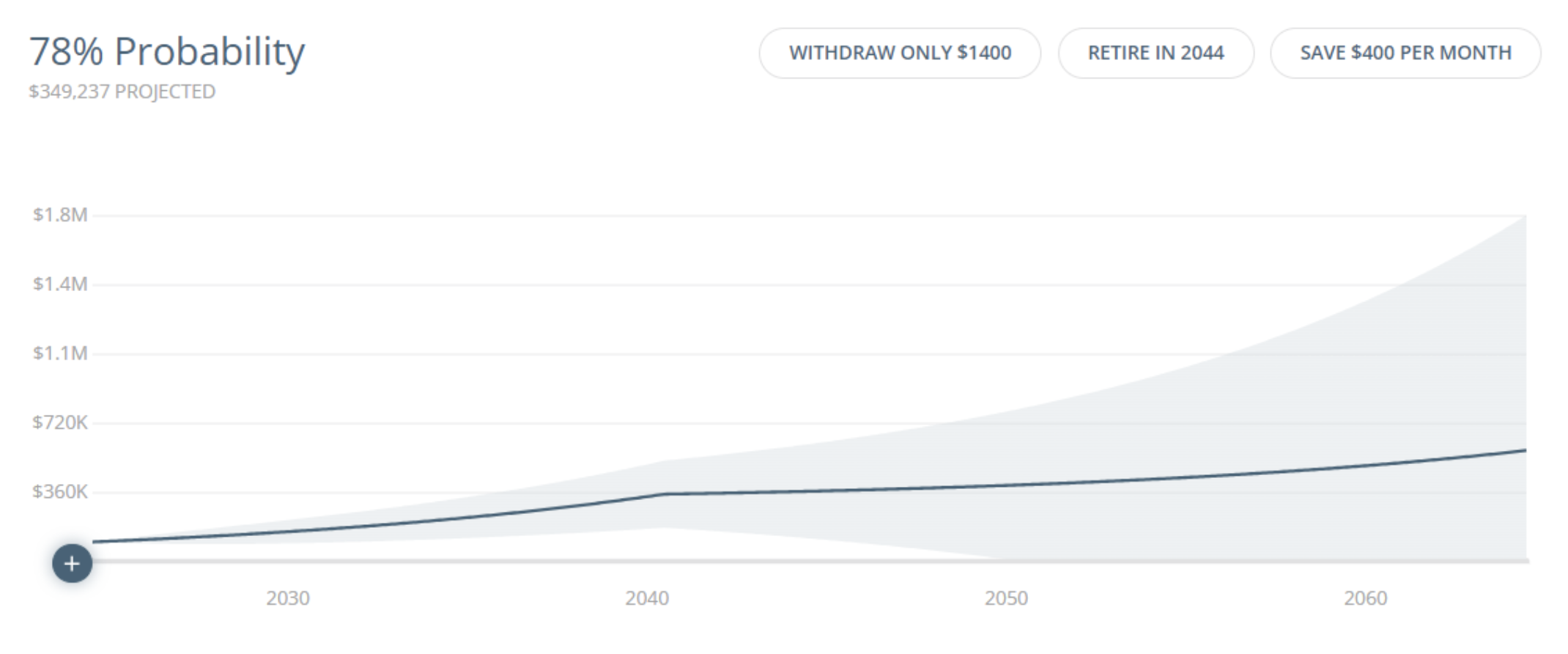

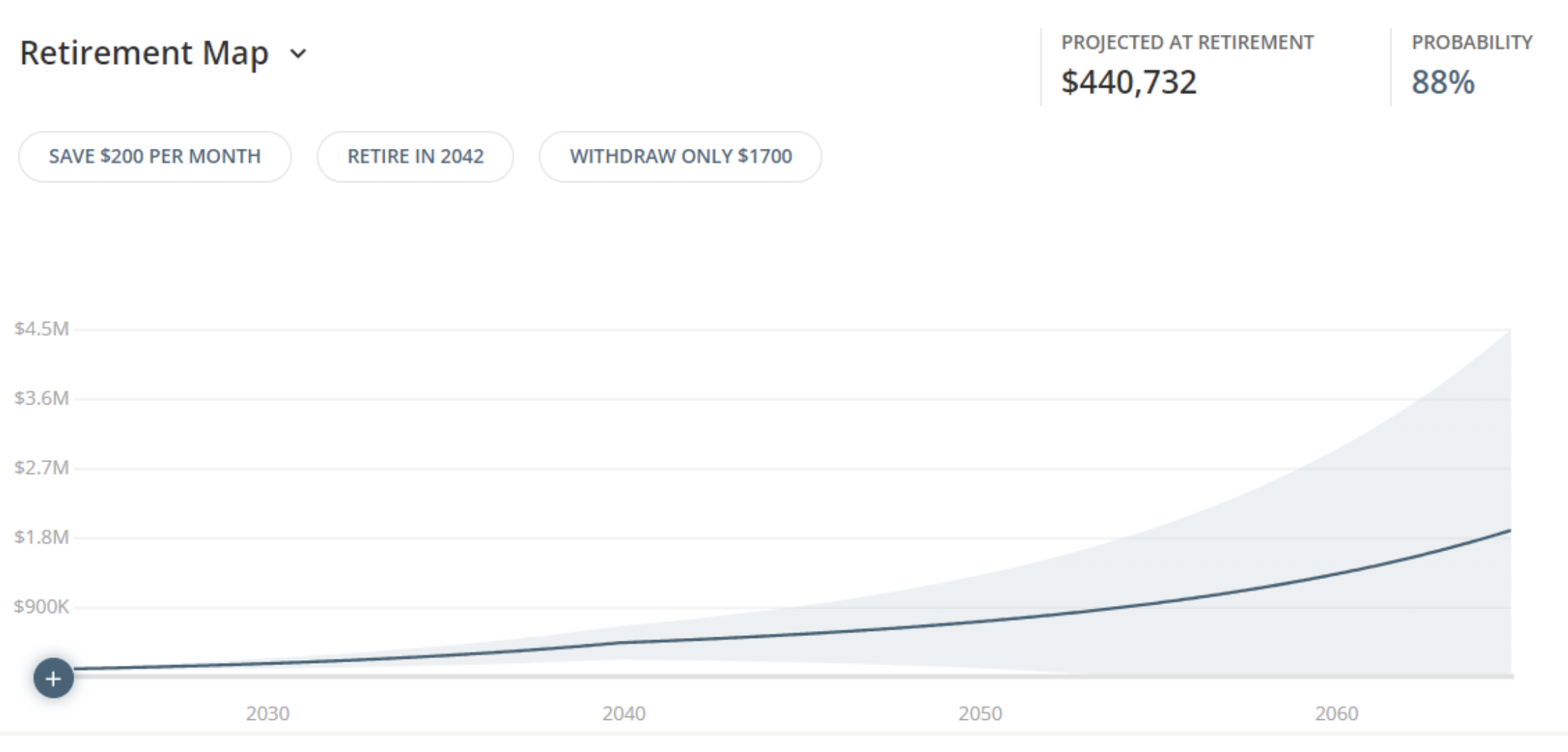

This update will not negatively affect the likelihood of success or the appearance of visual graphics. Figure 1 below is the current graphic for real returns and Figure 2 is the new nominal graphic. (Note: Figure 2 adjusts the withdrawal timing and the future value.) Dollar values will be larger to reflect inflation, and income needs will be adjusted to grow with inflation over time. Investment returns will no longer be adjusted for inflation, and withdrawal amounts will represent future values. For instance, if retirement is set for 2040 with a $5,000 monthly withdrawal, the first withdrawal will be $5,000.

Additionally, the assumed retirement start month will be set to January of the selected retirement year, and life expectancy will be assumed to end in December of the final forecasted year. These changes effectively extend the retirement period by one year. As a result, this adjustment may impact the likelihood of success and forecasted retirement and estate values, see Figure 4. Users can shift their selected retirement year forward by one year to maintain the same retirement duration and similar probability as demonstrated in Figure 2. Figure 3 represents the new assumptions without any adjustments to retirement timing or withdrawal amounts.

Figure 1: Current Retirement Maps Graphic

Figure 1 Assumptions:

- Starting Investment Amount: $100,000

- Retirement Year: 2040 – August

- Retirement Monthly Withdrawal: $2,000

- Inflation Rate: 2%

- Portfolio Return: 10.06%

- Life Expectancy: 2064-August

Figure 2: New Nominal Retirement Maps Graphic

Figure 2 Assumptions:

- Starting Investment Amount: $100,000

- Retirement Year: 2041 – January

- Adjusted Retirement Monthly Withdrawal: $2,714

- Inflation Rate: 2%

- Portfolio Return: 10.06%

- Life Expectancy: 2064-August

Figure 3: New Nominal Retirement Maps Graphic with New Timing Assumptions w/o Withdrawal Adjustment

Figure 3 Assumptions:

