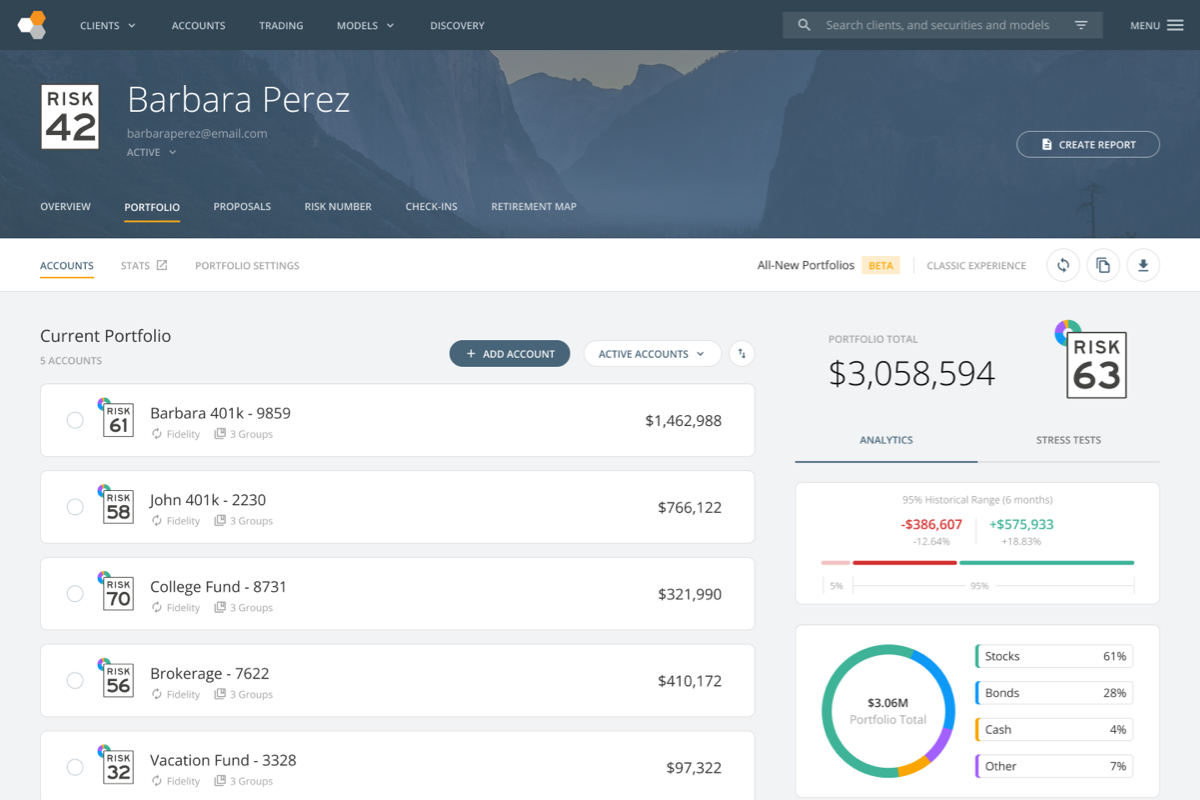

The portfolio screen is the hub of the work you do in Nitrogen. Whether you’re reviewing a client’s portfolio, preparing for an upcoming prospect meeting, or building a new proposal — this is where you start. We’ve been making huge strides in our development of the all-new portfolios experience.

Most of the features we build and release, we build from scratch and then we iterate over time. But our new portfolios experience is about taking all the innovation we’ve poured into the most complex part of our platform over the course of a decade, and bringing it all into the modern era.

That brings us to today—because we’ve reached some major milestones not just in performance and functionality, but in how intuitive the whole design is.

Take it from our Chief Product Officer, Justin Boatman.

As you can see, we’ve released a ton of powerful updates over the last year, but I’d like to highlight a few features that will change the way you use portfolios.

