Portfolio Stress Tests just got an upgrade

Have you ever noticed how most clients always feel like the grass is greener on the other side?

You know better than anybody that clients want to know what’s “normal” for their portfolio. And you also know setting expectations based on average return doesn’t work — after all — the market almost never hits its own average!

Even when clients understand their Risk Number® and 95% Historical Range, they still get tempted by the latest news and updates about the market. They start comparing their portfolios with their friends and family, and start wondering why they aren’t doing as well. Or they ask the question, “Why is the market beating my portfolio?”

It’s enough to drive any advisor insane.

We built portfolio Stress Tests to answer that very question. And today, we’re announcing that Stress Tests have been rebuilt from the ground up so that you can run any of your client’s portfolios through a market timeline and compare them to just the right benchmark to make your point.

Stress Tests have been rebuilt from the ground up!

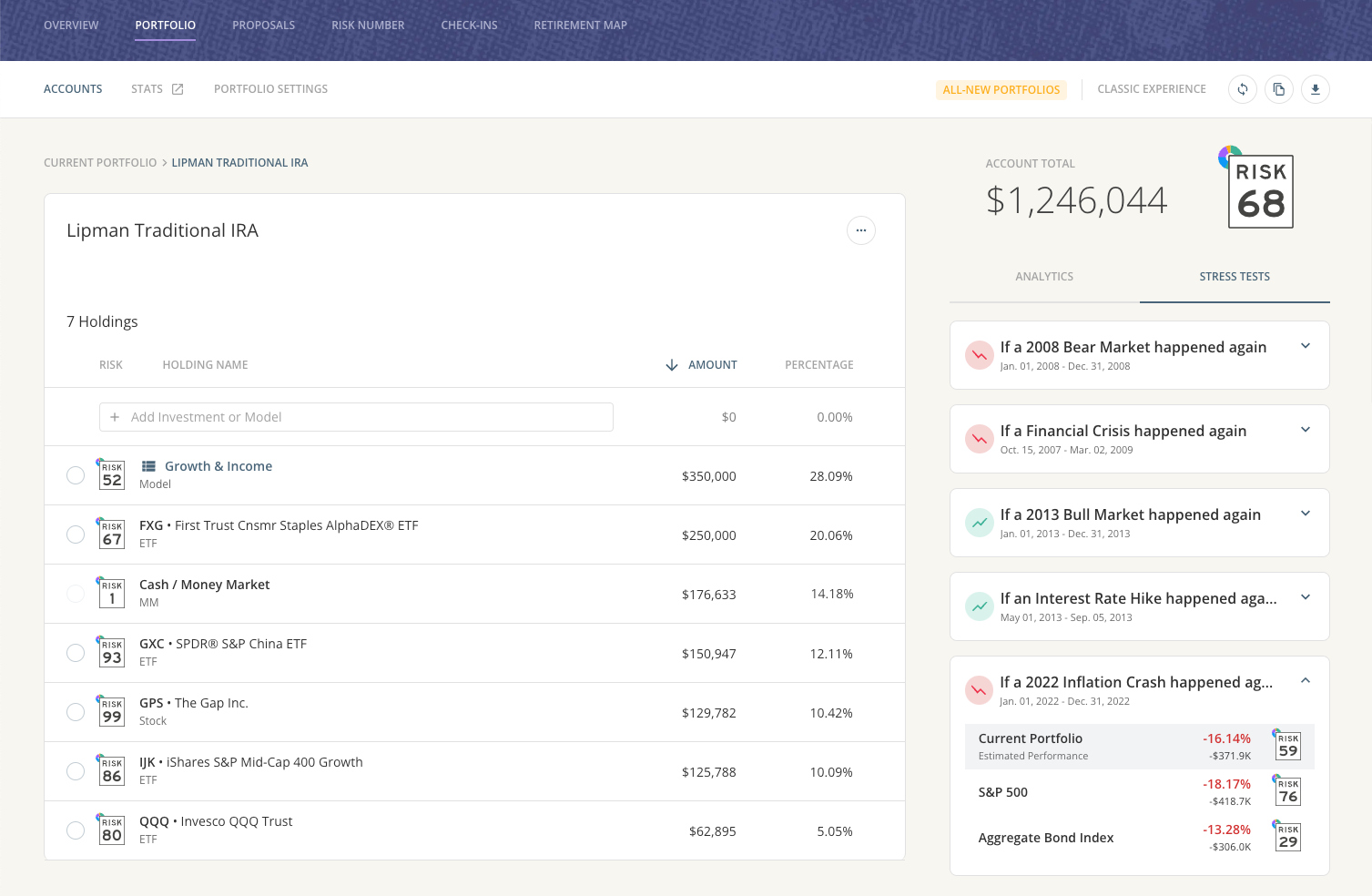

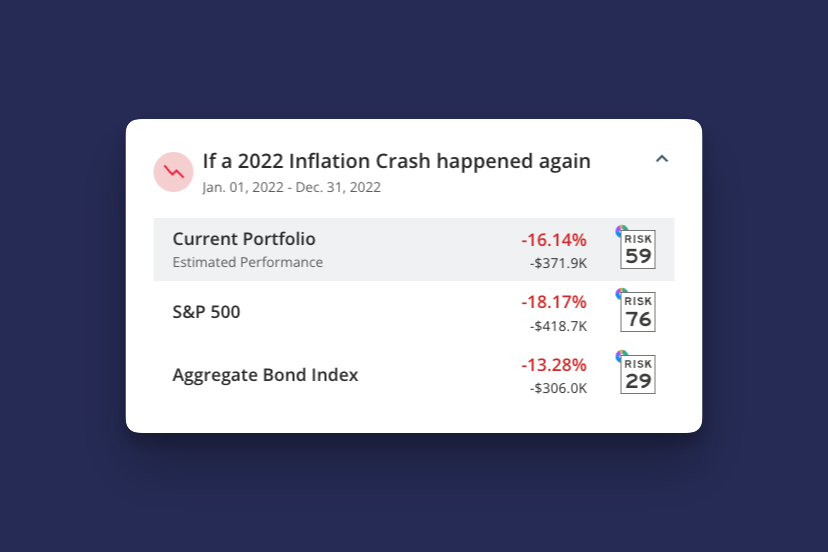

We’ve redesigned our proposal and portfolio Stress Tests to keep the Risk Number front and center. This makes it even easier to show your clients the difference between being invested like the S&P 500 (Risk Number 76) and their current portfolio.

