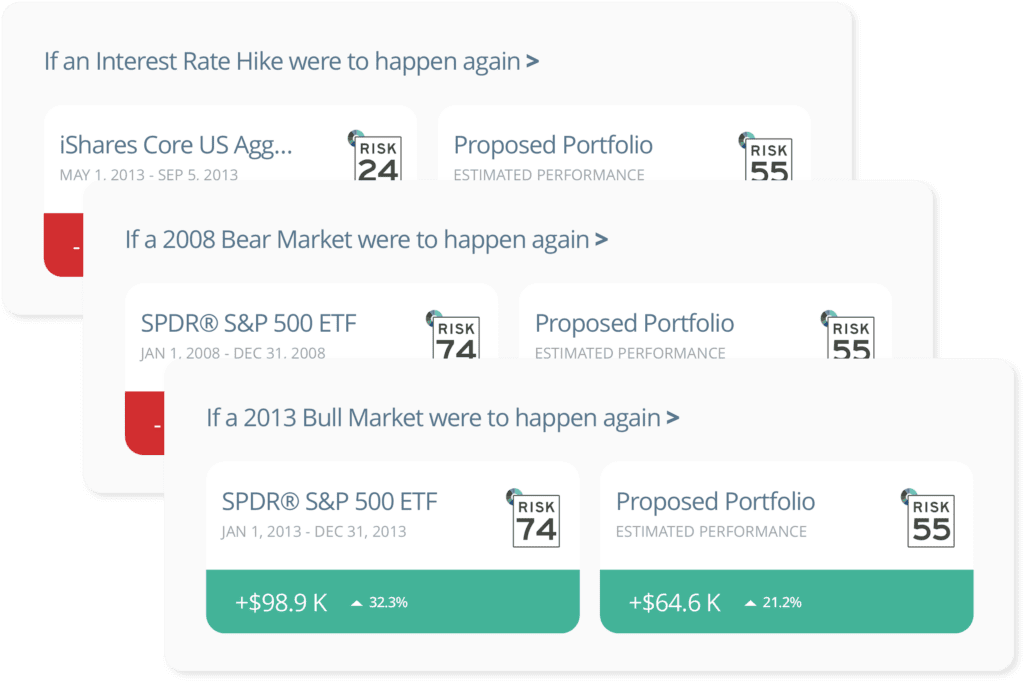

What if 2008 happened again?

You know better than anybody that clients want to know what’s “normal” for their portfolio. And you also know setting expectations based on average return doesn’t work — after all — the market almost never hits its own average!

Stress Tests give you preset market scenarios to illustrate hypotheticals with your clients. These examples are not only powerful for illustrating how you’ve built a portfolio (maybe it’s fortified from interest rate spikes), they’re also a game-changer when it comes to reinforcing how you set a client’s expectations.

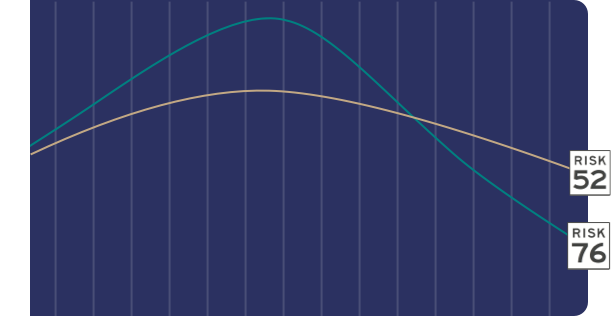

Control risk? Or beat the market?

There’s no better way to illustrate your answer to the question “why is the market beating my portfolio?”

You can show them that the S&P 500 is a Risk Number 76, and while their Risk Number 52 portfolio won’t make as much when markets are up, it’ll lose a whole lot less when markets are down. They’ll remember exactly why they’re a 52 — clients just “get it.”

Every tool at your disposal.

It’s never been easier to set expectations with clients, prove your fiduciary care, and grow your business.

Meet the objective metric that has paved the way to measuring the efficiency of investments not just at the fund level, but at the portfolio level as well.

Eliminate the stereotypes that have made risk tolerance useless. Use leading scientific theory to objectively pinpoint an investor's Risk Number®, whether you’re across the room or across the world.

Unlock the power of events in Retirement Maps. See how changing your client's Risk Number®, income, or expenses over time will affect their overall risk capacity.

Run a portfolio through a market timeline and compare it to just the right benchmark to make your point.

Unleash your inner math geek with in-depth analysis of everything from modeled performance comparisons, sector breakdowns, regional exposure, and more!

The risk/reward heatmap pinpoints the risk and reward contribution of individual securities in accounts, allowing you to have productive conversations about risky or concentrated positions.

Want to leverage the Risk Number® for your brand? We've got an interactive portal of design templates and other resources available in your Nitrogen Elite account.

