Let’s chat risk center

Set the right expectations with a proven process

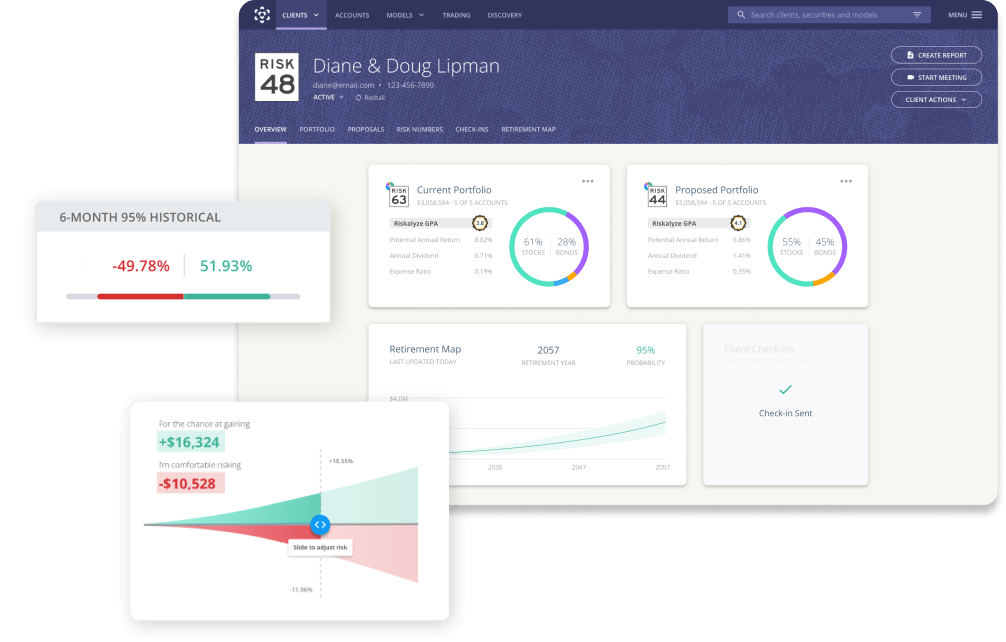

Leverage the Risk Number and 95% Historical Range across your firm to manage client expectations and objectively pinpoint how much risk clients want, have, and need to reach their goals.

-

Financial Advisors

Set better expectations with clients. A portfolio-wide Risk Number and 95% Historical Range enable advisors to make investment decisions and demonstrate alignment to prospects, clients, and regulators.