- Starting Investment Amount: $100,000

- Retirement Year: 2040 – January

- Retirement Monthly Withdrawal: $2,000

- Inflation Rate: 2%

- Portfolio Return: 10.06%

- Life Expectancy: 2064-December

Figure 4: New Nominal Retirement Maps Graphic with New Timing Assumptions with Withdrawal Adjustment

Figure 4 Assumptions:

- Starting Investment Amount: $100,000

- Retirement Year: 2040 – January

- Retirement Monthly Withdrawal: $2,714

- Inflation Rate: 2%

- Portfolio Return: 10.06%

- Life Expectancy: 2064-December

Disclaimer: Results may vary from the above examples based on individual circumstances, market conditions, and other factors. Users are encouraged to review their retirement plans to ensure that the strategies remain aligned with stated goals.

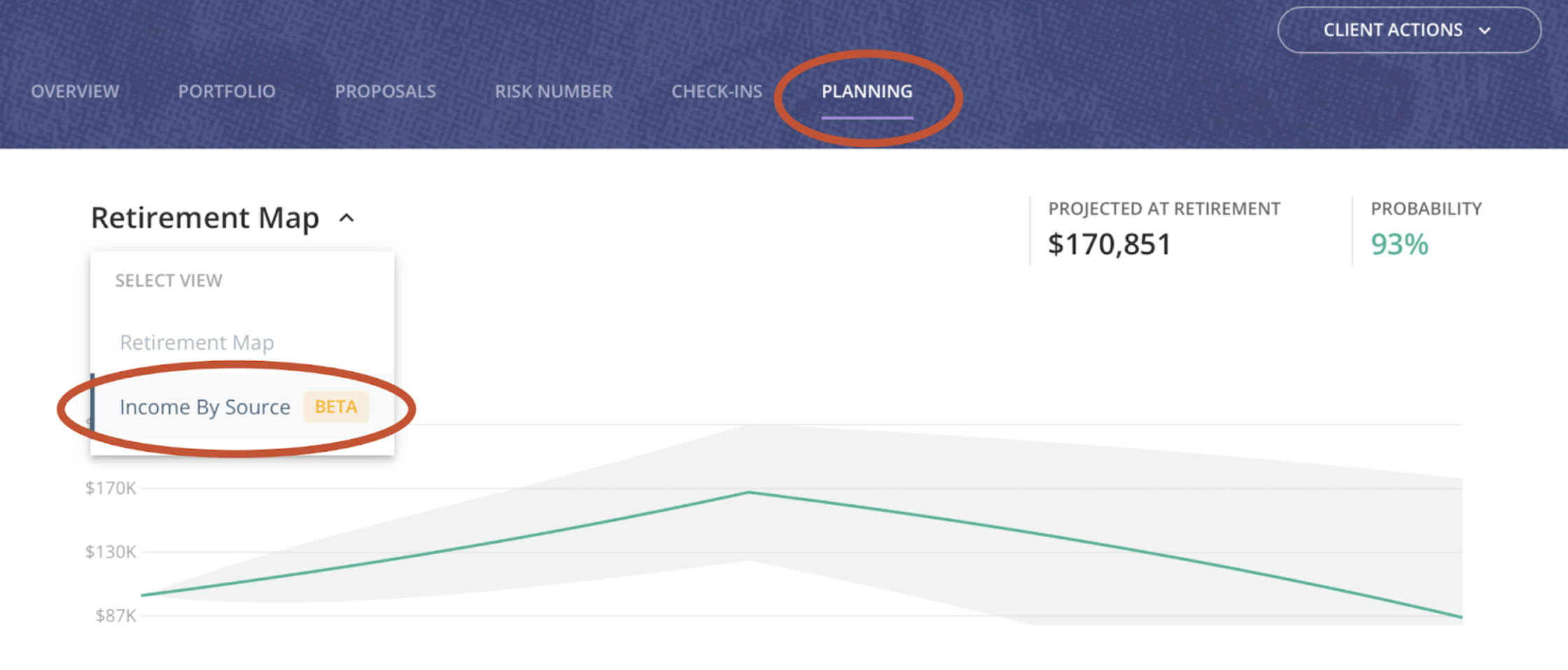

How do I know if these changes have taken place in my account?

These changes to Retirement Maps accompany the rollout of other features in Planning Center. If you have access to “Income by Source” under a tab that has been relabeled “Planning,” these changes are active in your account.

Have any questions? The industry’s leading support team is here to help—just reach out to us at support@nitrogenwealth.com.