Q2 2024 Product Release: Driving growth and engagement for firms with Command Center, Retirement Income By Source, and more

We held our second quarterly product launch of the year on May 14th 2024 and it was an awesome turnout! If you weren’t able to tune in live last week, you can watch the full recording here!

We love shipping new products that change the way wealth management firms and advisors interact with clients and grow their businesses. This latest launch introduces a ton of powerful new features that are all about putting you in control of how you manage and measure the growth of your firm, engage with clients, and build retirement plans.

Click here to read the full press release

Let’s dive into the latest and greatest on the Nitrogen platform!

1 – Build Custom Securities with Command Center

We are launching an all-new Securities Builder! This gives firms the ability to create custom securities, upload monthly historical performance, and share those securities with all of their advisors.

Even though Nitrogen has industry-leading security coverage with a 97% recognition rate, there are a lot of reasons a firm may want to manage custom securities on their own. Maybe your models are tactical in nature, and you want the analytics on them rolled up into an SMA. Now your advisors can propose them just how you configure them. Security Builder enables firm executives on Nitrogen Ultimate to create custom securities that can be proposed by all the advisors in your firm.

Learn more about Securities Builder >

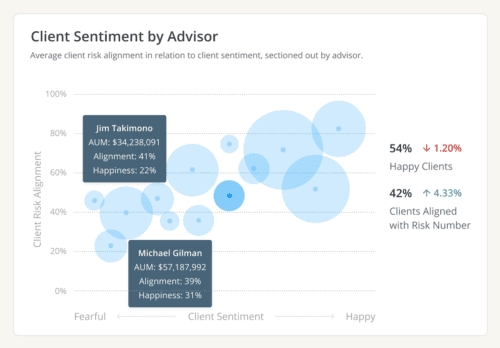

2 – Measure Client Sentiment Across Your Firm

We’ve talked to countless scaling RIA firms that are looking for a scalable, measurable way to see client satisfaction. However, asking investors to rate their advisor on a scale from 1-10 can feel a little cheap in such a relational business.

How do we find out which advisors are truly taking care of their clients and empowering them to invest fearlessly?

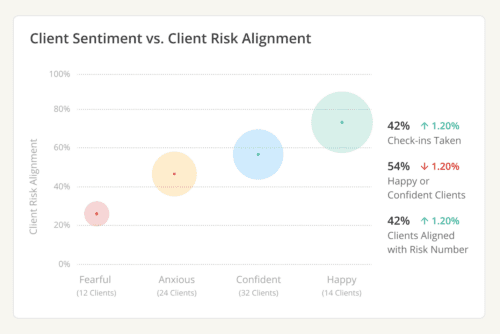

That’s why we’ve brought insights from our Check-ins feature into Command Center.

Advisors love using Check-ins, right? It’s their favorite way to get an automated checkup from clients on a regular basis. Their client just has to give them two taps on their smartphone, letting the advisor know how they’re feeling about the markets, and about their own plan, and the advisor gets an early warning sign when a client needs a little engagement.

Now with Client Sentiment Insights in Command Center, you can drill in to see where advisors are on a scale of client sentiment and risk alignment. You can take this one step further by drilling into specific advisors to see which of their clients are fearful, anxious, confident, or happy.

And that’s where these Insights really come to life — it helps you finally answer the question, “how do I tell my advisors apart?”

You can drill in on any advisor at your firm and see their zoomed-in version of all metrics on the Insights dashboard and see who’s above or below trend. As you can see, this is quickly going to become a critical part of your platform. Because you can’t grow what you can’t measure

3 – Build a Retirement Plan with Income By Source

We love learning from advisors. We asked a panel of advisors, “What’s the number one question you get from your clients?” And every single advisor on the panel agreed on this: “Am I going to be okay?” Retirement Maps does a great job of framing up that conversation and advisors love it for a bunch of reasons:

- It puts risk capacity in context. For the client who want to take on zero risk, retire early, and live like a king (do you have any of those?) …you can illustrate why they might need to take on more risk. Because they can’t make it from Los Angeles to New York in six hours if they’re afraid to fly.

- It helps uncover held-away assets. Clients love seeing their map bounce into the green. And you’d be surprised how often a client’s desire to bolster their Retirement Map jogs their memory about an old account you don’t manage.

- The underlying analytics are powerful. We’ve got the distinct advantage of having security-level risk analytics under the hood. We don’t have to rely on assumptions, we know which securities and asset classes facilitate more or less volatility, letting us model a Retirement Map in a way nobody else can. It resonates with clients in a way that a monte carlo simply can’t.

- With Timeline events, you can dynamically model the impacts of major financial decisions like paying for a child’s college education or shifting Risk Numbers in retirement. It’s incredibly powerful when you can plot events onto the Timeline and show clients the impact on the Retirement Map in real-time.

- It all displays beautifully in our reports. By popular demand, reports display each timeline event, making this the fastest way to generate a simple, one-page financial plan.

So, when it comes to that question — “Am I going to be okay?” — Retirement Maps allows you to say, “Yes.” But for retirees, we don’t think simply treating it as a yes or no question goes far enough. It doesn’t truly empower them to invest fearlessly unless you can help them answer the how and why for that question.

That’s why we’re announcing a brand new view we’re calling Retirement Income By Source.

With just a single tap, you can switch from Retirement Maps to Income By Source giving your clients a dynamic view into each account and product that is going to supply their income needs in retirement. You can even add Timeline events to visualize real-time impacts on their retirement income.

Have a client with a low Risk Number that is concerned about outliving their accounts? Retirement Income by Source gives you the tools to illustrate how much income they can generate with just their social security and pension income.

With just a few clicks, you can add additional income streams like annuities or insurance products to boost their likelihood of generating enough income in retirement.

Learn more about Retirement Income By Source >

Join us this fall for the Fearless Investing Summit

So, that’s a wrap on our second quarterly launch event of the year. But the fun doesn’t stop here, we’ll be launching more upgrades and enhancements to the Nitrogen platform at the Fearless Investing Summit this October 23-25 in Nashville. And boy do we have some exciting things in store.

Now if you haven’t been, this isn’t just our annual customer conference or the event where we give a sneak peek at the latest product innovations our team is launching, it has turned into an industry gathering. Michael Kitces named it the Top Advisor Marketing Conference to attend in 2024, US News has featured it as a top conference in wealth management, and we have so much in store this year.

Check out the website and block off your calendar for the highlight of the year. The agenda and many of our speakers are now live on fearleslessinvestingsummit.com.

Want to experience the Nitrogen platform yourself? Enjoy an interactive tour of Nitrogen today.