A Decade of Platform Enhancements

Since we introduced the Nitrogen Growth Platform in 2013, advisors and firms have generated more than 50 million Risk Numbers. And that number continues to grow at a staggering rate!

Advisors around the nation have adopted the Risk Number as their source of truth to grow their AUM, engage with clients and prospects, protect their businesses, and empower fearless investing.

Understanding the Risk Number is simple, which makes it an invaluable resource for advisors and clients. Clients can easily get frustrated and confused when given standard deviations, Sharpe ratios, and scatter plots. It’s not that clients have too little information — the problem is that clients are overwhelmed. That’s why the Risk Number was born.

The Risk Number boils that complexity down into understandable terms.

Because, when advisors can orient conversations around how much risk investors can handle and have the tools to articulate that investment strategy, that turns prospects into engaged clients, and those engaged clients into referral champions.

When we first launched our product, it was just the Risk Number questionnaire and basic portfolio alignment. But over the past decade, we embarked on a decade of building the ultimate growth platform for advisors.

Nitrogen has been at the forefront of this evolution, rolling out enhancements and features that not only keep advisors ahead of the curve but also revolutionize the way they engage with clients. Let’s take a look at how the platform has evolved over the years.

2014: Help Clients Understand How to Control Risk or Beat the Market

In 2014, we built three powerful visualization tools that help clients understand how much risk they are taking.

