Better Expectations. Engaged Prospects. Fearless Clients.

Illustrate your expertise through the lens of risk with the platform trusted by tens of thousands of financial advisors.

-

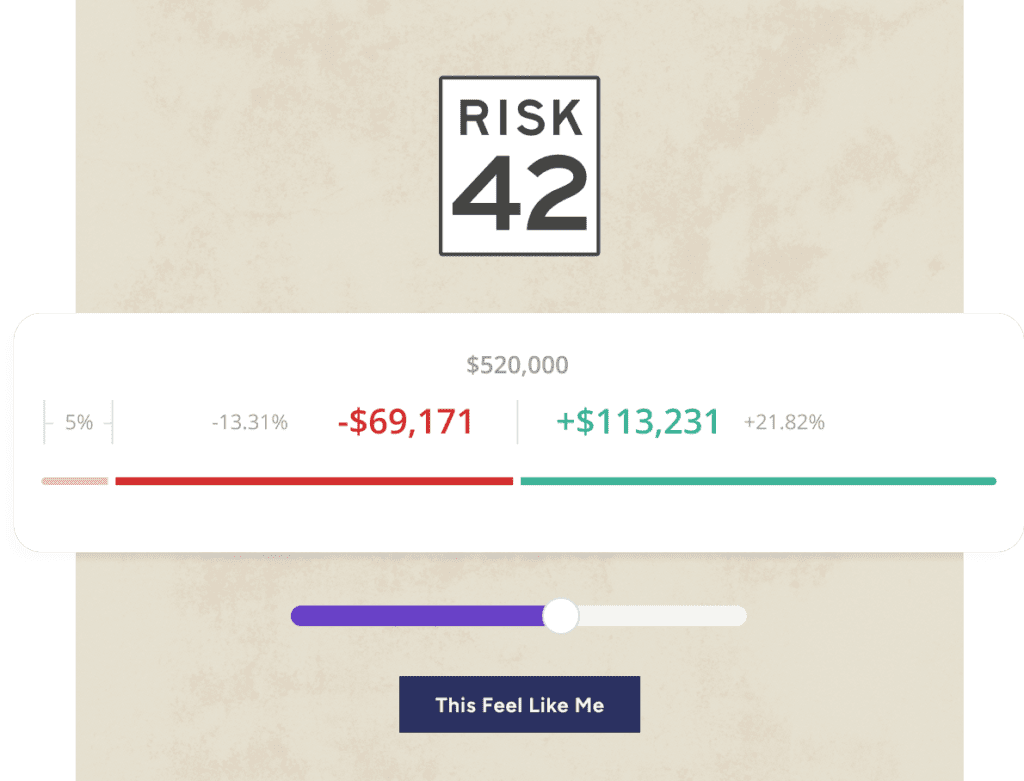

Risk Tolerance

Risk Assessments pinpoint exactly how much risk an investor wants — eliminating the stereotypes that have made risk tolerance all but useless. Use the leading scientific framework to objectively pinpoint an investor’s Risk Number®, whether you’re across the room or across the world. Learn More

-

Portfolio Risk

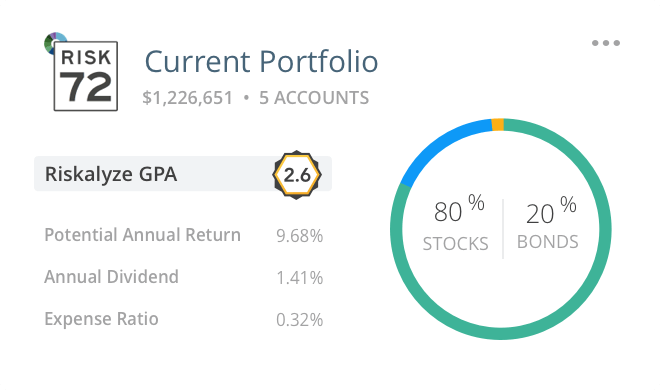

Portfolio analysis empowers you to assess how much risk an investor currently has. A portfolio-wide Risk Number and 95% Historical Range™ enable you to make investment decisions and demonstrate alignment (or misalignment) to your prospects and clients. Learn More

