Monitor Proposals and Drive Growth with Command Center

In addition to navigating compliance, advisory firms must track their firm growth, client retention, and delivery of compliant proposals across their entire book of business. Managing it all can quickly become tedious and time-consuming, especially in light of the SEC’s recent 2024 exam priorities release. Now, advisors are being held to higher standards on what investment recommendations they’re making and how they’re determining the best interest of their clients.

With so many moving parts and regulations to abide by, it all can become hard to manage. Firms want to grow their practice, and the right technology is out there to help them do so. But how do they know what solutions are right for their firm?

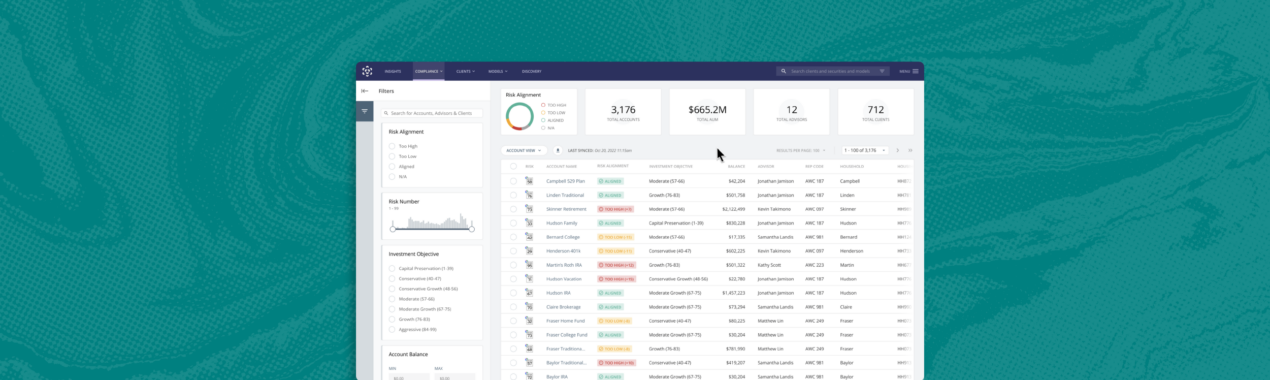

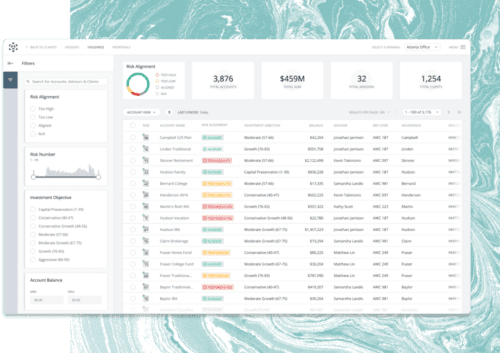

Nitrogen Command Center is a one-stop shop for monitoring risk alignment, delivering compliant proposals, and tracking the growth of your AUM. Our proactive dashboards allow you to zoom in and out from an individual account to your entire organization.

Related: Improve Your Bottom Line With Compliance Technology

Let’s explore what firmwide management and controls you can access through the Command Center, as well as how those insights can fuel growth, and detect misalignment across your book of business.

What is Command Center (and What Can it Do For Your Firm?)

We know that knowledge is the key to growth. Each of our tools serves to equip advisors with insights to help make the right decisions and effectively communicate that rationale to both clients and regulators.

Available to Nitrogen Ignite and Ultimate users, Command Center contains insight dashboards that provide advisors, firm owners, and enterprise executives the data they need to make key investment recommendations and business decisions.

There are three main benefits of Command Center:

1. You can assign qualitative numbers to your growth.

Command Center allows you to view key metrics of an individual account from a high-level perspective. See how many clients have received their Form CRS, which accounts need attention, and more – before they pose a problem.

2. You can be proactive about risk alignment.

Your firm’s reputation and revenue can become compromised when you’re unable to predict risks. But with firmwide risk monitoring, you can see which portfolios are in alignment with risk tolerance and be alerted to those that may need attention – without having to manually scan accounts. That automated data analysis means your days of spot-checking are in the past.

3. You can easily develop compliant proposals.

With the power of the Risk Number®, your firm can easily manage the creation, delivery, and alignment of proposals across your entire book of business. It’s never been easier to wow prospects with a proposal built just for them. And when you need an audit trail, you can quickly capture the data you need, without getting into the weeds. Command Center allows you to monitor and document the proposal process, ensuring each proposal is being delivered to clients in a compliant manner.

Related: 5 Compliance Process Improvements to Help Your RIA Scale

Increase Growth with Better Insights

Compliant proposals and data-informed client communication can help your firm win more revenue by freeing up your time to focus on what matters most. Spending fewer hours manually scanning accounts, addressing regulatory concerns, and documenting your processes means your clients stay front and center year-round.

For one firm, the switch to Nitrogen allowed them to reach an impressive 90% close rate – a win they attribute largely to Nitrogen’s custom portfolios and easy-to-understand risk tolerance deliverables. And they aren’t an anomaly – firms that use Nitrogen have improved prospect close rates from 40% to 94%.

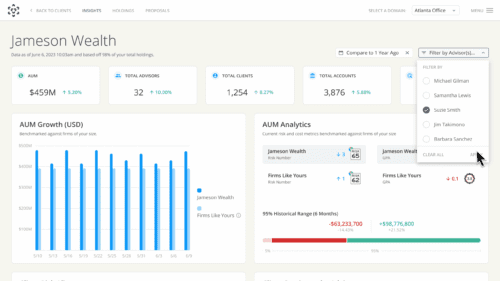

Whether it’s the advisors within your firm or the clients they’re serving, Command Center’s data analytics deliver personalization and built-in risk management to give everyone the best of both worlds. You can also filter that data by advisor, how long a client has been on board your firm, Risk Number, and more.

Related: A Client Experience that Builds Loyalty—and Referrals

Plus, you can use Command Center to track your benchmarks against similar-sized firms and compare AUM growth, giving you perspective on what’s working within your organization.

Scale Your Firm with the Full Power of Nitrogen

Command Center is just one important piece of the puzzle. The full Nitrogen platform is built to help firms win new assets, increase client satisfaction, and protect their business.

Nitrogen’s solutions uncover growth opportunities through:

- Client engagement

- Risk tolerance

- Personalized proposals

- Portfolio analytics

- Firm controls and oversight

- And more

With our proprietary Risk Number Questionnaire, you can bring real, actionable insights to prospective clients before they even walk in your door. This lead-gen tool has been used over five million times and can reduce investor anxiety three times over.

Nitrogen Command Center’s firmwide controls can help wealth management firms of all sizes stay compliant, grow their business, and deliver a better client experience. With Nitrogen’s intuitive platform, your firm can find scalable success while meeting regulatory requirements.

Ready to start? Click here to schedule a free demo and see how Nitrogen Command Center can streamline your firmwide controls and oversight processes.