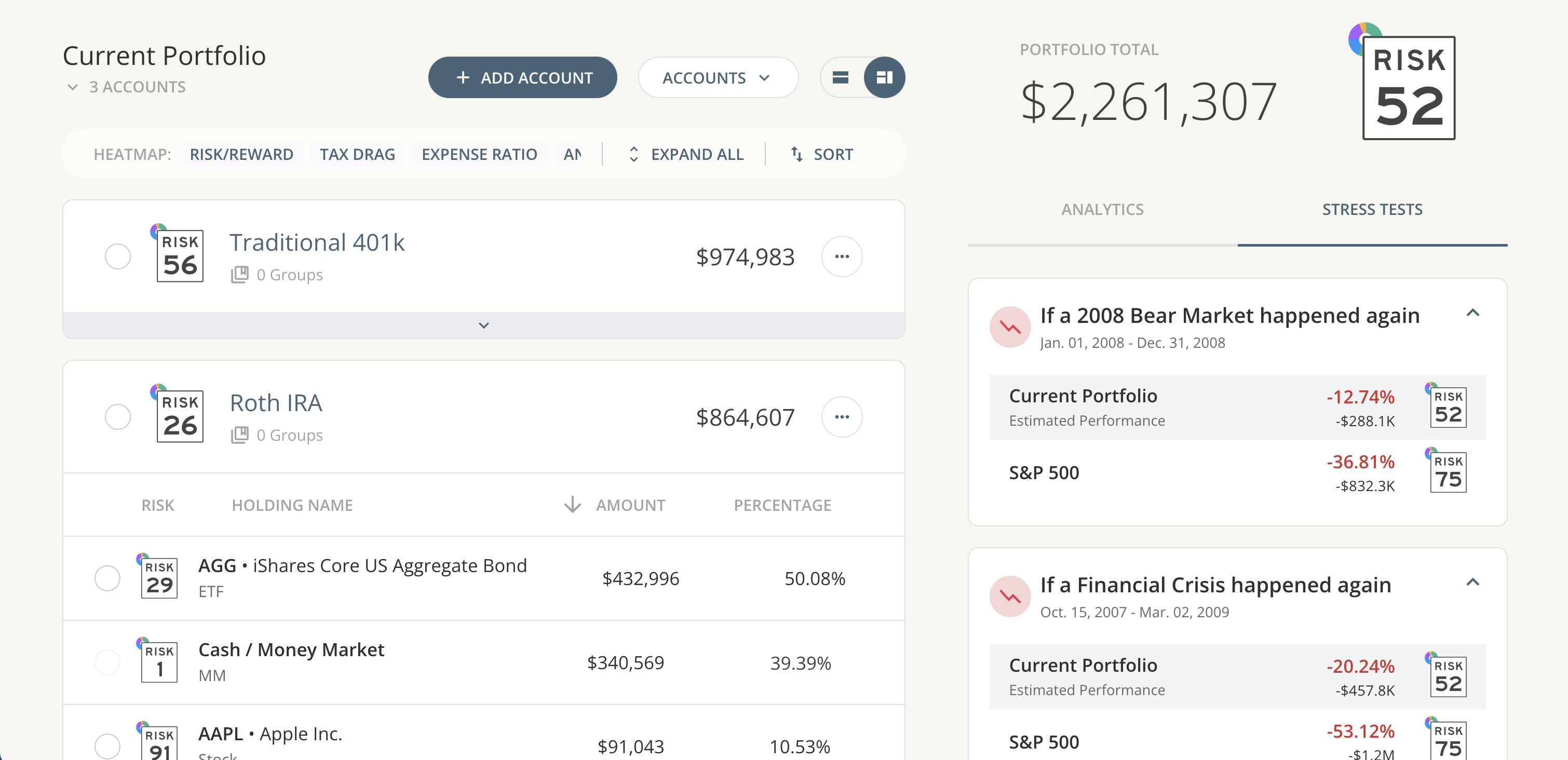

Stress Tests allows advisors to run portfolios through historical events like the 2008 Financial Crisis, 2013 Bull Market, or 2022 inflation crash. This helps clients understand what it means to control risk or beat the market.

Now, your firm can create preset market scenarios to illustrate hypotheticals with your clients. These examples are not only powerful for illustrating how you’ve built a portfolio, they’re also a game-changer when it comes to reinforcing how you set a client’s expectations.

