A Deep Dive into Size & Style

In the intricate world of financial markets, the classification of companies based on size and style is a critical element that profoundly influences investment strategies. Diverse methodologies are employed by various organizations to categorize companies into distinct size and style categories. These methodologies vary from percentage-based tiered and relative calculations, offering stability in assignments, to more fluid assignments from fixed-based calculations. This blog delves into the complexities of size and style classifications, comparing different methodologies and their implications in discerning value, growth, and core companies within the market.

Determining Size

The classification of companies by size is a fundamental aspect of understanding market dynamics. Different methodologies are utilized to establish size categories, each with its own approach and implications. Morningstar and Lipper employ approaches that define capitalization ranges based on cumulative rankings, while entities like FINRA, and Standard & Poor’s, rely on fixed capitalization cutoffs or percentiles. Nitrogen, on the other hand, employs an adaptive approach by reevaluating cutoffs to capture evolving market conditions. These distinct methods result in varying classifications for companies at the margins, occasionally leading to disparities between methodologies. Despite these variations, the ultimate aim is to provide investors with insights into the diverse landscape of companies based on their sizes. Let’s delve deeper into each of these approaches.

Morningstar’s size classification methodology defines the capitalization ranges as follows, based on a cumulative ranking of capitalization:

- Large-cap: Top 70%,

- Mid-cap: Next 20%,

- Small-cap: Bottom 10%

This approach establishes a flexible size cutoff that fluctuates with market price changes, while also providing a static definition of the market’s percentage in each size category.

In contrast, other methods such as FINRA’s fixed capitalization cutoffs set specific thresholds:

- Large-cap: Over $10 billion

- Mid-cap: Between $2 billion and $10 billion

- Small-cap: Under $2 billion

Standard & Poor’s employs a combined approach with quarterly adjustments to fixed cutoffs. The size cutoffs most recently adjusted in 2022 are the following ranges:

- Large-cap: Over $12.7 billion

- Mid-cap: Between $4.6 billion and $12.7 billion

- Small-cap: Under $4.6 billion

Additionally, Standard & Poor’s defines the capitalization distribution as follows:

- S&P 500: 85 percentile

- S&P MidCap 400: 85th-93rd percentile

- S&P SmallCap 600: 93rd-99th percentile

Lipper defines size classification similarly to Morningstar but varies based on region and a representative index. For U.S equity funds the distribution is determined based on the Russell 3000 index holdings.

- Large-cap breakpoint: Top 70% of total ranked capitalization

- Mid-cap breakpoint: Between 70% and 85% of total ranked capitalization

- Small-cap breakpoint: Bottom 15% of total ranked capitalization

For U.S. registered global/international equity funds, breakpoints are based on the MSCI World Index holdings with thresholds of:

- Large-cap: Top 75% of total ranked capitalization

- Mid-cap: Between 75% and 95% of total ranked capitalization

- Small-cap” Bottom 5% of total ranked capitalization

Nitrogen has evolved its approach from adhering to FINRA’s definition to restructuring cutoffs to align with market conditions.

Methodologies using a fixed percentage grouping within a ranking approach versus a capitalization-based cutoff may lead to firms with large capitalization values ranked as Mid-Cap or Mid-Cap securities classified as Small and vice versa. For example, Metlife has a capitalization over $41 billion and is classified as Mid-Cap by Morningstar. Conversely, there may be instances where Nitrogen classifies a security as Mid-Cap and Morningstar classifies the security as Large-Cap, like with Seagate Technologies that has a market capitalization of $12.5 billion. While there might be discrepancies, they typically occur at the margins and are infrequent.

In a sample of over 3500 stocks, the capitalization between Nitrogen and Morningstar matched 89% of the time.

Determining Style

Investors often distinguish companies based on the broad categories of ‘value’, ‘core’, and ‘growth,’ each with its unique attributes and investment focus. Value companies are generally deemed “cheap” in terms of earnings or asset prices, while growth companies prioritize future earnings potential and consistent growth. Core companies fall between value and growth and exhibit the attributes from both value and growth. These definitions guide style methodologies that encompass various metrics such as P/E ratios, P/B ratios, dividend yields, and growth indicators. Value investing focuses on lower P/E and P/B ratios with higher yield while Growth investing focuses on consistent revenue and earnings momentum resulting in higher P/E and P/B ratios with little or no dividends. Different entities adopt distinct methodologies for evaluating style. Morningstar utilizes ten factors divided into Value and Growth components, Lipper employs a set of six metrics along with index relative z-score calculations, while Nitrogen combines an absolute approach with periodic relative adjustments. These methodologies reveal the multifaceted nature of style classification and its implications on investment decisions.

