Thanks in large part to the SEC’s newly updated ad rule, Google has recently expanded a new way for financial advisors to increase visibility in local searches.

Considering that searches for the phrase “financial advisor” have been steadily growing year after year, this is more than just a run of the mill change. This is an opportunity to put your advisory firm first up whenever someone in your local area needs financial advice.

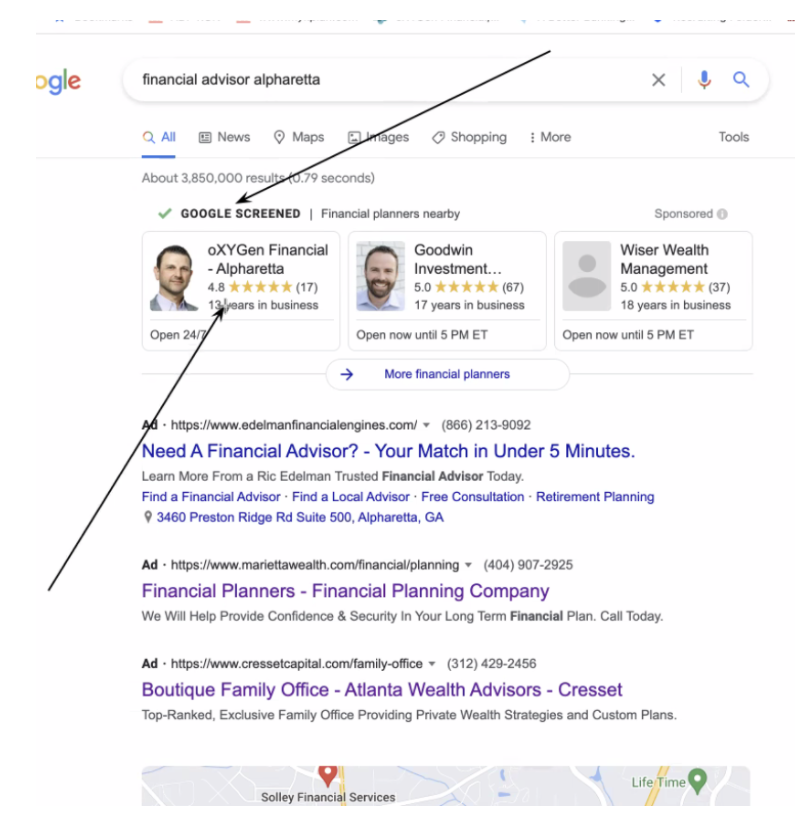

The program is called Google Screened, and today we’re going to tell you all about it.

Becoming Google Screened means you rank higher in search results and get an eye-catching green check mark next to your listing, both of which are factors that can serve to increase trust from potential clients—and get your listing noticed by curious prospects.

Becoming Google Screened means you rank higher in search results and get an eye-catching green check mark next to your listing, both of which are factors that can serve to increase trust from potential clients—and get your listing noticed by curious prospects.

Not only that, but getting Google Screened is now a requirement if you want to run Local Services Ads on Google.

Pro Marketer Tip: Local Services Ads are a way to appear at the top of local search results for keywords you choose to target, like “financial advisor” or “wealth manager [your city].”

Now, you’re probably wondering: How do I get started? Let’s take a look.

How Can My Firm Become Google Screened?

Getting started is really simple. If you’re at all interested in using Google ads to grow your audience, signing up for the program is a no-brainer.

Step One: Sign Up for Google Local Services Ads

Currently, the only way to become Google Screened is to apply for a Google Local Services Ads account. It’s free, simple and only takes a few minutes. The Google Ads customer service team is very responsive, so reach out to them if you need help.

Step Two: Get 3 Stars in Google Reviews

To get Google Screened, your firm must have a 3-star rating or higher on Google. If you don’t have any reviews or you’re not at 3 stars, you are technically allowed to request reviews from your clients.

This is where the all-new SEC advertising rule in 2021 comes in really handy, by making it clear that you can ask your clients to use reviews (which you can then in turn use on your website and other promotional materials). The only sticking point is that you must document your request for reviews and be able to prove that you sent the same request for reviews to all of your clients. No cherry-picking your best clients here.

In order to get reviews on Google and share your review link with clients, you have to first sign up for Google My Business. If you haven’t already done so, take a few minutes out of your day to get it done. It’s free and easy.

The only part of signing up for GMB that takes a little longer is the confirmation postcard. After you enter your business’s address, Google will mail you a postcard with a confirmation code to ensure you gave the right address. That can typically take a week or two.

Step Three: Pass a Few Background and License Checks

In order to qualify to be Google Screened, financial planners must meet a few requirements:

- Background check requirements:

- Business check

- Owner check

- Professional check

- Insurance requirements:

- General liability insurance

- License requirements:

- License checks for each financial planner in the firm

As you can imagine, getting through all these requirements can take at least a couple weeks, but the process itself is relatively simple. If for some reason your firm fails and you believe it was a mistake, you can appeal Google’s decision and apply again after 30 days.

To learn more, check out Google’s guide to the qualification process.

Once the checks are successfully passed, you can start promoting your business as being Google Screened, in addition to running local services ads and ranking higher in local searches!

Is Getting Google Screened Worth It for Advisors?

Getting Google Screened might take a few weeks, but the time investment on your side is fairly small, and it will cost you literally nothing—unless you want to run ads, that is.

As you might have guessed by now, Google Screened appears to be a way for Google to encourage more businesses to run Local Services Ads. That may be true—and you may want to run those ads—but getting Screened doesn’t cost anything and you are under no obligation to run ads if you’d rather not.

If we had to give this tactic a Risk Number, we’d say its downside risk puts it somewhere south of twenty.

We love seeing exciting new ways for advisors to increase visibility and set themselves apart. If you’re curious how Nitrogen can help you build a better practice that attracts more attention, click here to book a personal demo.