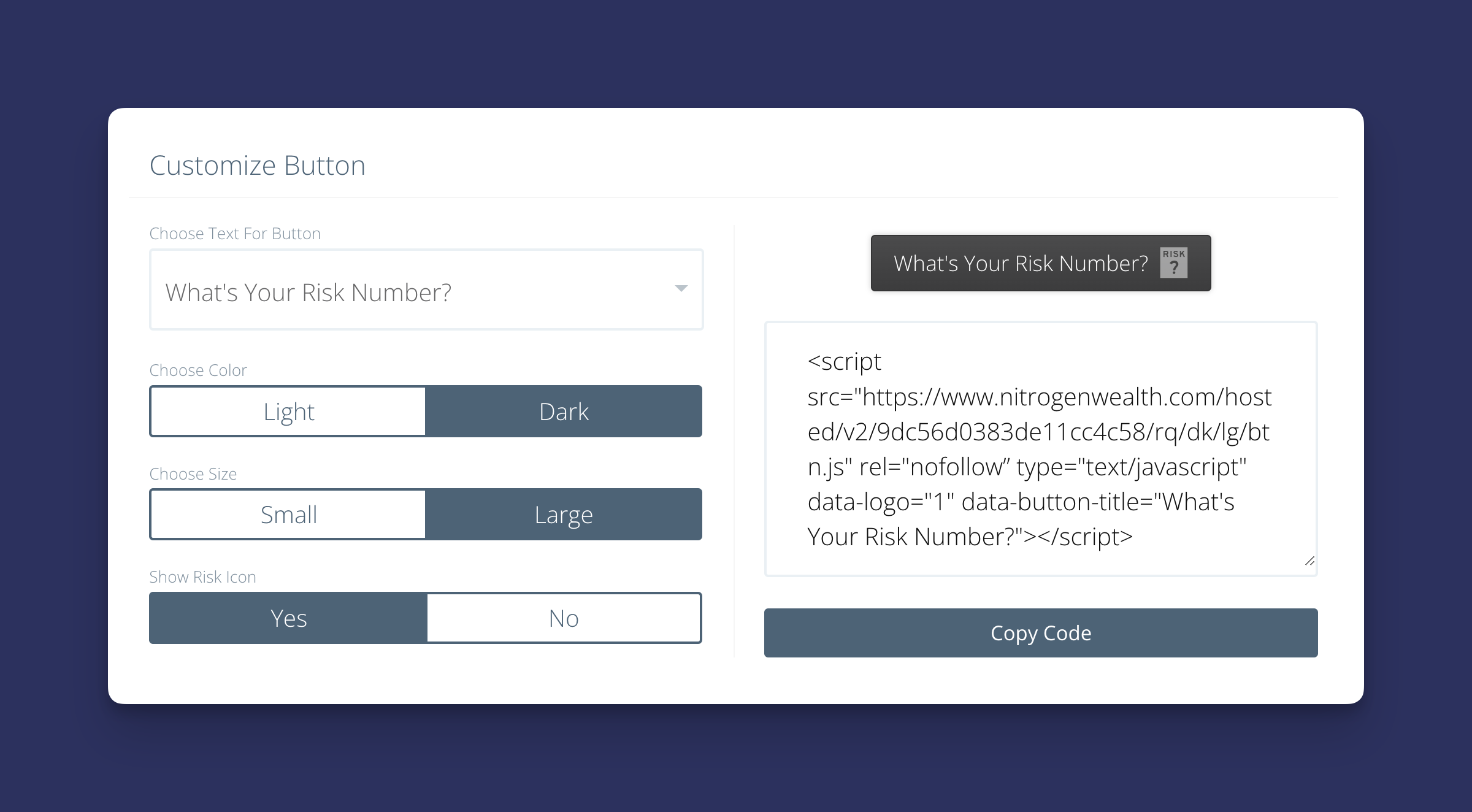

The Lead Generation Questionnaire gives you the power to drop a simple link onto your website or email signature to turn it into an interactive risk analysis tool and a lead-capturing machine. Now you can leverage the four most powerful words in financial advice — “What’s Your Risk Number? — to turn leads into prospects, prospects into meetings, and meetings into engaged clients.

Retirement Maps helps you illustrate how much risk your clients need to reach their goals. Now you can calculate their probability and build a map to success. It’s never been easier to Illustrate the bigger picture and even uncover outside assets.

2016: An Automated Behavioral Coaching Tool

In 2016, we launched Check-ins — an automated coaching tool to build a strong foundation to support your message between client reviews.

With powerful, behavioral coaching, you can take the pulse of your clients on a regular basis. That way, you’re set to receive an early warning sign if a client’s psychology needs a little care. Now, you get data points on how your clients are feeling about the markets and their financial future, allowing you to take action at the first sign of trouble.

2018: Unleash Your Inner Math Geek with Powerful Analytics

The beauty of the Risk Number is how it empowers investors to stay the course during the short term so they don’t lose sight of the long term. But what happens when your analytical clients need more detailed analysis or reporting?

Detailed Portfolio Stats and Individual Security Analysis is data analytics taken to the next level. With a variety of tools ranging from modeled performance, sector breakdowns, risk/reward scatter plots, and data correlation, it’s the most effective way to analyze a portfolio through the lens of risk.

Whether you need detailed analytics for individual stocks, ETFs, mutual funds, portfolios, models, or proposals, we’ve got you covered.

2019: A Suite of Marketing Tools and Templates

In 2019, we launched the Advisor Marketing Kit, an interactive portal of design templates and resources available in Nitrogen Elite, Ignite, and Ultimate. Complete with personalized client-facing videos, templates for presentations, brochures and press releases, social media images, and more, it’s your one-stop shop to infuse the Risk Number into your firm’s marketing.

These materials are designed to showcase your brand, not ours! Take a look at our client-facing video. ?

