Win Prospects Faster with Tax Drag

When it comes to meeting with prospects, you often build a compelling proposal, complete your due diligence process with Discovery, Individual Security Analysis, or Stats, and then you know what comes next…

Meeting with the prospective client for the first time.

It’s time to win the business and bring a new client aboard! If you’ve been using Nitrogen for a while… you know the formula.

There’s a really solid chance that the prospect has more risk in their current portfolio than they want or need. It’s about 88% of the time. When you’re able to show a client that they are off track, that’s a powerful recipe for growth — we call it the ACAT form moment.

But that means about 12% of the time, the prospect’s current risk might actually line up with where they want to be. So, what do we do then?

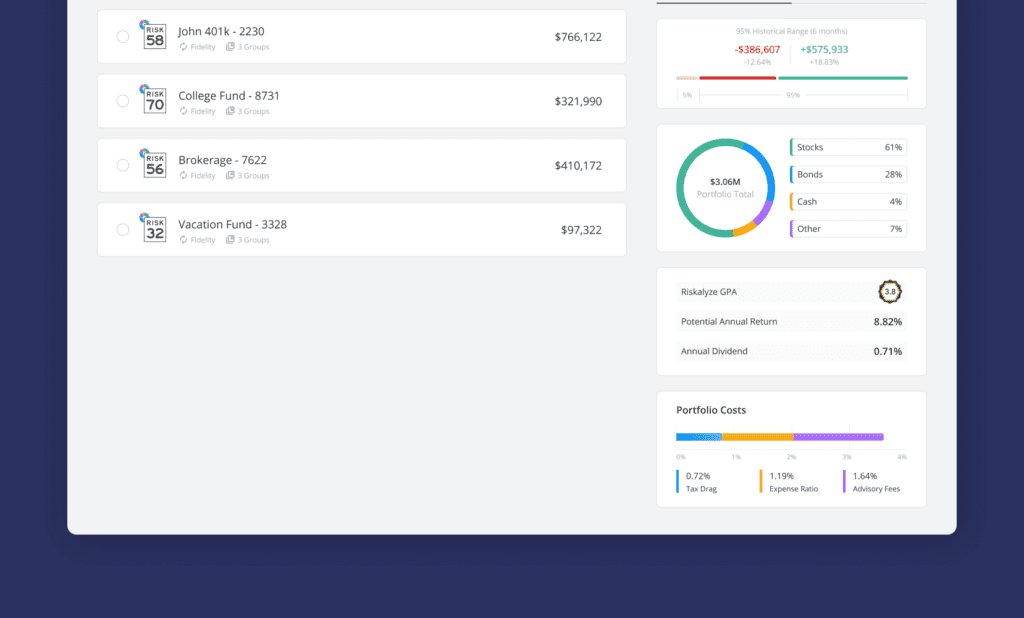

Over the last few years, advisors have been using Riskalyze GPA to answer that question. GPA is an easy-to-understand metric that illustrates how much return a portfolio is typically delivering in exchange for its risk.

But let’s say that the prospect’s risk is in line, and their GPA isn’t too shabby either. That’s where the third lever—Tax Drag—comes into play.

We recently added Tax Drag on individual securities, but, today, we’re proud to announce Tax Drag is available in the All-New Portfolios Experience and Stats.

Today, we’re proud to announce Tax Drag is available in the All-New Portfolios Experience and Stats.

Tax Drag is defined as the reduction of a portfolio’s annualized return due to taxes. Very simply, it’s the tax liability triggered by distributions and capital gains in a non-qualified account.

Every financial advisor talks about tax efficiency, but very few provide understandable metrics to demonstrate it.

Just like high expense ratios drag down returns, inefficient tax management has a massive impact on your clients and the assets they have invested with you. And Tax Drag illustrates this beautifully!

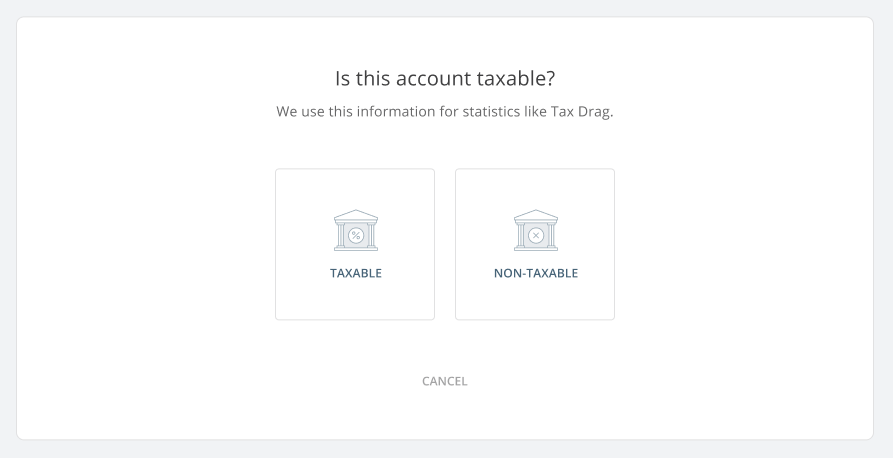

Once you’ve started building a proposal or portfolio, it’s easy to assign the account a tax status—taxable or non-taxable. This information is critical to calculating the Tax Drag on a portfolio or proposal.