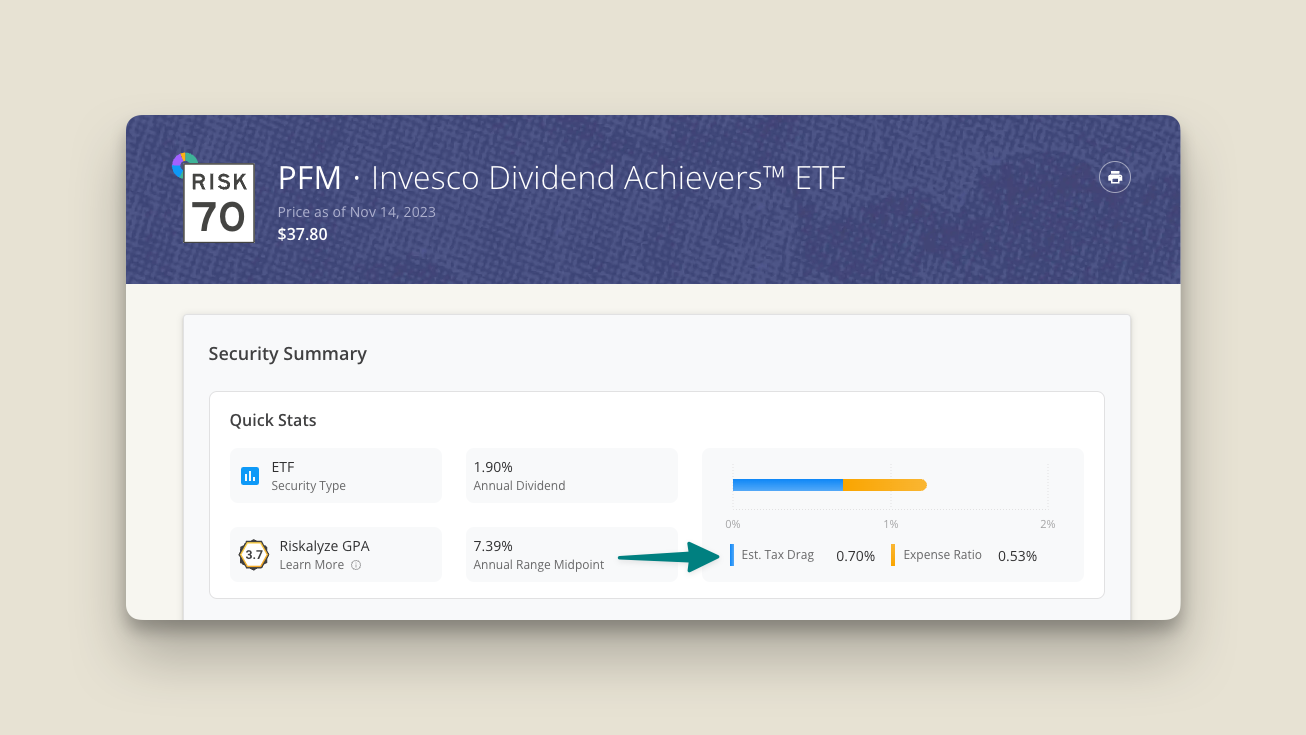

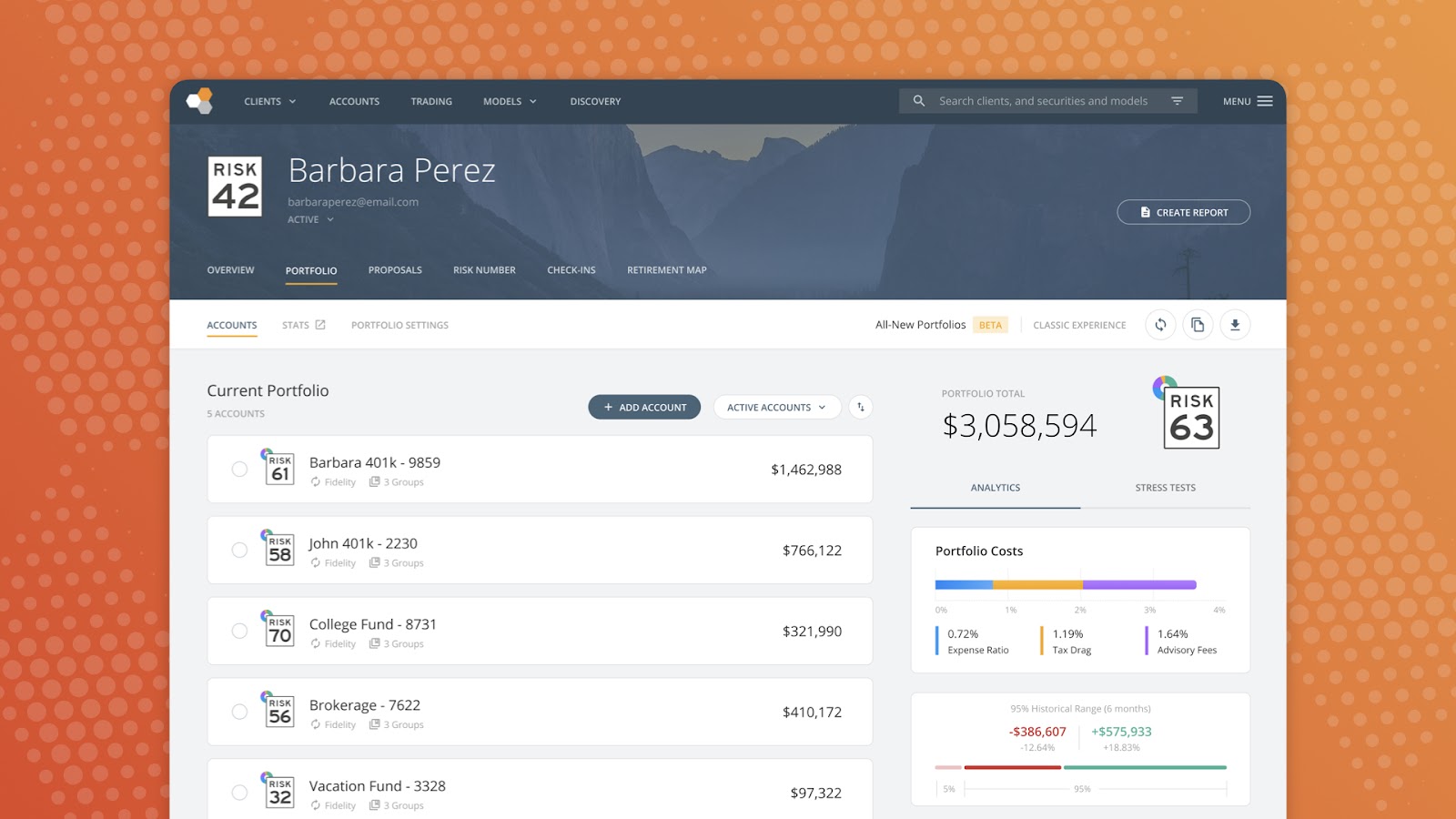

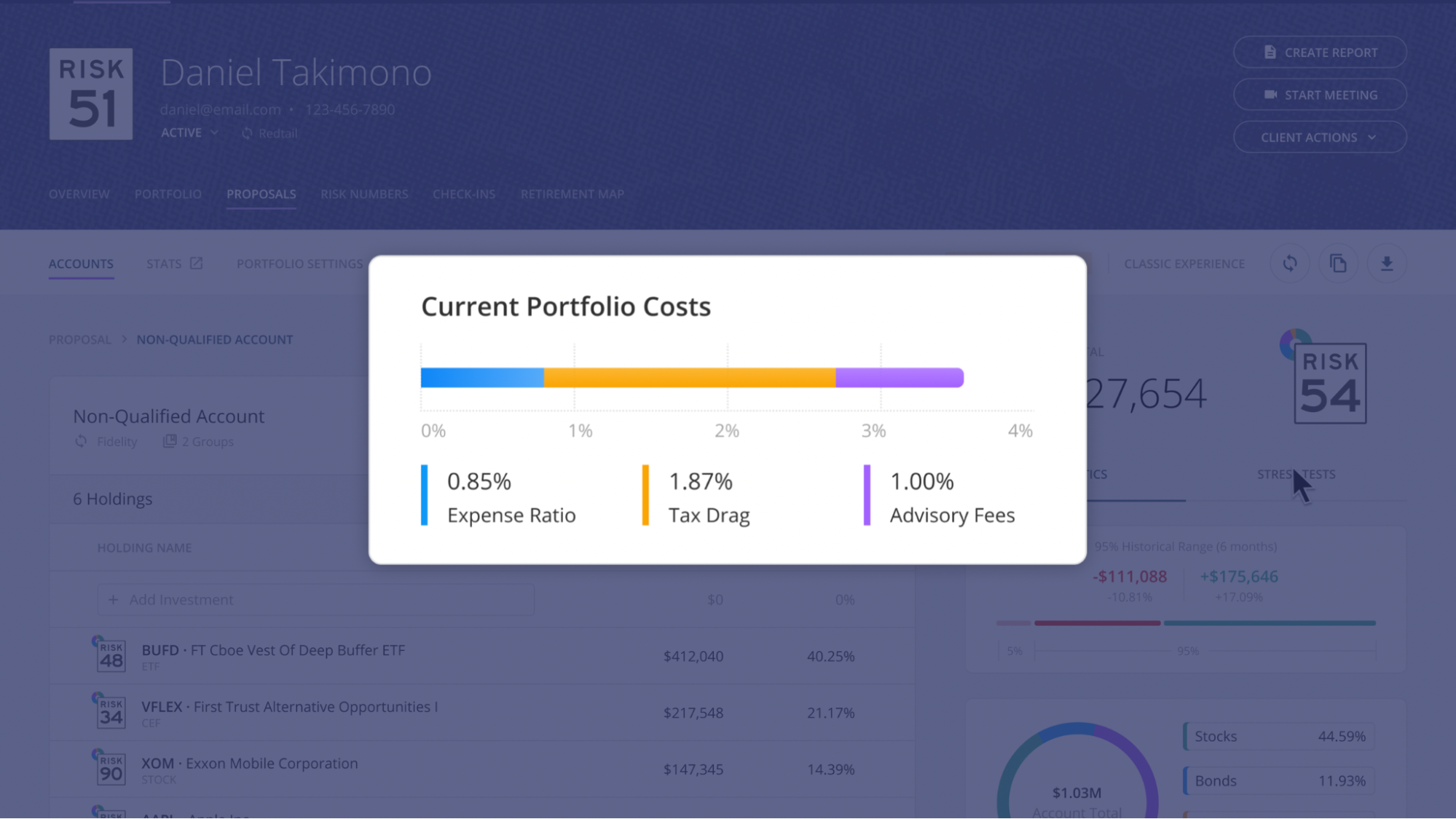

Tax Drag

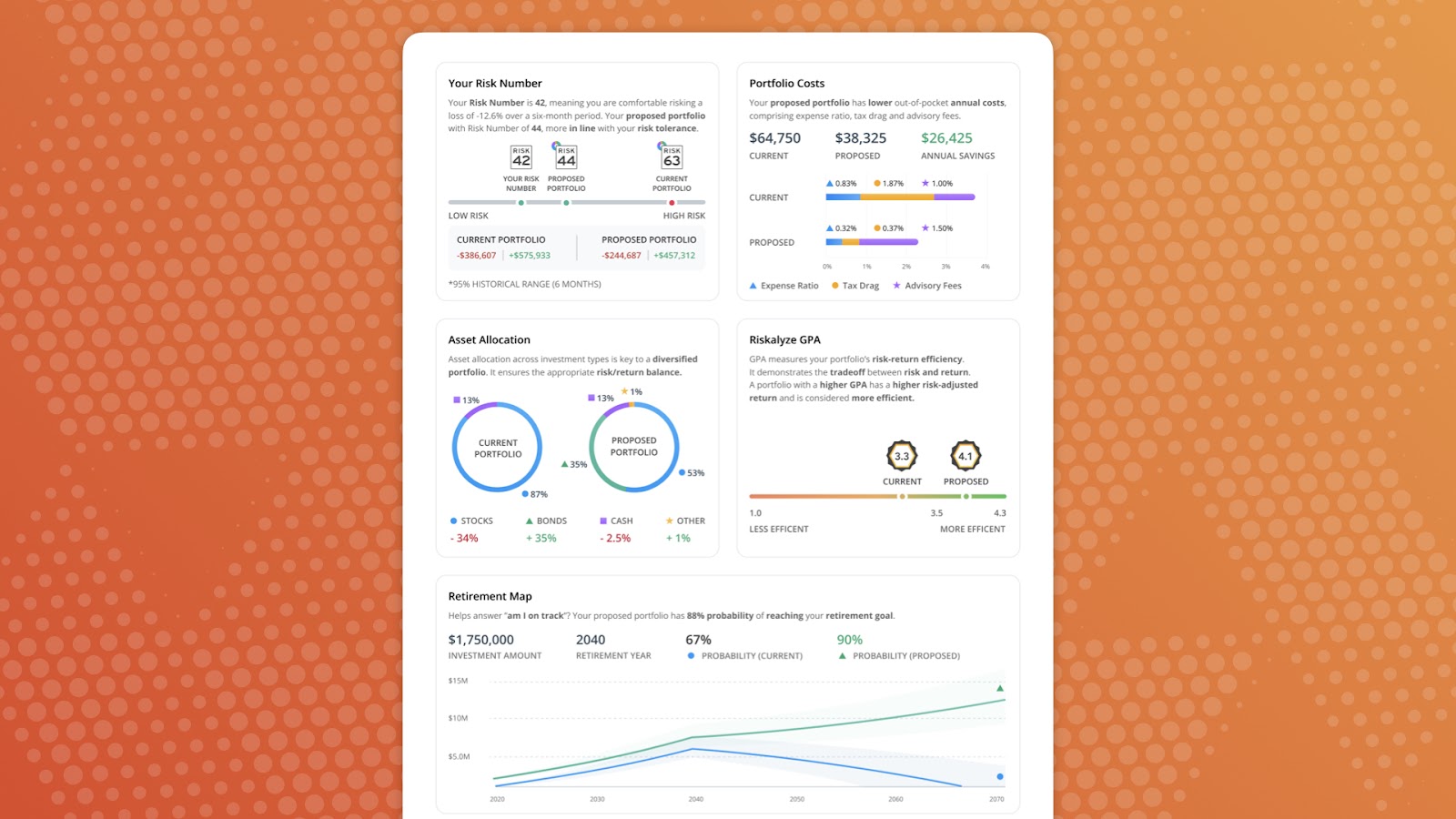

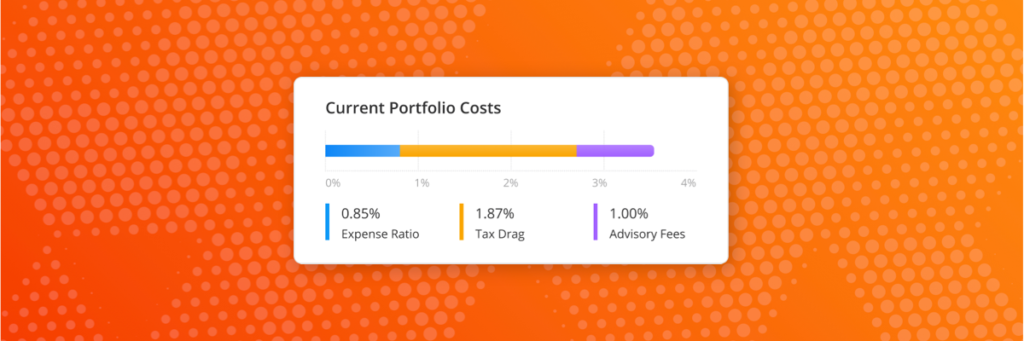

Last year at Fearless, we announced Tax Drag, which we first applied to securities. This year, we’ve applied Tax Drag calculations at the account and portfolio level as well.

You know of Tax Drag as the reduction of a portfolio’s annualized return due to taxes, or you might say it’s tax liability triggered by distributions and capital gains. Putting it at the heart of portfolios lets you tell that story about non-qualified accounts to clients, so you can win and keep business.