Check-in emails build a strong foundation to support your message between client reviews and give you an early warning signal when client psychology needs care.

Find the perfect investment for your clients with security analysis and fund screening. Discovery empowers you to quickly dive into your investment research based on your most important search criteria including the Risk Number®, GPA®, expense ratios, and more.

Dive deeper into your analysis with a rich set of analytics and metrics for individual stocks, ETFs, and mutual funds.

Drop a simple link onto your website or email signature to turn it into an interactive risk analysis tool and a lead capturing machine. Now you can leverage the four most powerful words in financial advice, "What's Your Risk Number?"

Effortlessly launch a remote meeting with just two clicks. Your client joins with a web browser, and you’re protected from sharing the wrong data with the wrong client.

Seamlessly import outside assets from thousands of institutions. With client credentials entered remotely or by your side, manual updates become a thing of the past.

Take advantage of our collection of free and subscription-based models and download them into your Nitrogen account. Stay up to date on the industry's best strategies!

Does an investor's risk tolerance align with how they're invested? A portfolio-wide Risk Number® and 95% Historical Range™ enable you to make investment decisions and demonstrate alignment to your prospects and clients.

Don't wonder if a client's risk preference will allow them to achieve their goals—calculate their probability and build a map to success. Illustrate the bigger picture and even uncover outside assets.

Finally, it's easy for you to use the Risk Number® to match hundreds or thousands of 401K, 457, 403B, or Simple IRA plan participants with just a few clicks. The Risk Number creates a common language, allowing you to bridge the gap between advisor and participants without flooding your to-do list.

Create a roadmap for your clients with Nitrogen — your go-to interface where assembling reports isn’t just intuitive, it’s powerful and flexible.

Meet the objective metric that has paved the way to measuring the efficiency of investments not just at the fund level, but at the portfolio level as well.

Eliminate the stereotypes that have made risk tolerance useless. Use leading scientific theory to objectively pinpoint an investor's Risk Number®, whether you’re across the room or across the world.

Unlock the power of events in Retirement Maps. See how changing your client's Risk Number®, income, or expenses over time will affect their overall risk capacity.

Run a portfolio through a market timeline and compare it to just the right benchmark to make your point.

Unleash your inner math geek with in-depth analysis of everything from modeled performance comparisons, sector breakdowns, regional exposure, and more!

The risk/reward heatmap pinpoints the risk and reward contribution of individual securities in accounts, allowing you to have productive conversations about risky or concentrated positions.

Want to leverage the Risk Number® for your brand? We've got an interactive portal of design templates and other resources available in your Nitrogen Elite account.

Check-in emails build a strong foundation to support your message between client reviews and give you an early warning signal when client psychology needs care.

Find the perfect investment for your clients with security analysis and fund screening. Discovery empowers you to quickly dive into your investment research based on your most important search criteria including the Risk Number®, GPA®, expense ratios, and more.

Dive deeper into your analysis with a rich set of analytics and metrics for individual stocks, ETFs, and mutual funds.

Drop a simple link onto your website or email signature to turn it into an interactive risk analysis tool and a lead capturing machine. Now you can leverage the four most powerful words in financial advice, "What's Your Risk Number?"

Effortlessly launch a remote meeting with just two clicks. Your client joins with a web browser, and you’re protected from sharing the wrong data with the wrong client.

Seamlessly import outside assets from thousands of institutions. With client credentials entered remotely or by your side, manual updates become a thing of the past.

Take advantage of our collection of free and subscription-based models and download them into your Nitrogen account. Stay up to date on the industry's best strategies!

Does an investor's risk tolerance align with how they're invested? A portfolio-wide Risk Number® and 95% Historical Range™ enable you to make investment decisions and demonstrate alignment to your prospects and clients.

Don't wonder if a client's risk preference will allow them to achieve their goals—calculate their probability and build a map to success. Illustrate the bigger picture and even uncover outside assets.

Finally, it's easy for you to use the Risk Number® to match hundreds or thousands of 401K, 457, 403B, or Simple IRA plan participants with just a few clicks. The Risk Number creates a common language, allowing you to bridge the gap between advisor and participants without flooding your to-do list.

Create a roadmap for your clients with Nitrogen — your go-to interface where assembling reports isn’t just intuitive, it’s powerful and flexible.

Meet the objective metric that has paved the way to measuring the efficiency of investments not just at the fund level, but at the portfolio level as well.

Eliminate the stereotypes that have made risk tolerance useless. Use leading scientific theory to objectively pinpoint an investor's Risk Number®, whether you’re across the room or across the world.

Unlock the power of events in Retirement Maps. See how changing your client's Risk Number®, income, or expenses over time will affect their overall risk capacity.