Five Features to Grow Your Client Base as a Financial Advisor

As a financial advisor or firm executive, you know how important it is to focus on consistent business growth. The truth is that once you factor in market growth, most wealth management firms are only growing ~3% each year.

If finding clients as a financial advisor is challenging, and you’re looking for ways to grow your client base, you may need a growth platform. The Nitrogen growth platform is a powerful tool that helps convert leads to clients, creates a personalized client process at scale, and much more.

Whether you’re new to the growth platform or a seasoned veteran, this blog will provide in-depth insights into how your firm can grow today. So, let’s dive in and discover the five key features that your firm can leverage to perform investment research, win prospects faster, retain clients, and protect your business.

1. Screen for stocks, funds, fixed income funds, and SMAs with Discovery

The old way of using a fund screener requires you to build a screen, click through a bunch of filtering mechanisms, and drill down to find the needle in the haystack.

This can often take 5 minutes and 45 clicks until you’ve painstakingly added enough filters just to get to a manageable set of options.

It’s very reminiscent of how we navigated the Internet in the 1990s.

But that all changes with Discovery. It’s the fastest, most intelligent way to screen through tens of thousands of stocks, funds, SMAs, and fixed income funds to find the perfect fit for your clients and their portfolios.

It’s as simple as selecting a fund type, choosing a Risk Number range, and diving into the fund choices. It’s that easy.

With Discovery, your team has the tools to quickly build efficient portfolios and proposals to win over prospects and retain your clients.

2. Convert prospects to clients with Tax Drag

Whether your firm proposes models, custom strategies, or captures additional wallet share from clients, there’s no better growth driver than equipping your team with a system to win. That’s why advisors love using the world’s #1 proposal engine in Nitrogen to build tax-efficient portfolios.