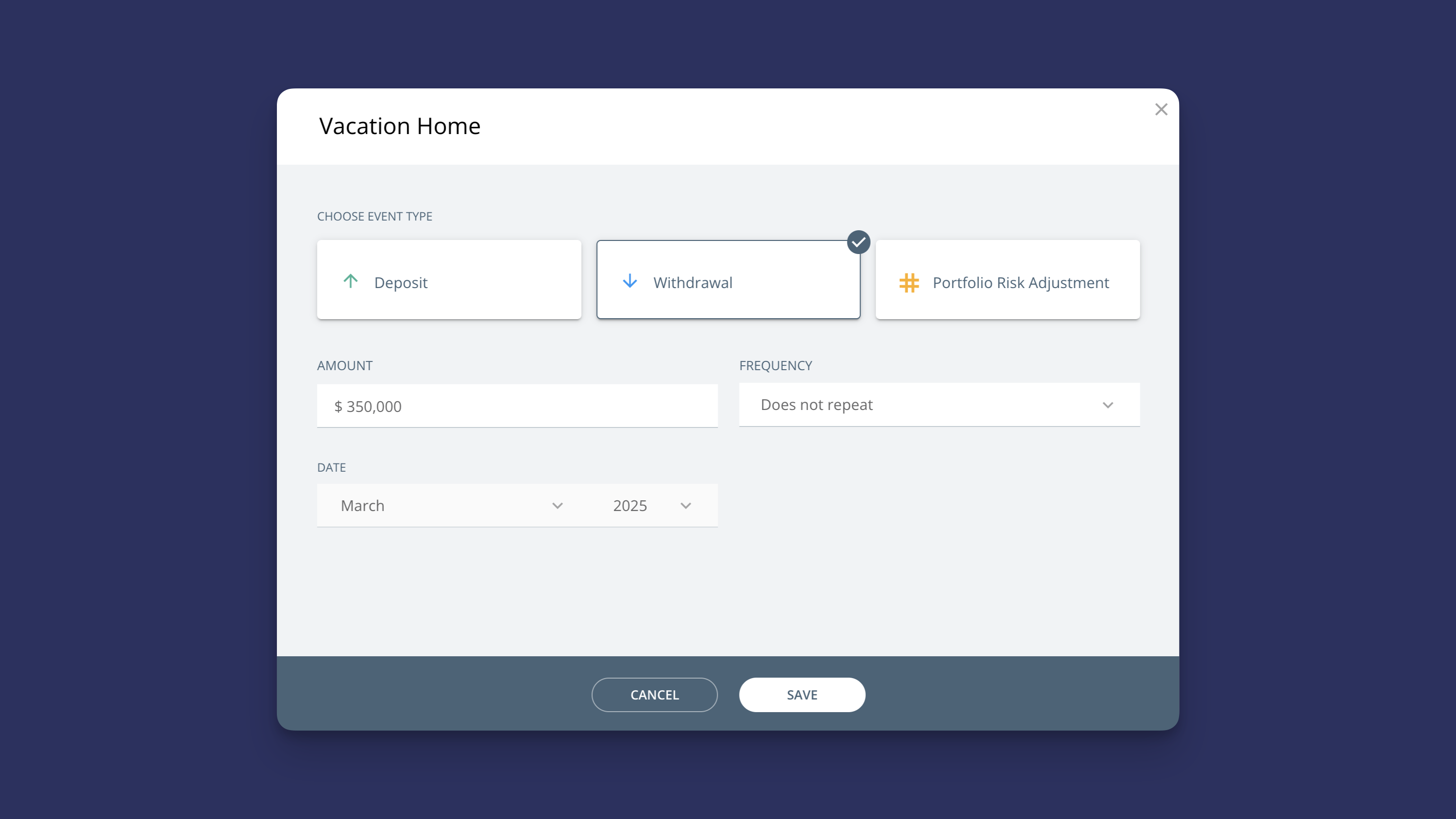

And with Timeline, you can unlock the power of events in Retirement Maps. Now you can illustrate how changing your client’s Risk Number, income, or expenses over time will affect their overall risk capacity.