The fundamental metrics utilized in the determination of style are fairly consistently based on these broad definitions, however, it is the application that results in differences. The application can be relative or absolute, forward or historical, based on varying years of historical data, weighted to certain metrics over others, and so forth.

The general rule of thumb for value is where the P/B is less than or equal to one. However, as the overall market cycles through bull and bear markets, this metric is also shifting. The average P/B over the 3 year period ending in 2022 on a universe of 5000 stocks is 11.7. The average P/B over the 10 year period ending in 2022 is 9. Does this shift mean more stocks have become growth and there are fewer value stocks? Relatively speaking, there were likely the same level of value stocks, just now carrying higher P/B as market conditions have driven prices higher. In an absolute sense, a value investor would likely argue the other way in that there are fewer value “deals” available. Let’s delve deeper into each of these approaches.

Morningstar Style utilizes 10 factors to determine style, separating them into Value measures and Growth measures. The application is similar to size in that it is relative to other securities in a defined peer group.

| Value(Yield) Measures-Weight | Growth Measures-Weight |

| 1. Price-to-Projected Earnings (P/E) – 50% | 1. Long-term Project Earnings Growth – 50% |

| 2. Price-to-Sales – 12.5% | 2. Book Value Growth – 12.5% |

| 3. Price-to-Book (B/P) – 12.5% | 3. Sales Growth – 12.5% |

| 4. Price-to-Cash Flow – 12.5% | 4. Cash Flow Growth – 12.5% |

| 5. Dividend Yield – 12.5% | 5. Historical Earnings Growth – 12.5% |

Each group of measures is scored and then a net value is determined by taking the resulting Value score minus the resulting Growth score. The thresholds are determined such that value, core, and growth stocks are each assumed to account for ? of total capitalization. For each variable in the above list, the float weighted average is determined for a trimmed universe in order to create a “market” relative score for each security. In addition, if the factor is negative it is excluded from the calculation. Growth metrics are based on the average of 4 years. This summary is high-level and not intended to represent all the aspects of the methodology, more detail is available from Morningstar.

Lipper utilizes similar metrics to determine the classification of a strategy. The Lipper method contains six factors:

- Price-to-Book (B/P)

- Price-to-Earnings (P/E)

- Dividend Yield

- Return on Equity (EPS/BPS)

- Price-to-Sales

- Three Year Sales-Per-Share Growth

Lipper (Refinitiv) assigns each fund to an investment universe group in order to calculate an overall Z-score for a fund utilizing capitalization subsets such as MSCI World for global funds, MSCI EAFE for international funds, and S&P 500, S&P 1500, S&P 400, and S&P 600 for US funds as determined by the capitalization classification of the security. Each factor is equally weighted to determine an overall score z-score. Lipper’s distribution is not equally distributed for value, core, and growth. The z-score ranges results in a lower percentage to core relative to value and growth. Similarly, this summary is not intended to represent all aspects of the methodology, more detail is available from Refinitiv/Lipper.

In 1992 Fama and French introduced their 3 factor model which was an expansion of the CAPM to include additional factors for style and size. The measure for style chosen was a single factor Price-to-Book to represent value versus growth. While this model is helpful, additional statistics are required to provide a clearer indication of the style of the stock.

Nitrogen utilizes an absolute approach while applying a periodic relative adjustment as needed.

The similar measures Nitrogen utilizes are as follows:

- Sales/Revenue growth

- Earnings growth

- Price-to-Earnings (P/E)

- Price-to-Book (P/B)

- Dividend Yield

As shown in the examples above there are different methods to determine the style of a security. The underlying attributes of a company are ultimately what determines whether a company is a “deal” and classified as value or has the ability to deliver growth. The introduction of forced distributions or measuring a firm in a relative fashion can mask the financial condition of a company. The process of share or capitalization weighting to determine the market average also creates a bias where the financial conditions of the larger companies define what a value or growth company looks like.

