REGULATION BEST INTEREST

Turning an Industry Challenge Into Opportunity

Reg BI is about demonstrating your care for clients while educating and informing them about your decisions. Here’s a short checklist of how your firm needs to engage with investors under the new rule.

Talk to a SpecialistProvide full and fair disclosure of the material facts of your client relationships.

Prove and document that you have clients’ best interests first, always.

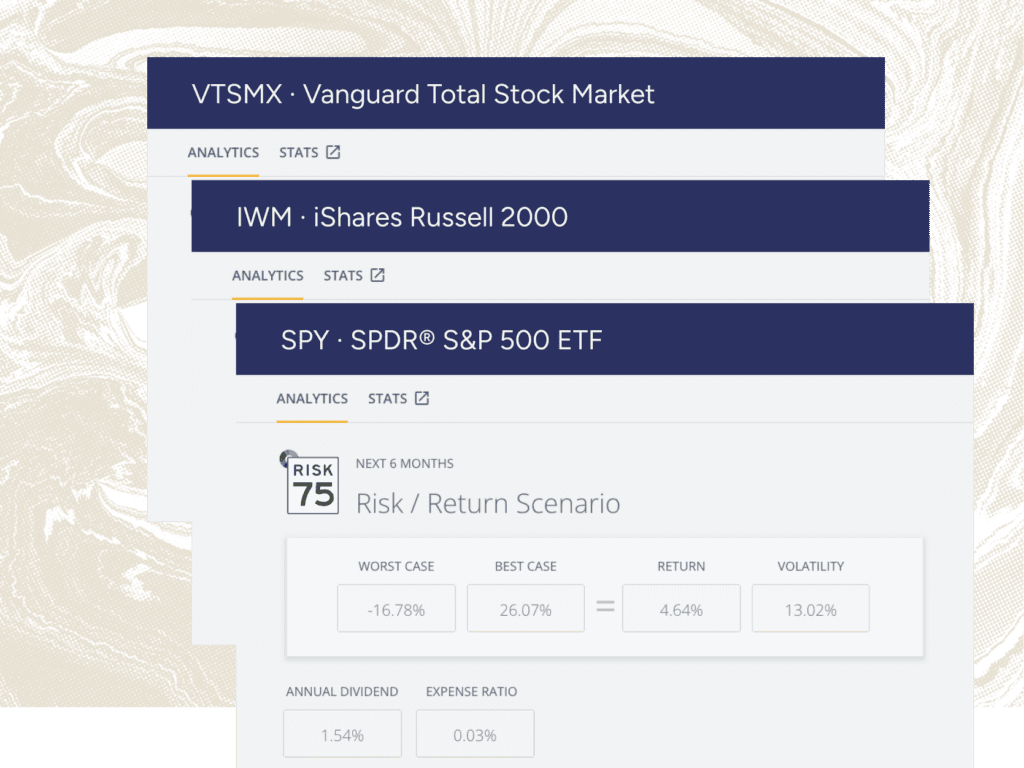

Understand the risks, rewards, and costs of your recommendations.

Show a reasonable basis to believe your recommendations are in the best interest of your clients.

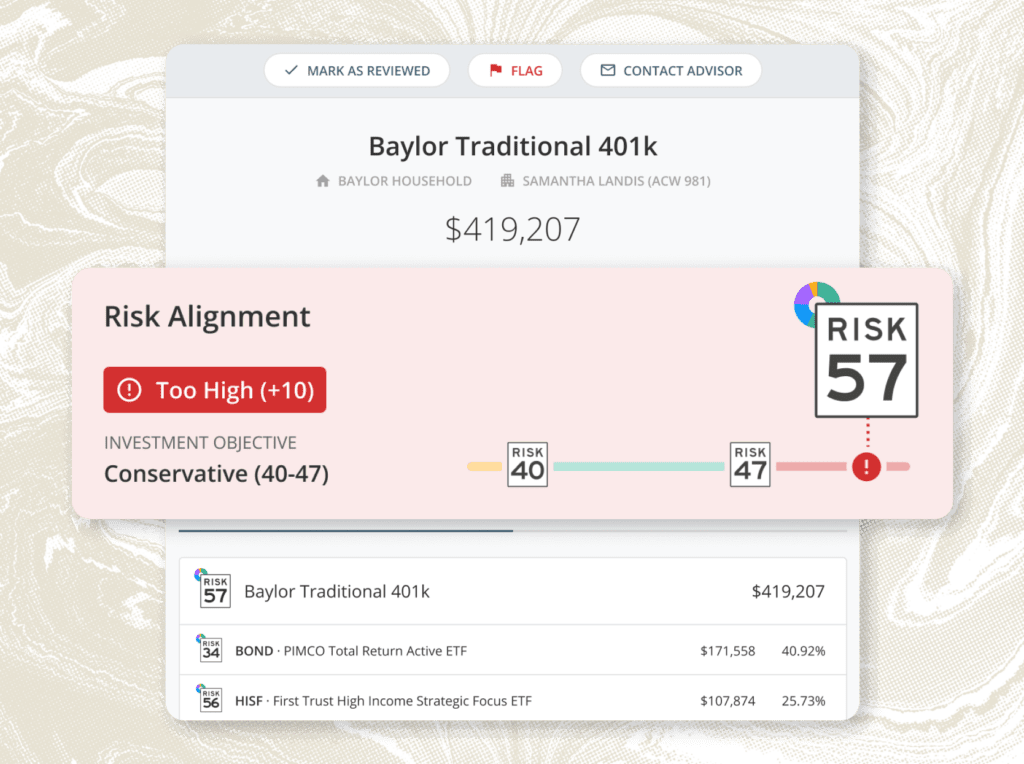

Demonstrate that recommendations are in a client’s best interest based on their investment profile.

Show that recommendations alone, and when viewed holistically, are in a client’s best interest.

Implement a system to mitigate conflicts of interest that may arise.

Create policies and procedures to prevent your advisors from making recommendations that place their interests ahead of their clients.

Factor in the cost and expense of your recommendation. Show that the cheapest option isn’t necessarily in the client’s best interest.

Imagine: advisors and compliance always on the same page.

thousands of firms leverage the sophisticated analytics in Nitrogen to set better client expectations and welcome new business into their firm as well. We hear it from compliance officers all the time: “How in the world do you get so many advisors wanting to use a best-interest documentation tool?” When the very same Risk Number® that quantifies best interests can also give you a tangible ROI, you’ve got a solution everyone can agree on.

Build your solution on a foundation of bulletproof methodology.

Built on a Nobel Prize-winning framework, Nitrogen’s client assessments use real dollar amounts in a refined approach that captures the right data about what the client is looking for. When you combine that with unparalleled investment analytics, you’re able to prove alignment in the client’s best interest (even when that’s not always the cheapest option). We analyze risk down at the securities level instead of using the conventional approach of making assumptions at the asset class level. Other tools that assume Facebook and Home Depot are the same “large cap stock” simply aren’t going to cut it during the next recession or the next audit.

SCHEDULE A DEMO

Ignite firm growth with Nitrogen

Let one of our experts guide you through the Growth Platform, answer any questions you may have, and show how thousands of firms like yours have found success with Nitrogen.