Can your client afford a vacation home? Drop it on the timeline.

Want to see the effects of Social Security? Add it with a click.

Timeline is dynamic and interactive, helping facilitate conversations around what is most important.

2021: Unlock Powerful Investment Research

With the addition of Discovery, advisors can quickly dive into their investment research based on the most important search criteria including the Risk Number, GPA, expense ratios, and more. It’s as simple as clicking and dragging the filters that are most relevant to your search.

And with Individual Security Analysis, you can take your research one step further. You can dive deep into the modeled performance, asset classification, risk metrics, and so much more. You can even favorite funds right from the Discovery screener to add them to client portfolios.

2022: Advisors and Compliance Can Agree on How to Engage Clients

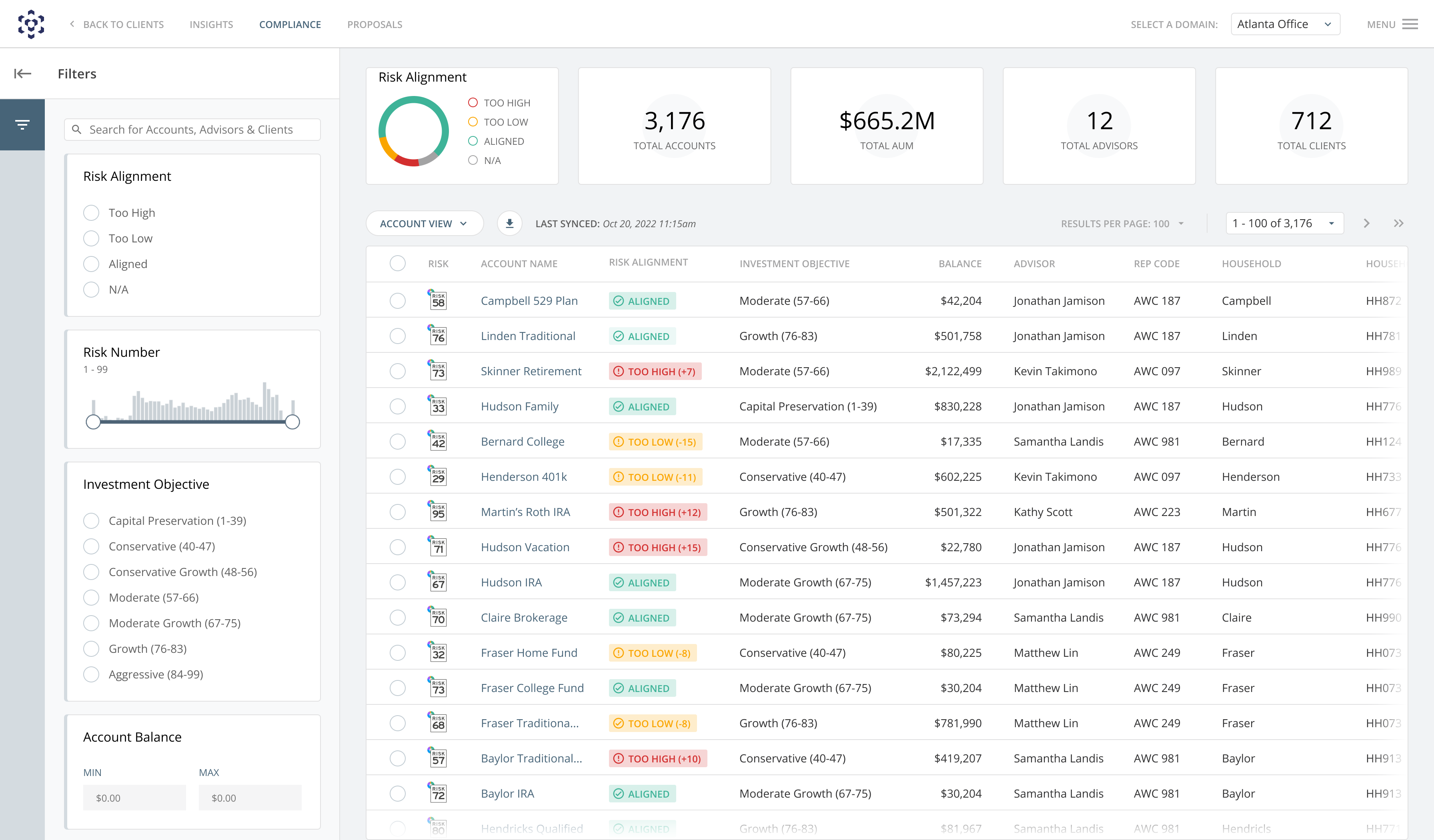

Whether you’re a Chief Compliance Officer or compliance is one of your many hats at your firm, Nitrogen Compliance has the tools you need to fly through thousands of accounts, find issues before they become problems, and leverage the analytics necessary to get clients back on track.

With the launch of Nitrogen Compliance in 2022, we built a dashboard that gives you visibility into your entire book of business. What’s unique here, is that we calculate the risk on every single holding in every account using the proven risk methodology that has powered the Nitrogen platform since 2013.

Now, you have instant access to your firmwide risk alignment and can easily isolate accounts with risk above or below their target.

2023: You can’t grow what you can’t measure

How can you tell which advisors are performing at their best? Or how does your firm’s Risk Number and GPA stack up to others? Insights was built to answer all of those questions. Because you can’t grow what you can’t measure.

Insights is the Executive Dashboard that measures your firm’s growth and risk analytics across your entire book of business. Now, you can quickly see which advisors are outperforming and share their expertise with the rest of your team for exponential growth.