-

Clients & Prospects

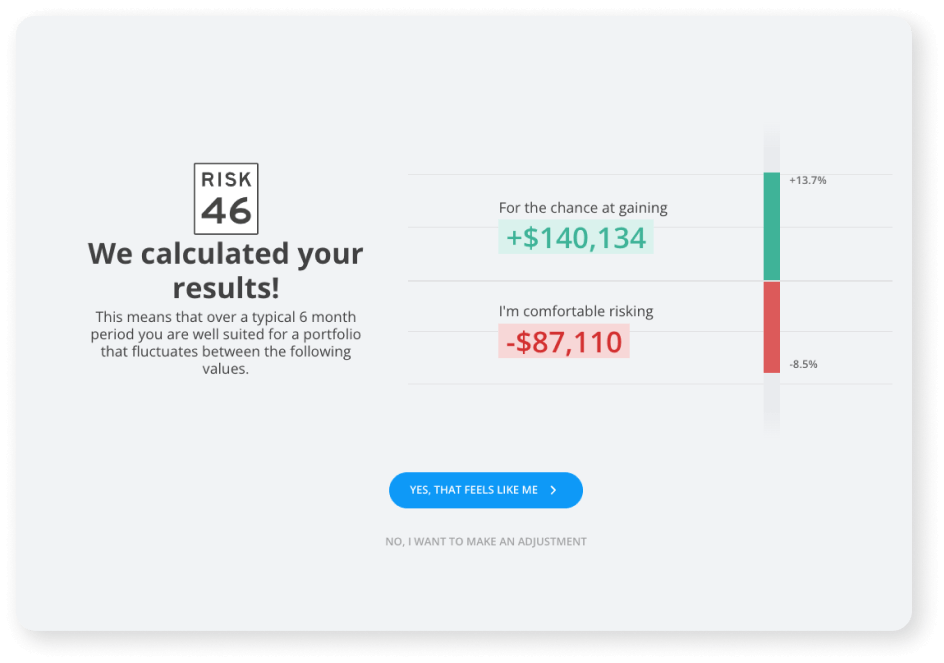

Once a client completes their risk assessment, Nitrogen generates their Risk Number on a scale of 1-99, utilizing a scientific framework that won the Nobel Prize for Economics. When clients know their Risk Number and understand the relationship between risk and reward, they know their advisor is acting in their best interests.

-

Compliance Personnel

Gone are the days of stereotyping investors based on age. The Risk Tolerance Questionnaire gives your entire team a repeatable process that is easy to document and proves that your team treats investors like individuals.

-

Firm Executives

Leverage the Client Engagement Platform for Wealth Management Firms, from the makers of Riskalyze, that equips your entire team with the tools needed to properly assess risk tolerance and risk capacity and create a repeatable, personalized client experience.

Benefits of a Risk

Alignment Solution

Quantify a client’s risk tolerance using a proven framework.

Compare how much risk a client has with how much they want and need.

Illustrate what is ‘normal’ for a portfolio so clients stay fearless.

Document, timestamp, and archive changes to prove due diligence.

Request a demo

See for yourself how the Nitrogen Client Engagement Platform can help your firm grow your assets, increase client satisfaction, and protect your business.

Alignment.

-

Risk Tolerance

Risk Assessments pinpoint exactly how much risk an investor wants — eliminating the stereotypes that have made risk tolerance all but useless. Use the leading scientific framework to objectively pinpoint an investor’s Risk Number®, whether you’re across the room or across the world. Learn more >