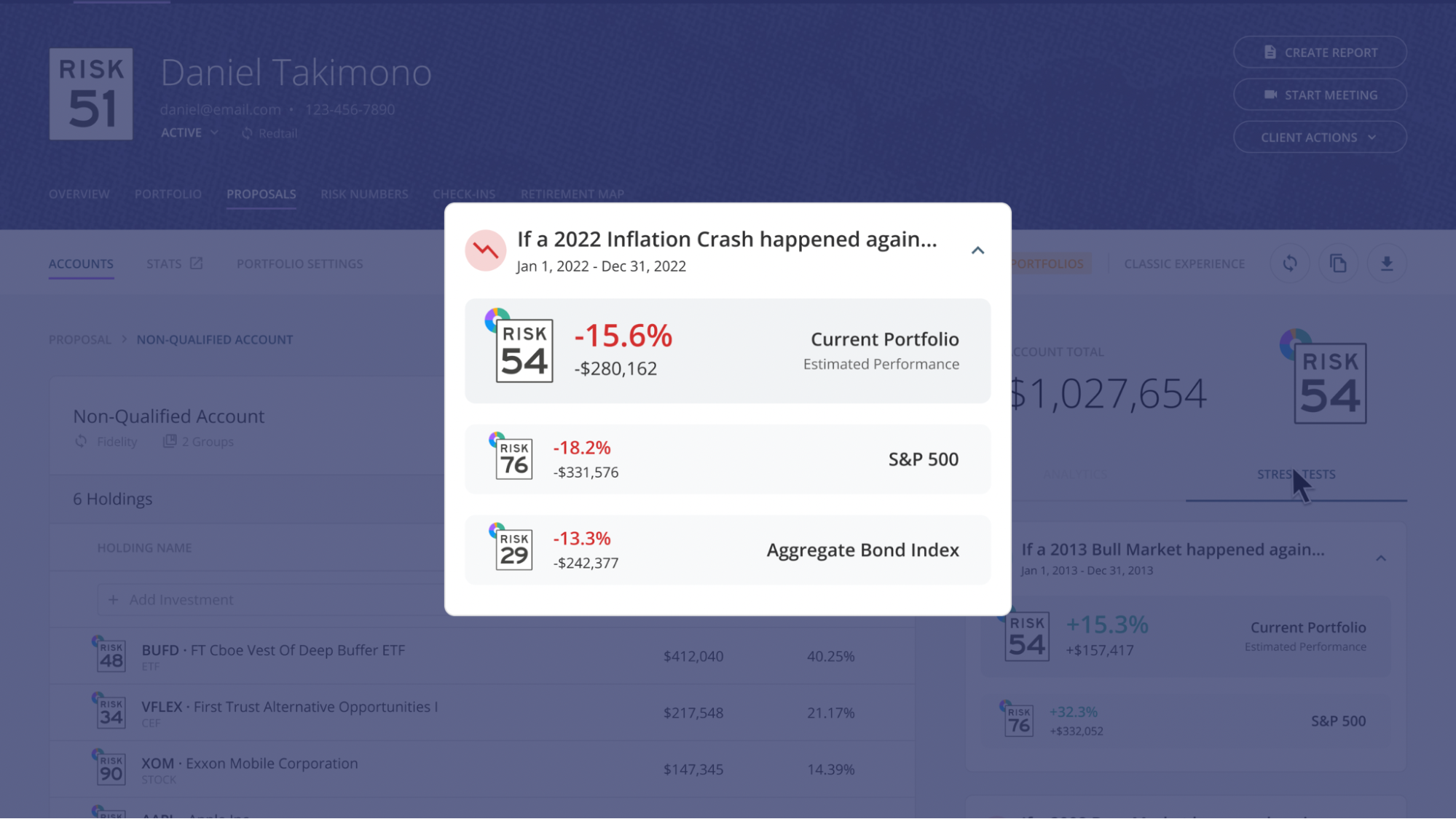

Stress Tests

We’ve completely redesigned Stress Tests this year. When a client asks why the market is beating their portfolio, you know exactly how to answer. We’ve made the Risk Number even more prominent—it’s front and center.

We’ve also added a new Stress Test to the mix. While you’ve always been able to model what happens to bonds in a high-interest rate environment, or to equities when times get tough, now you’ve got a multi-comparator stress test to illustrate the effects of the 2022 Inflation Crash on both stocks and bonds.