We also launched Nitrogen AI — an all-new AI content assistant that can generate high-quality marketing content with just three clicks. Powered by some of the most popular AI engines, we’ve fed it with our advisor-specific content to give you a head start the next time you need to write for social media, your blog, or anywhere else!

We’re just getting started!

The innovation for you and your firm doesn’t end here. At the 2023 Fearless Investing Summit, we announced two major product enhancements that are coming in 2024: Reports Builder and Lead Management.

Reports Builder will become your go-to interface where assembling reports isn’t just intuitive, it’s powerful and flexible. Reports builder will have an extensive collection of pre-built templates and elements that can be used to customize each client report. And if you are on Nitrogen Ignite or Nitrogen Ultimate, you can configure your primary and secondary brand colors to flow through all of the report elements to make each report feel like it was custom-built for your business. You can learn more about Reports Builder here.

Lead Management is also coming in 2024. Lead Management is going to help you automate more of what you do today in driving prospects toward a meeting and a successful proposal. It leverages cutting-edge AI-powered predictive analytics to surface the next best lead to follow up with, and gives you tools for getting that lead into a meeting to become your valued client.

All of this syncs seamlessly to the CRM of your choice, and it’s not just about making your workflows easier — it’s about setting a new industry standard for what client acquisition looks like for the wealth management firm of the future.

As we reflect on the past decade, the Risk Number was just the starting point. Now, we have a full-fledged Growth Platform that supports, engages, and grows with every facet of your business. With powerful tools that have redefined client engagement, risk assessments, and the compliance needs for advisors across the nation, Nitrogen has not only kept pace with the evolving landscape but has consistently stayed several steps ahead.

So here’s to the next chapter in this remarkable journey — where we not only keep up with change but drive it, ensuring our advisors are always at the forefront of innovation and can continue to empower the world to invest fearlessly.

Want to check out Nitrogen for the first time? Request a demo here and a specialist would love to show you around.