Nitrogen never fit into the traditional advisor tech categories – so we made our own.

By Aaron Klein

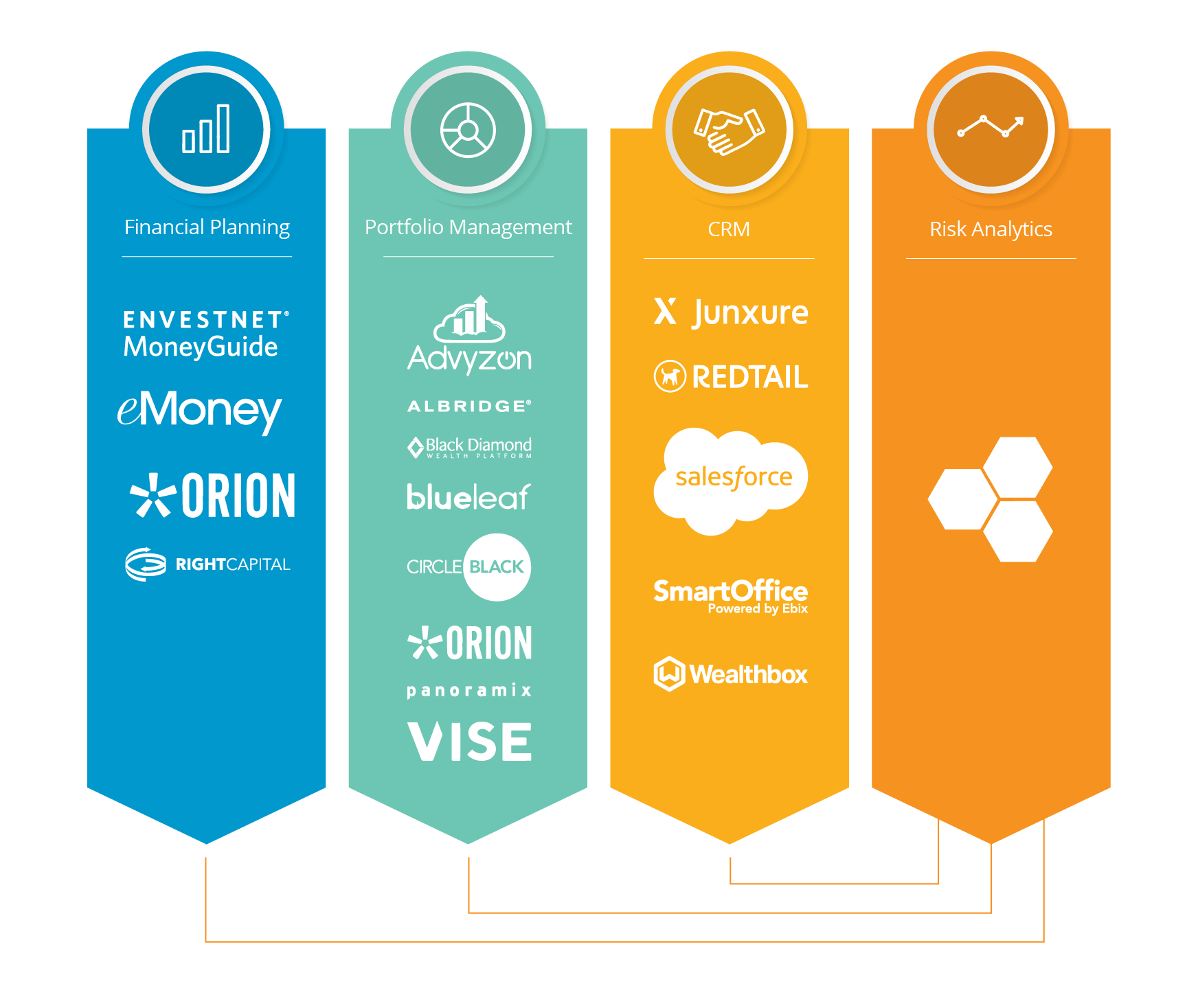

CEO at Nitrogen

Ten years ago, if you picked up an industry trade magazine and flipped to the technology section (if they even had one), you would have seen a very different picture of the advisor tech landscape. At that time, the tech solutions entering the marketplace were largely aimed at helping advisors streamline the processes they already had in place, and solutions like client portals, portfolio accounting, and onboarding tools were flooding into the marketplace. The ultimate goals were digitization and scalability, and there were three defined “technology pillars” the industry considered necessary for advisors to run their business:

Financial Planning

Portfolio Management

Customer Relationship Management (CRM)

When we were first pitching Nitrogen as an advisor product, I knocked on dozens of doors and got the same feedback, “Advisor tech is silioed into pre-defined buckets. Unless you fit into one of them, you’re not going to make it. Risk alignment analytics are nice-to-haves, not need-to-haves.”

But here’s the thing: since day one, we believed wholeheartedly that investing felt broken to the average investor. If great advisors could get people to react to risk appropriately, they could empower them to become fearless investors – shifting the financial industry as we knew it. Nitrogen, in our eyes, has always been a need-to-have.

So, what did we do? We set out to build the fourth pillar: risk analytics.

Today’s Tech Stack

I like to say that you’re only as efficient as the systems around you. For advisors, it’s not enough just to have all the pieces, but those pieces need to fit together in ways that lift you up and bring you closer to your clients.

We’ve humbly watched thousands of firms embrace risk analytics as the fourth pillar of advisor technology, which means we’ve also had to think very carefully about how we integrate into their existing systems and workflows.

Advisors love how easy it is to integrate Nitrogen into their tech stacks – like how the Risk Number plugs right into their financial planning platform, or how we can seamlessly sync data back and forth across their CRM and reporting engines.

And we’ve been lucky to work with the industry’s most awesome, advisor-centric integration partners in the process:

If you ask our team, we’ll give you hundreds of reasons why empowering your clients to invest fearlessly is not only beneficial to their bottom line, but yours as well. We’ll show you how talking about risk in terms of real dollars while using visuals that make sense can break down the psychological barriers that so often prevent clients from fully leaning into your advice. Here’s what some of our advisors have to say:

“If you can demonstrate misalignment in a current portfolio, you can demonstrate your value.”

– Jeffrey, advisor in Virginia

“Our meetings don’t focus on performance anymore — our clients don’t even ask. I haven’t had a single performance conversation in six months, but what I do talk to my clients about is their Risk Number and 95% Historical Range™.”

– Andre, advisor in New Hampshire

“If you took away Nitrogen, I would need a new career – it is vital to the way

we operate.”

– Dan, advisor in Massachusetts

A lot has changed in ten years, and a lot will change in the decade ahead. But with risk as an important pillar in advisors’ day-to-day conversations with clients, I’m excited to see where our industry can take us.