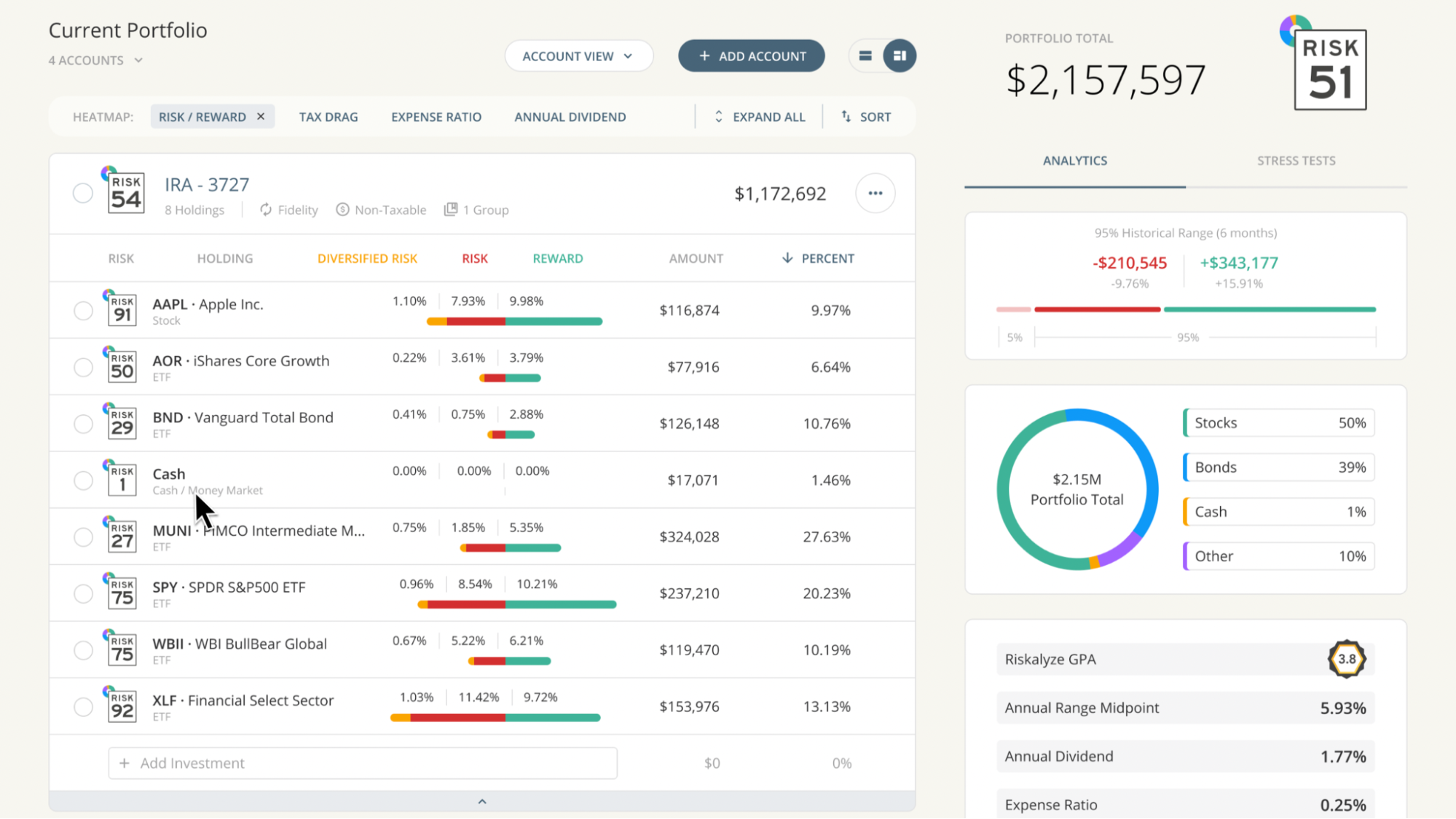

Heatmaps

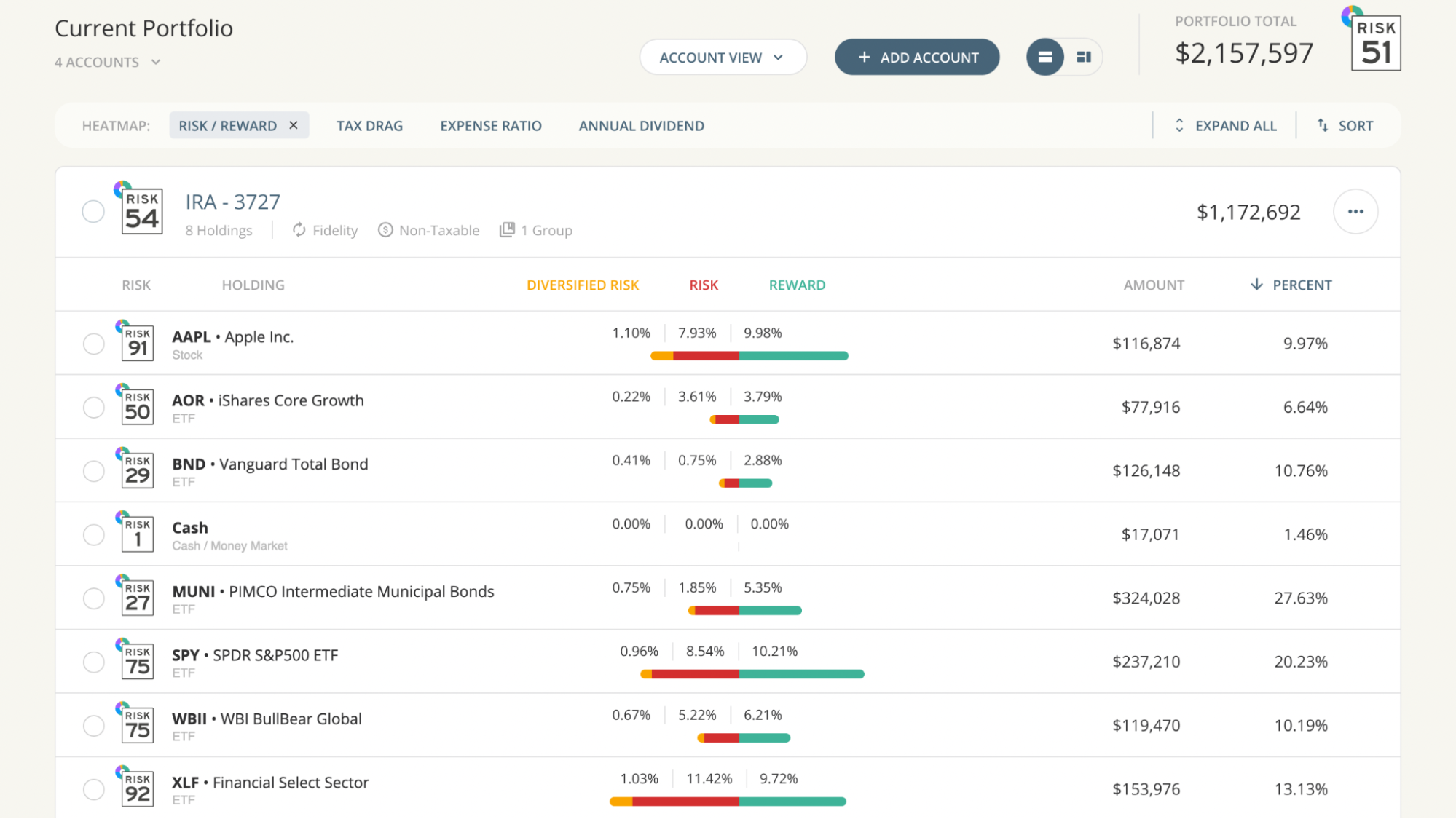

With Heatmaps, you can pinpoint which individual holdings have the greatest relative impact on the portfolio. The Risk/Reward Heatmap shows the weighted potential upside reward and downside risk of each security, so you can visually show clients how you want to rebalance holdings or propose anticorrelated assets to diversify away risk.

It’s the most powerful way to illustrate the effects of diversification to clients in a way they can see and understand.

It can also lead to additional conversations around held-away assets. When you can pull in outside accounts with Asset Sync, you can get a truer understanding of how much risk or diversification a client actually has in their whole portfolio.

Annuities

Annuities are also available in the new experience. And now, when you apply an income rider, it’ll show up as a timeline event with income in a client’s Retirement Map.