For example, a Risk Number 52 portfolio won’t make as much when markets are up, but it’ll lose a whole lot less when markets are down. It’s an incredible way to help clients remember why they’re a 52 — clients just get it.

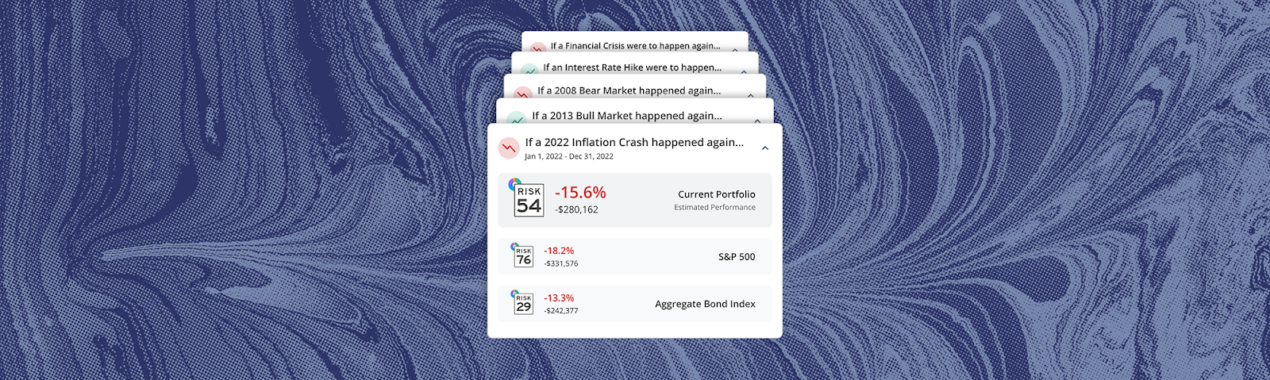

When Stress Tests first launched, we had four primary scenarios: the 2008 Bear Market, the 2008 Financial Crisis, the 2013 Bull Market, and interest rate hikes.

But what happens when inflation and rate hikes collide?

In addition to our Stress Test redesign, we’re also launching a 2022 Inflation Crash Stress Tests. Now you can show the impacts of inflation and Federal Reserve rate hikes on a given portfolio or proposal and compare it to SPY and AGG.

This is another incredible way to set the right expectations with clients and prospects.

The redesigned Stress Tests and 2022 Inflation Crash scenario are available today for all Nitrogen users! These updates are available exclusively in the All-New Portfolios Experience. Need access? Head to “Settings > Account Details > Early Access” and make sure “All-New Portfolios” is enabled. We’re so excited to see you leverage these portfolio Stress Tests in your client meetings.

If you are not a Nitrogen user, we’d love to give you a personal tour of the Growth Platform. It’s the all-in-one-platform that helps you win prospects faster, drive a personalized client experience at scale, and increase firmwide efficiency.