-

Risk Capacity

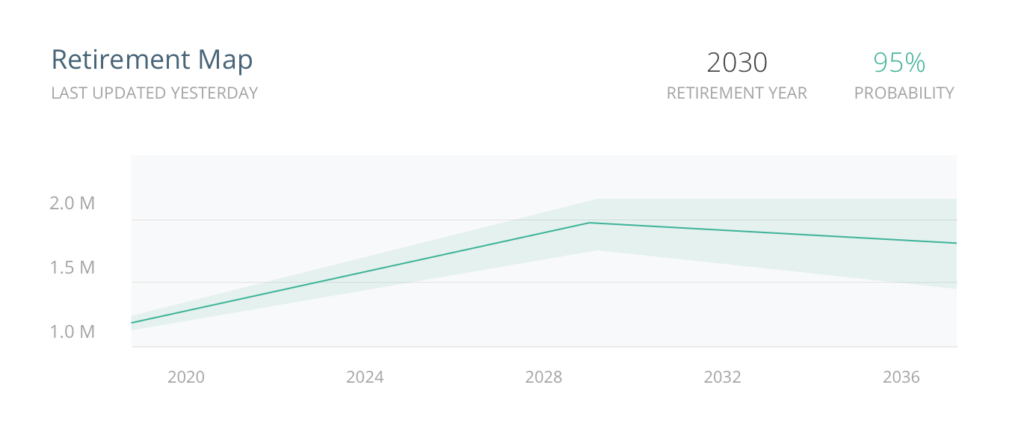

Retirement Maps paints a picture of how much risk an investor needs to take on to reach their goals. When you can calculate their risk capacity and illustrate the bigger picture, you can build a map to success for your clients. Learn More

-

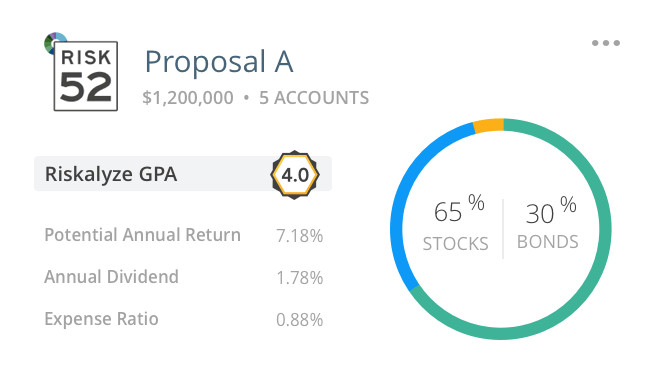

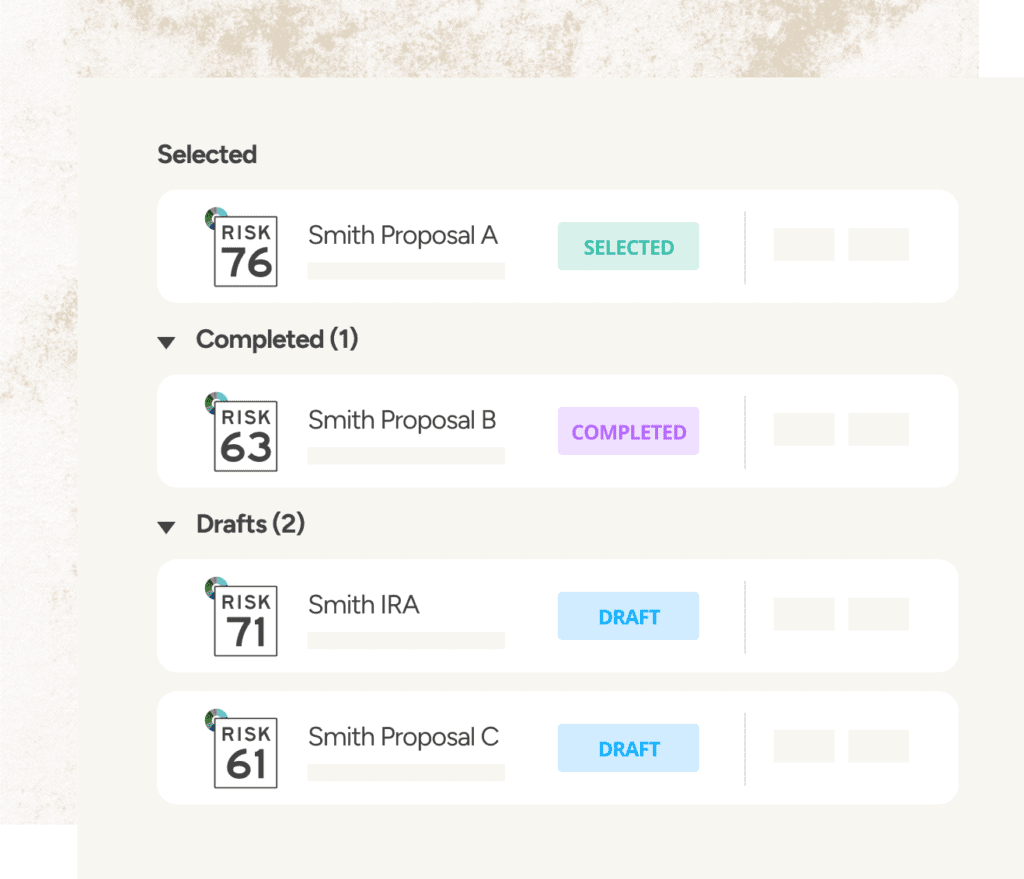

Proposed Risk

Proposals allow you to build the perfect portfolio with the exact amount of risk an investor should take on. Whether from scratch or from a model, you can easily showcase why a portfolio in alignment with the investor’s Risk Number is right for them.