Attributes Within Indices and ETFs: ETFs based on indices offer insights into the average attributes of companies within core, growth, and value categories. These attributes, including revenue growth; earnings growth; P/E ratios; P/B ratios; and dividend yields, exhibit distinguishable patterns for each category. While these averages provide a general overview, it’s important to note that individual securities may deviate from the overall category trend due to their unique characteristics. For example, the largest holding in the SP500 Value ETF is Microsoft (MSFT), a growth stock which is also the second largest holding in the SP500 Growth ETF.

The table below summarizes the attributes for a variety of index ETFs and demonstrates the consistency in the relationship between these factors and the classification of style. The value based indexes demonstrate lower P/E and P/B ratios with higher dividends and lower revenue and earnings growth in relation to the growth counterparts.

| Index | Rev Growth | Earn Growth | P/E | P/B | Div Yield |

| S&P 500 | 11.4% | 18.2% | 23.3 | 4.1 | 1.5% |

| S&P 500 Value | 8.0% | 13.2% | 21.7 | 2.7 | 1.9% |

| S&P 500 Growth | 17.8% | 22.4% | 24.8 | 7.0 | 0.9% |

| Russell 3000 | 11.5% | 18.2% | 21.8 | 3.7 | 1.4% |

| Russell 2000 Value | 10.6% | 18.9% | 9.2 | 1.3 | 2.3% |

| Russell 2000 Growth | 11.6% | 22.3% | 20.3 | 4.1 | 0.8% |

| Russell 2000 | 11.0% | 20.4% | 12.3 | 1.9 | 1.5% |

Source: Fidelity – As of 8/23/2023

Complexity and Alignment: Companies often exhibit a blend of growth and value attributes, making their classification a nuanced process. Variations in classifications may arise when comparing methodologies, as exemplified by the cases of JNJ, RCL, and GWW. Nitrogen’s approach, combining an absolute approach with relative adjustments, results in classifications that can differ from Morningstar’s more relative approach. The alignment between Nitrogen and Morningstar style classifications is around 55%, which varies based on capitalization.

| Stock | Morningstar Style | Nitrogen style | Avg Rev Growth | Avg Earn Growth | P/E | P/B | Div Yield |

| JNJ | Value | Core | 4.9% | 20.8% | 34 | 6 | 2.8% |

| JPM | Value | Value | 5.9% | -1.2% | 10.5 | 1.5 | 3.1% |

| RCL | Core | Growth | 157% | -113% | -23.8 | 8.7 | 0% |

| KO | Core | Core | 5.1% | 16.4% | 27.0 | 10.5 | 3.0% |

| GIS | Core | Value | 4.3% | 18.3% | 17.4 | 4.6 | 2.6% |

| MSFT | Growth | Growth | 16.1% | 16.5% | 36.6 | 12.9 | 0.8% |

| GWW | Growth | Core | 9.0% | 33.8% | 22.3 | 13.4 | 0.9% |

Source: Morningstar/NASDAQ as of 8/1/2023

Consider JNJ (Johnson & Johnson) in the above table. The revenue growth and dividend yield are representative of value characteristics however, the P/E and P/B are more in line with growth characteristics resulting in a core classification by Nitrogen. RCL (Royal Caribbean) has experienced significant revenue growth post COVID and while earnings are negative, the P/B and strong revenue growth result in a classification of Growth at this point in time. Similarly for GWW (WW Grainger) it has value characteristics in its revenue growth but growth characteristics in its earnings growth, dividend yield, and P/B ratio. Further, it demonstrates core characteristics in its P/E ratio. All of these taken into consideration, results in a growth classification.

In rare cases, a security may be classified as growth by Nitrogen and value by Morningstar or vice versa. One example of this is ABBV (Abbvie). The revenue growth of this firm is close to 20%, with a P/E ratio of 32, and a P/B ratio of 18. Even with its strong dividend of 3.6%, it possesses stronger style alignment with growth.

Nitrogen classifications follow the definitions of style where growth stocks will have strong revenue/earnings growth, high P/E ratio, and low dividends whereas value stocks are the inverse.

Nitrogen’s classifications will vary in degree of alignment with Morningstar because an absolute approach results in fluid classifications compared with a relative approach. The style alignment between Nitrogen and Morningstar is around 55% overall and 65% within the large and mid-cap stocks.