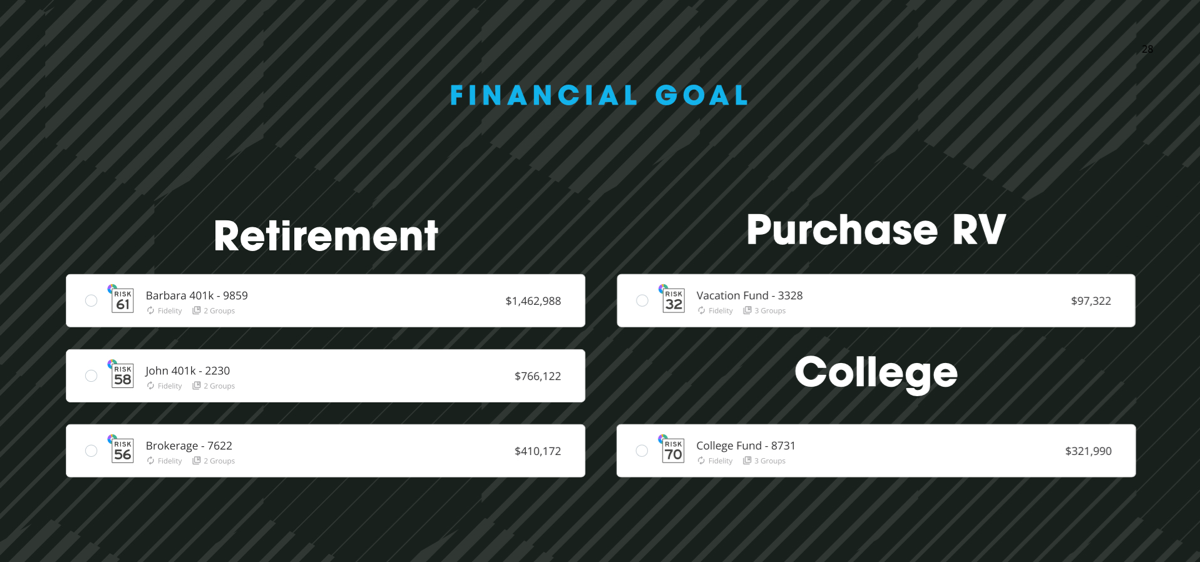

Navigating Portfolios

We’ve made working accounts just as intuitive as it should be. If you haven’t tried the new portfolios experience lately, now’s the time to play around with it. You’re going to find a lot of delightful little ways you can interact with accounts you may not have known about.

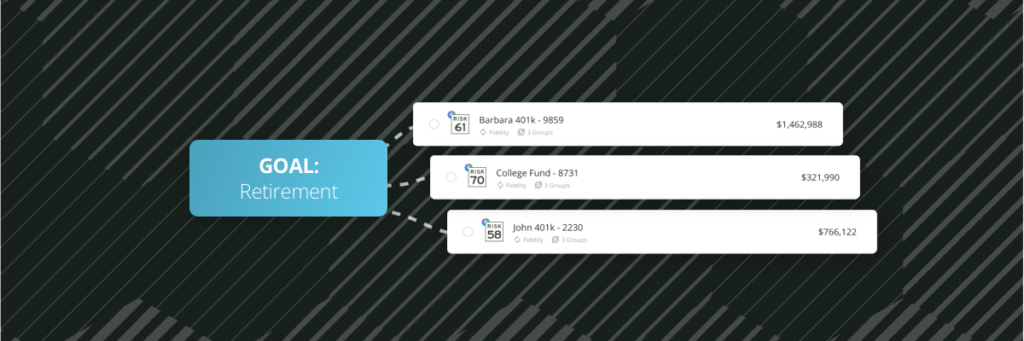

You can add holdings from your Discovery favorites, assign Account Groups, sort by Risk Number, name, and value, expand and collapse accounts, and even drill into accounts and models. And you can do it all in a new view as well. With Fullscreen Holdings View, you can expand your screen enabling you to put the focus right where you want it.

So, that’s what’s new in the All-New Portfolios Experience. We think you are going to love all of the updates and delightful touches that the team has been working on.

Next Up

The team is hard at work making sure there will be no reason you’ll need to go back and use the old, slower experience. Soon, custom securities will get new settings, you’ll be able to create a portfolio by importing a file or using model templates, you’ll be able to launch Scenarios, access the client actions menu, and adjust advisory fees at the account level. And that’s it! Give it a shot — we’d love your feedback.

Not seeing the new experience in your account? Head to Settings > Early Access, and toggle on “All New Portfolios.” Need a hand? The industry’s best Customer Care team would be glad to help at [email protected].

If you’d like to get a demo of the All-New Portfolios Experience and all of the other powerful features in the platform, sign up for a demo here. We’d love to show you around.