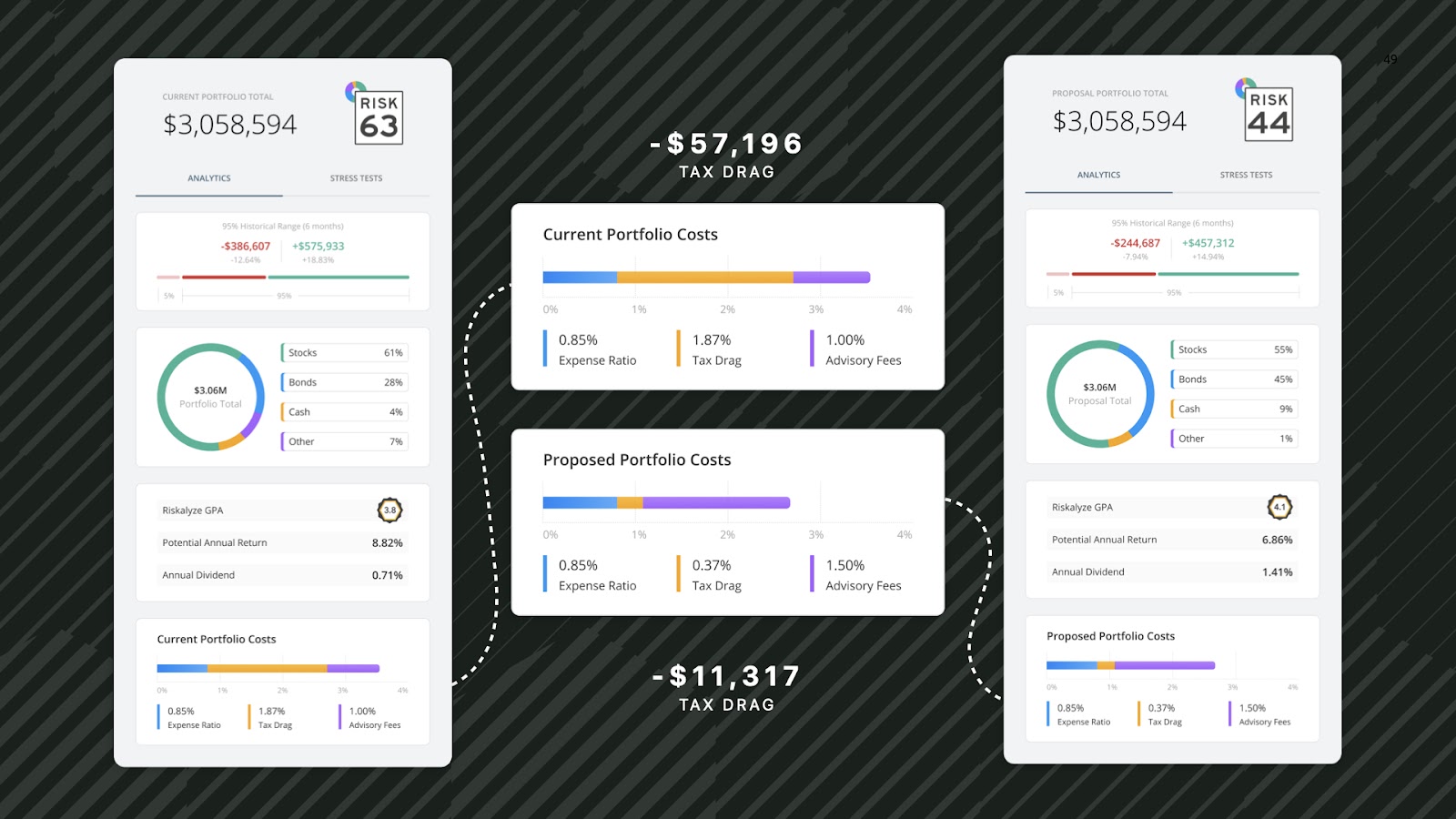

When advisors leverage the Risk Number, GPA, 95 Historical Range, and now Tax Drag, there’s no better way to set the right expectations and create more ACAT form moments.

Our team recently launched Tax Drag to give your firm one more lever to prove your portfolios are more tax-efficient than the competition.

So, how does Tax Drag work? When you first meet with a prospect, there’s a really solid chance that the prospect has more risk in their portfolio than they want. When you can show them that they’re off track, that’s a powerful recipe for growth.

Next, you can use GPA to illustrate how much return a portfolio will typically deliver in exchange for its risk.

Lastly, Tax Drag gives you a third lever to drive a great comparison. Tax Drag is defined as the reduction of a portfolio’s annualized return due to taxes—it’s the tax liability triggered by distributions and capital gains in a non-qualified account.

With the new Tax Drag widget in Detailed Portfolios Stats*, Individual Security Analysis, and in the All-New Portfolios Experience*, you’ve got access to a game-changing comparison to show your proposals can have lower expenses, lower fees, and a lower tax drag meaning you win more clients and they keep more money in their pockets!

*Coming in March 2023.

3. Create a personalized client process across your firm with Check-ins

When you’re looking to grow your business, it’s important to utilize the proper tools to engage with clients and retain your assets under management. With Check-ins, you can automate monthly or quarterly Check-ins to take the pulse of clients and know when a client’s psychology might need a little extra care.

When you send a Check-in, your clients get an email branded for your firm and answer the questions:

- “How do you feel about the markets?”

- “How are you feeling about your financial future?”

When the survey is complete, your clients can see adaptive analytics about what is ‘normal’ for their portfolio, and you get insight into how their psychology is really doing.

The Nitrogen team has recently rebuilt the entire Check-ins experience to make it far more accessible and actionable when advisors want to check in on clients. We’ve implemented powerful search and sorting capabilities to make it even easier to take action with clients that might need a little care.