The exact definitions of core, value, and growth can vary slightly between different financial institutions and analysts, but the overarching concept remains consistent. The general industry definitions regarding style is the foundation for the Nitrogen methodology.

- Value stocks are generally considered to be undervalued by the market. These stocks tend to trade at lower price-to-earnings (P/E) and price-to-book (P/B) ratios compared to the overall market or their industry peers. Investors interested in value stocks are often seeking companies that appear to be priced lower than their intrinsic value, indicating potential for price appreciation as the market reevaluates the company’s prospects.

- Growth stocks are companies expected to experience above-average revenue and earnings growth compared to other companies in the market. These stocks often trade at higher P/E and P/B ratios because investors are willing to pay a premium for the potential future growth. Investors in growth stocks are often interested in companies that are expanding quickly and have the potential to deliver strong returns in the future.

- Core stocks, also known as “blend” stocks, fall in between value and growth stocks. They typically possess qualities of both value and growth companies. Core stocks are usually considered to be stable and mature companies with moderate growth potential. They may have slightly higher P/E ratios than value stocks and slightly lower P/E ratios than growth stocks.

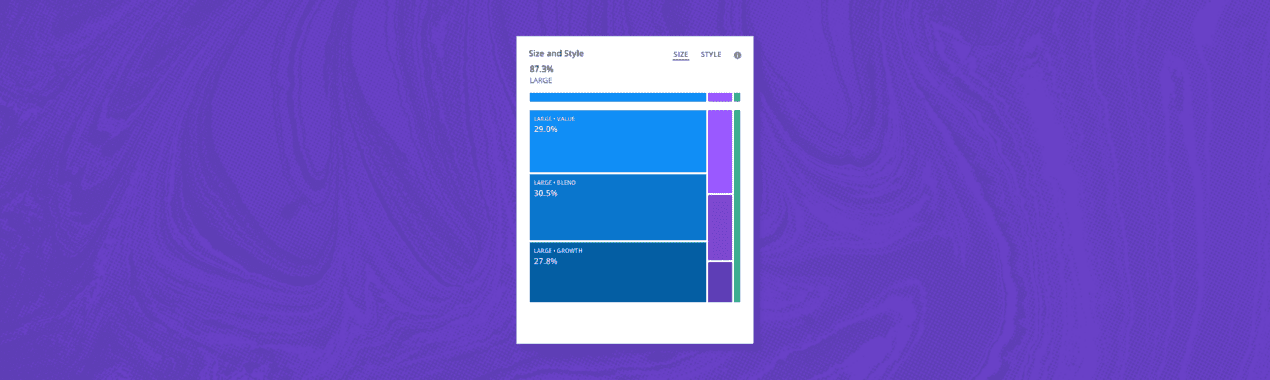

The updated methodology adjusts the distribution of size and style to be more closely aligned with current market conditions and provides consistency with the general industry definitions of style. The updated methodology is highlighted below in comparison with the previous Nitrogen and current Morningstar approaches.

| Updated Nitrogen Style box for SPY | Value | Blend | Growth |

| Large | 13 | 43 | 35 |

| Mid | 2 | 7 | 1 |

| Previous Nitrogen Style box for SPY | Value | Blend | Growth |

| Large | 6.2 | 51.4 | 41.5 |

| Mid | 0.2 | 0.6 | 0.1 |

| Morningstar Style box for SPY | Value | Blend | Growth |

| Large | 16 | 31 | 35 |

| Mid | 6 | 9 | 3 |

Source: Morningstar as of 12/14/2023

Conclusion

The determination of a company’s size and style involves intricate calculations and varying methodologies. Morningstar’s ranked, relative, and percentage-based approach, FINRA’s fixed ranges, Standard & Poor’s dynamic classifications, Lipper’s use of indices, and Nitrogen’s absolute and periodic relative adjustment all contribute to the diversity of categorizing companies. While these methodologies may result in discrepancies and occasional mismatches in classifications, they collectively aid investors in making informed decisions about their investment portfolios. As the market landscape evolves, so too do these methodologies, adapting to changing market conditions and providing investors with refined insights of market conditions. Understanding the nuances of these size and style classifications is essential for making informed decisions and effective navigation of the complex terrain of the financial markets.