Next-level stress testing

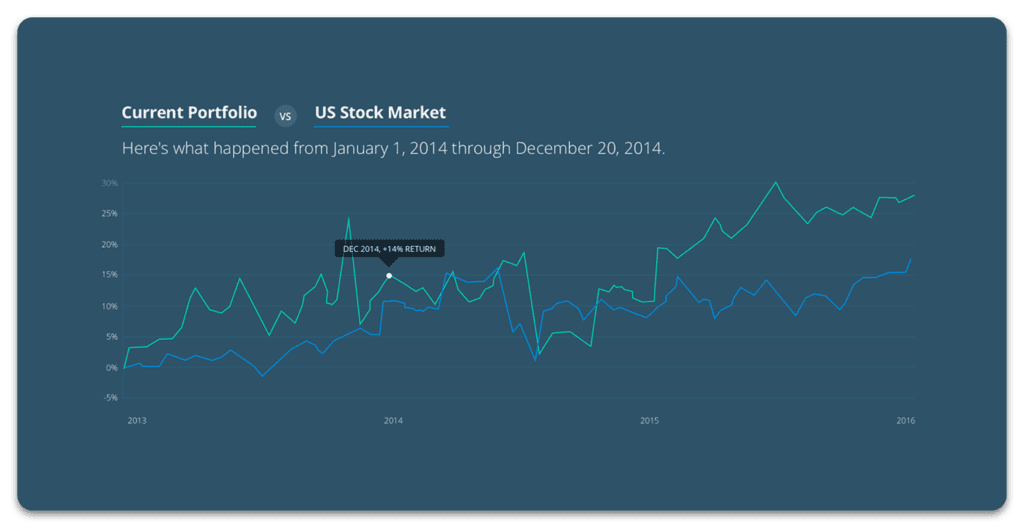

You’ve always been able to see how a client’s portfolio would have performed during specific market events, but now you can string these events together to create a portfolio narrative that settles the question once and for all… “Why is the market beating my portfolio?”

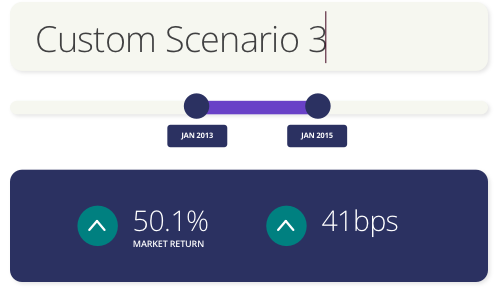

Prove your fiduciary care with custom scenarios

Want to show off the historical dynamics of 2020 volatility or the dot com bubble with your clients’ current portfolios? Now you can illustrate your point by visualizing custom scenarios.

With up to five comparisons — using proposals, indexes, blended benchmarks, or individual stocks or funds — you can illustrate the relationship between risk and reward in a historical context to help them make the right decisions.

Every tool at your disposal.

It’s never been easier to set expectations with clients, prove your fiduciary care, and grow your business.