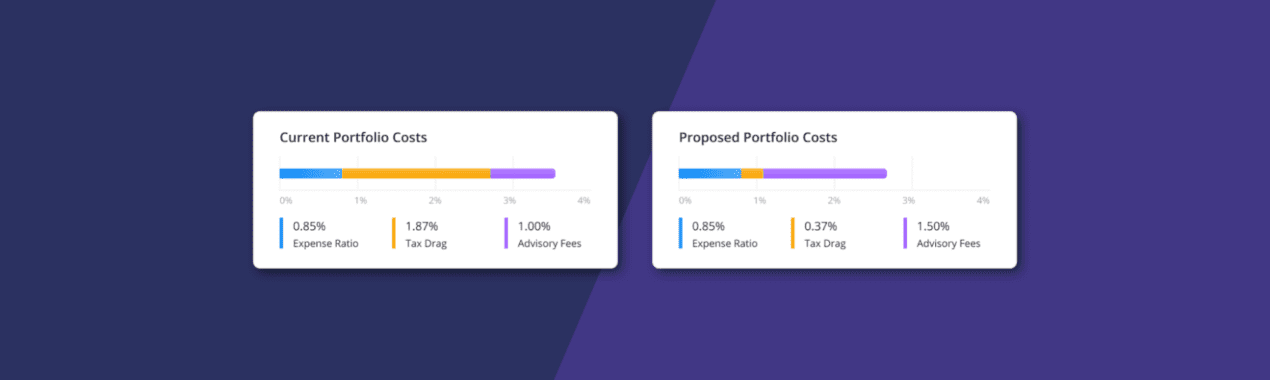

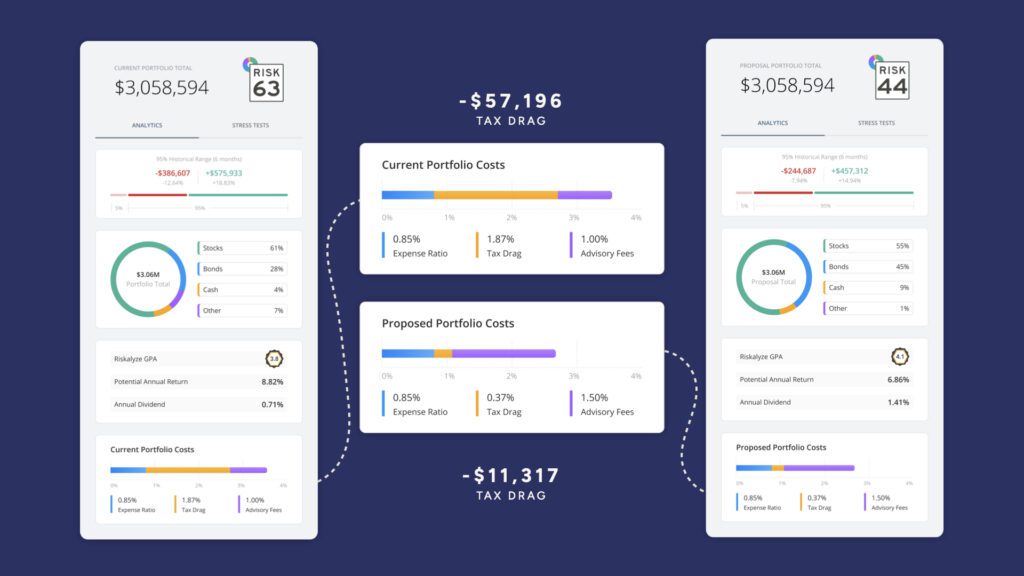

Once your holdings have been entered, it’s easy to see the effects of Tax Drag on a given portfolio. Take a look at this existing portfolio—it’s losing 1.87% of its return to tax drag. It’s so powerful to dollarize it — on a $3 million portfolio, that’s $57,000 of real portfolio value every year, vanishing with taxes.

But if we pull up a proposal you’ve built for your client, it’s a very different story — just 0.37% tax drag. And that saves $46,000 a year that keeps compounding for the client, and by the way, increases your AUM!

This can be a real game changer to drive client engagement and conversions. In many cases the cost to transition a taxable portfolio can be offset by reducing tax drag!

There’s something magical that happens when you can save clients money on taxes. It’s one of the most powerful things you can do as a financial advisor.

But that’s not all. Tax Drag can be accessed in Detailed Portfolio Stats! This means you can take your analysis to the next level and dive even further into your portfolios and proposals to ensure you are building the most tax-efficient portfolios for your clients.