-

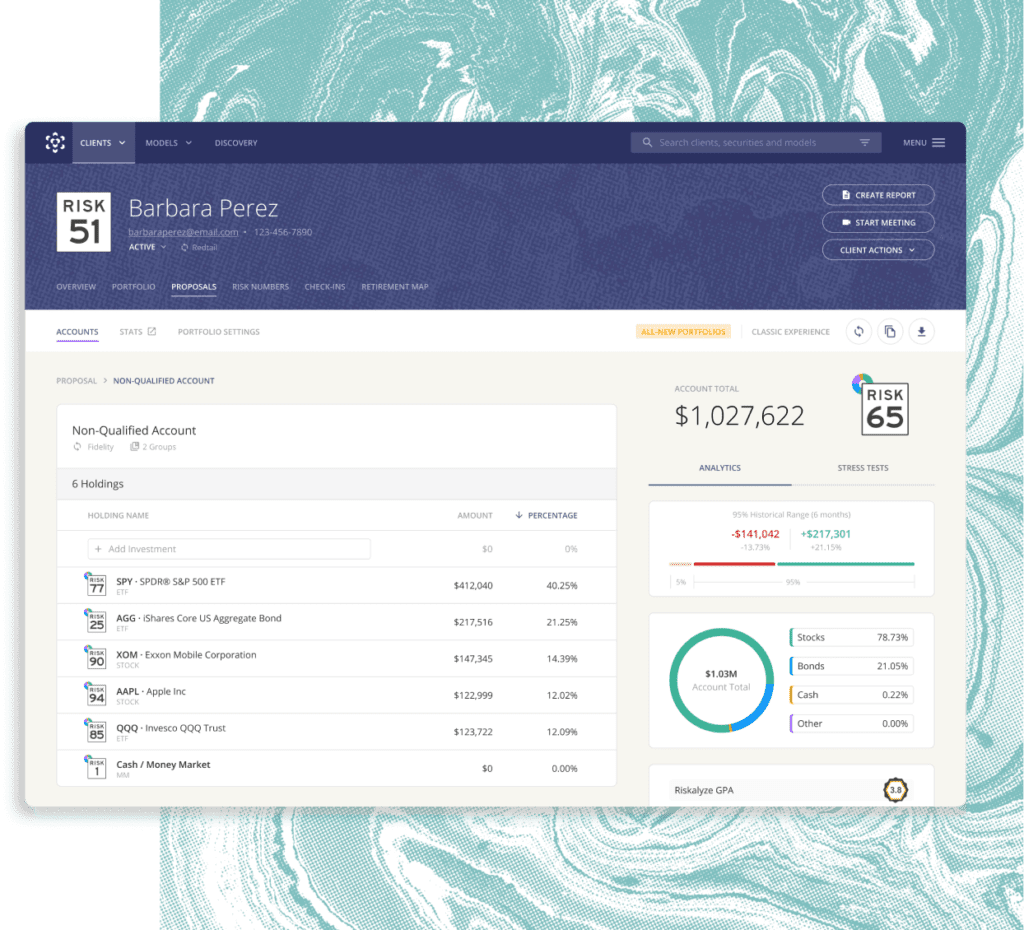

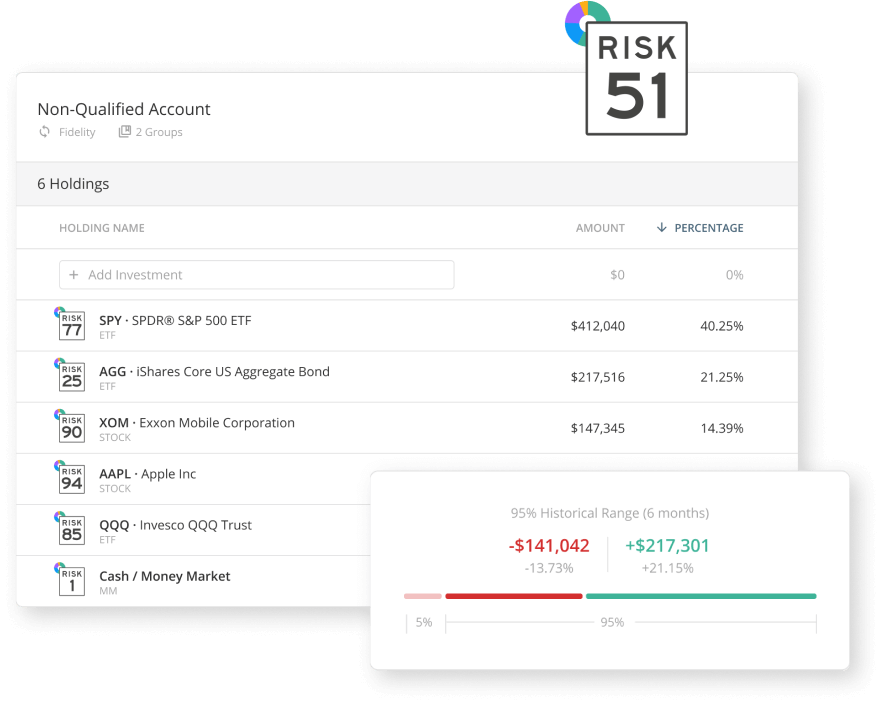

Portfolio Risk

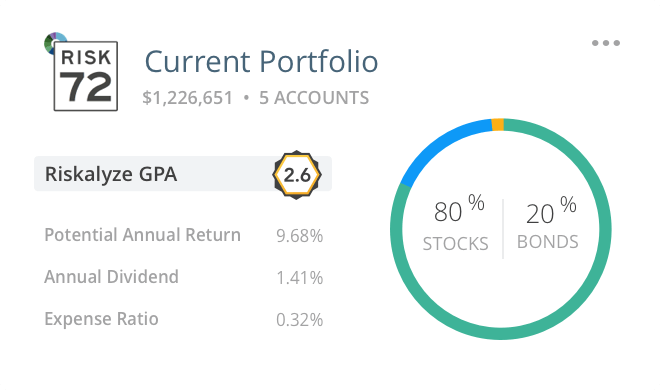

Portfolio analysis empowers you to assess how much risk an investor currently has. A portfolio-wide Risk Number and 95% Historical Range™ enable you to make investment decisions and demonstrate alignment (or misalignment) to your prospects and clients. Learn more >

-

Risk Capacity

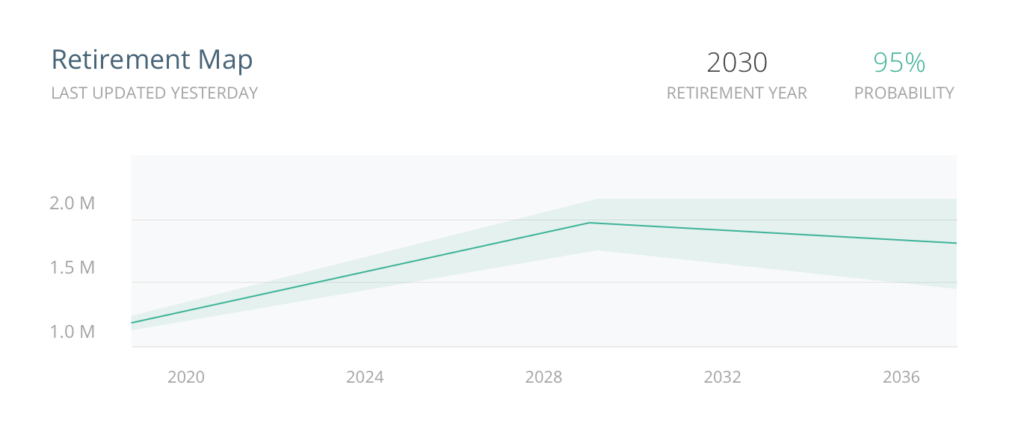

Retirement Maps paints a picture of how much risk an investor needs to take on to reach their goals. When you can calculate their risk capacity and illustrate the bigger picture, you can build a map to success for your clients. Learn more >

-

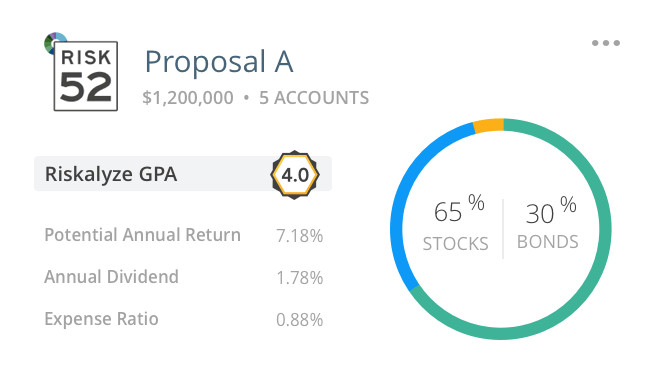

Proposed Risk

Proposals allow you to build the perfect portfolio with the exact amount of risk an investor should take on. Whether from scratch or from a model, you can easily showcase why a portfolio in alignment with the investor’s Risk Number is right for them.

A POWERFUL TOOL FOR FIRMS

See how firms are driving

growth with Nitrogen

This tax-focused CFP uses objective data to help clients manage their relationships with money.

"Nitrogen doesn’t just help advisors educate their clients about risk, it also pays for itself, and then some!”

Virginia Harriett and Michael Harriett increase their firm’s efficiency, attract more clients, and have better client conversations with Nitrogen as a central part of their tech stack.

Trusted by the best brands in wealth management

Thousands of wealth management firms and financial advisors have propelled their success with Nitrogen.