Set better expectations with clients

Does an investor’s risk tolerance fit with how they’re actually invested? A portfolio-wide Risk Number and 95% Historical Range enable you to make investment decisions and demonstrate alignment to your prospects and clients.

Document and showcase your fiduciary care

Act in the best interest of clients…and prove it. Document and showcase alignment between portfolio construction, risk tolerance, and risk capacity.

Grow your business

Put a led gen machine onto your website, email signature, or social media. Now you can prompt curiosity with the four most powerful words in financial advice, “What’s Your Risk Number?”

“Nitrogen’s Lead Generation Questionnaire still outperforms anything else we’ve done to generate leads.”

Nyle, Advisor in California

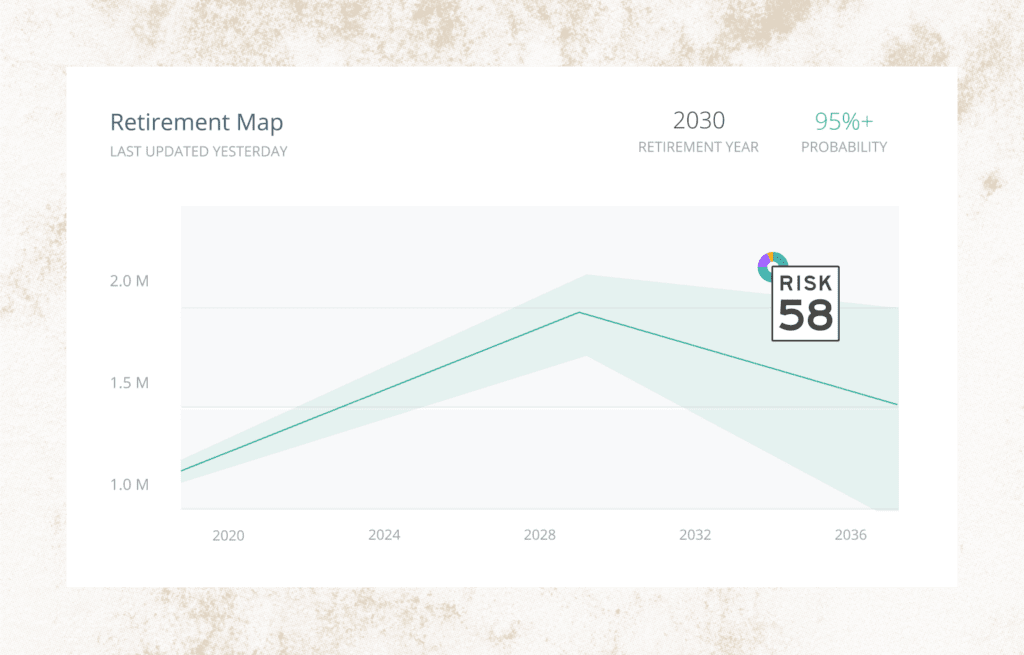

RETIREMENT MAPS

Paint the picture of risk capacity

After you’ve determined how much risk a client is comfortable with, and how much risk they should have in their current portfolio, the next step is to determine how much risk they need.

Retirement Maps is a fantastic precursor to a financial plan and helps paint a picture of how much risk your clients need to take on to reach their long-term goals.

Features for Financial Advisors

Eliminate the stereotypes that have made risk tolerance useless. Use leading scientific theory to objectively pinpoint an investor's Risk Number®, whether you’re across the room or across the world.

Run portfolios through historical events like the 2008 Financial Crisis or 2013 Bull Market to help clients understand what it means to control risk or beat the market.

Run a portfolio through a market timeline and compare it to just the right benchmark to make your point.

SEAMLESS INTEGRATIONS

We integrate with your existing tech stack

You’re only as efficient as the systems around you. That’s why Nitrogen integrates seamlessly with your existing technology, enabling you to connect the Risk Number into all of your wealth tech solutions.

See All IntegrationsSCHEDULE A DEMO

Ready to dive into Nitrogen?

Let’s equip your advisors with powerful tools to increase their wallet share.