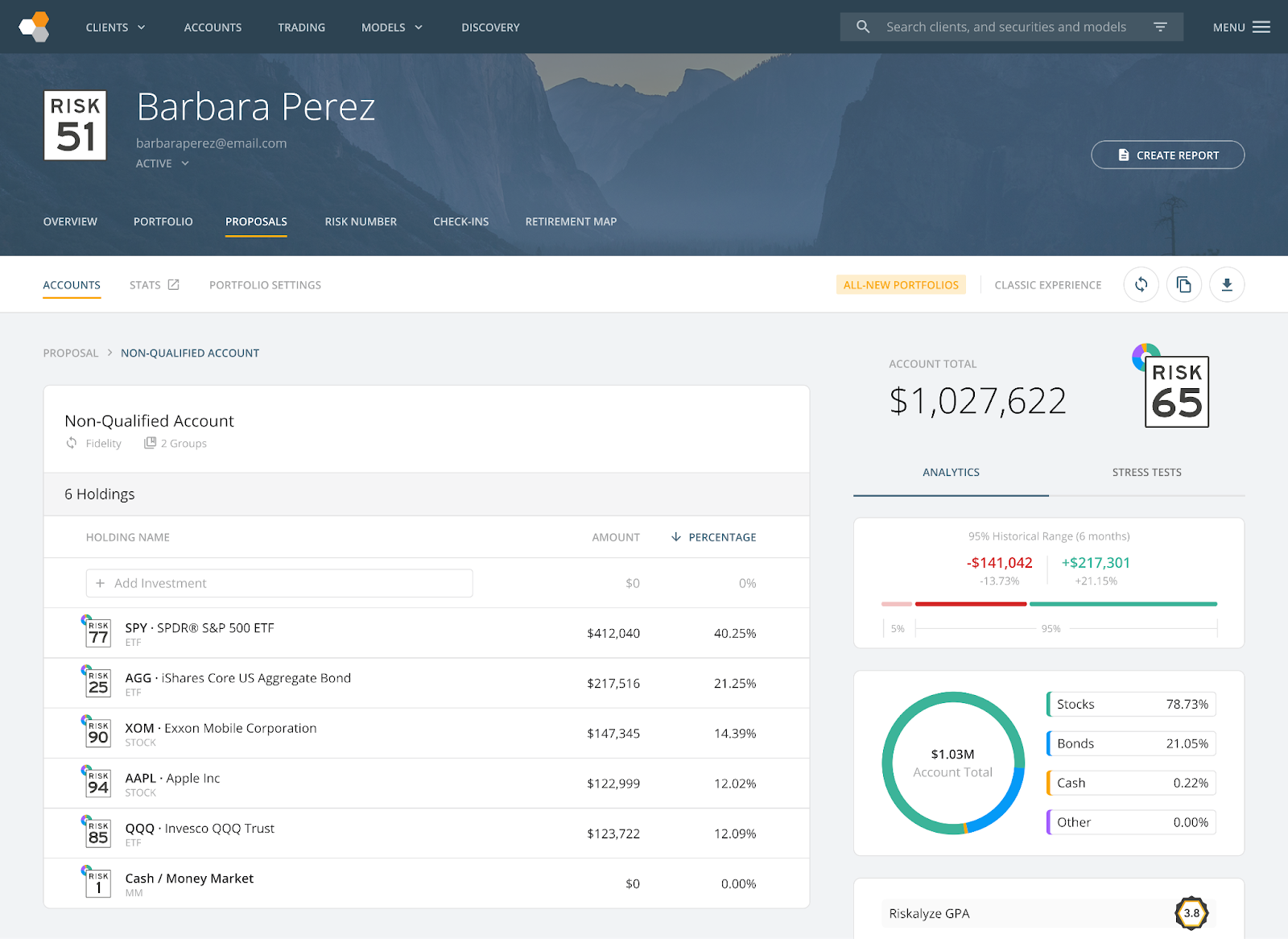

4. Leverage the All-New Portfolios Experience to drive efficiency

The portfolio screen is the most used screen in all of Nitrogen. And that’s for a good reason. It’s the place where you bring in integrated accounts, bring in outside assets, start portfolio construction, and build proposals for ACAT form moments.

If you haven’t taken a look at the All-New Portfolio Experience in a while, it might be time to check back in.

The All-New Portfolios Experience has proven to drive far more efficiency in the day-to-day workflow for advisors across the entire Growth Platform.

Not only does this portfolio screen load 8x faster, but we’re actively building incredible new features that’ll help you win more business and work far more efficiently in the platform.

We’ve made it easier than ever to flip on Stress Tests, and all of the analytics are adaptive, meaning any time you drill into an account, you’ll see updated analytics for the Risk Number, 95% Historical Range, GPA, and more.

You can learn more about the All-New Portfolios Experience in our Knowledge Base.

5. Protect your business with Nitrogen’s Compliance features

One of the most important parts of a growth platform is your ability to protect your firm’s revenue with a dedicated compliance solution. With Nitrogen, your entire team can work collaboratively to turn compliance into your firm’s biggest opportunity.

Compliance empowers your team to fly through portfolios, flag accounts, and alert advisors when accounts need immediate action. Now your firm can retain revenue, fly through accounts faster than ever, and have an all-in-one advisor-compliance platform that keeps the regulators away.

Nitrogen Ultimate brings together every aspect of the Growth Platform and helps you grow your business, retain those clients, and have the compliance tools to keep everything on track.

If you’re interested in learning how the Nitrogen Growth Platform can benefit your firm, we’d love to give you a personalized tour today.