Advisory firms are constantly looking for ways to differentiate themselves in the market to clients. If you lead a wealth management firm, or are trying to grow your book of business as a single advisor, you know the challenge of distinguishing your investment process and brand.

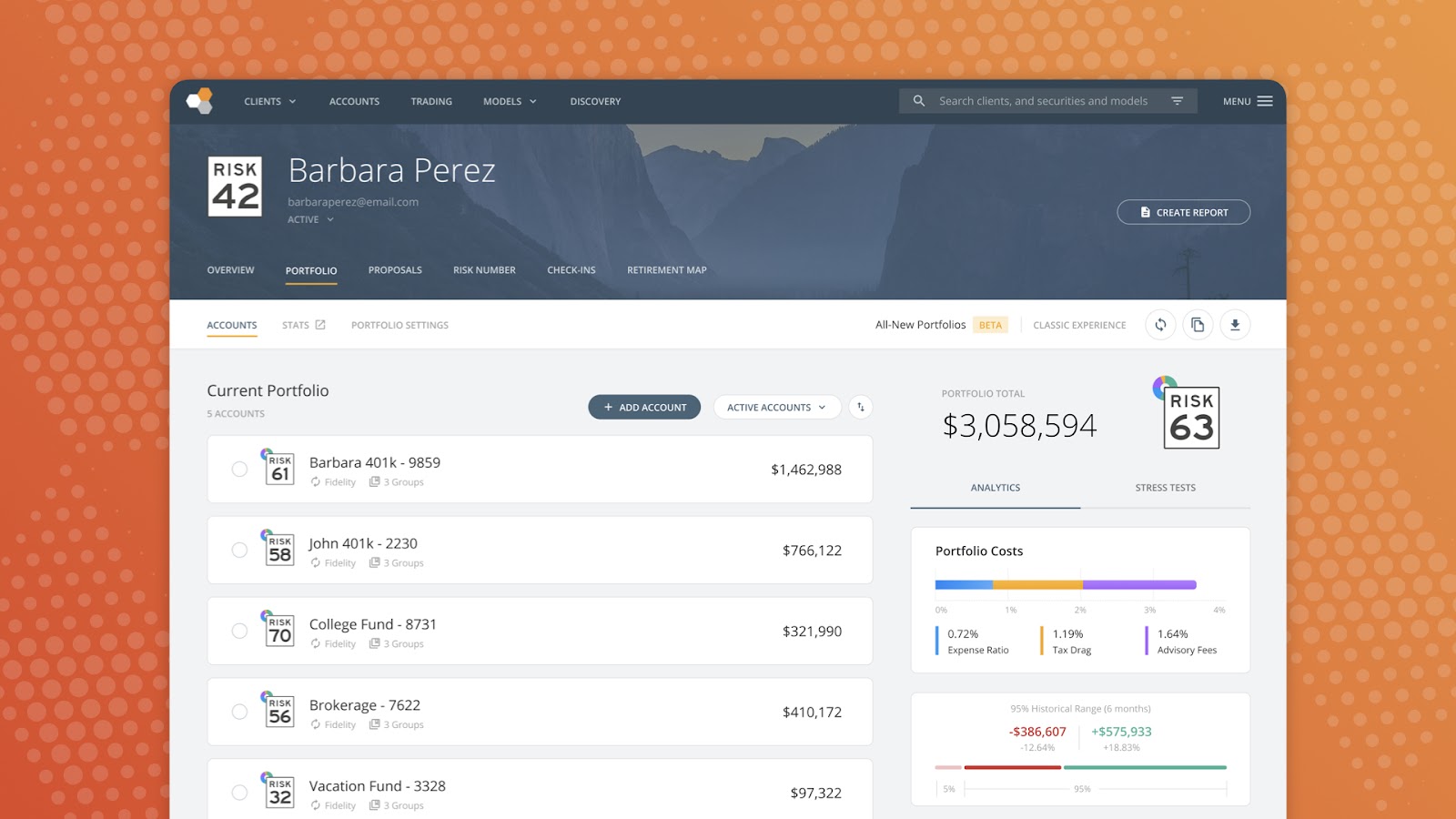

At Nitrogen, we’re proud to be a key differentiator for many advisory firms. For advisors using Nitrogen, there’s a solid chance that prospects that come into their office (in-person or virtually) have more risk in their current portfolio than they want or need. This happens about 88% of the time. When advisors can show them that their current advisor isn’t paying attention or doesn’t have the tools to really understand how to align them with their portfolio, that’s a powerful recipe for growth — which often leads to the ACAT form moment.

But what happens when a prospect’s portfolio already aligns with their risk tolerance?

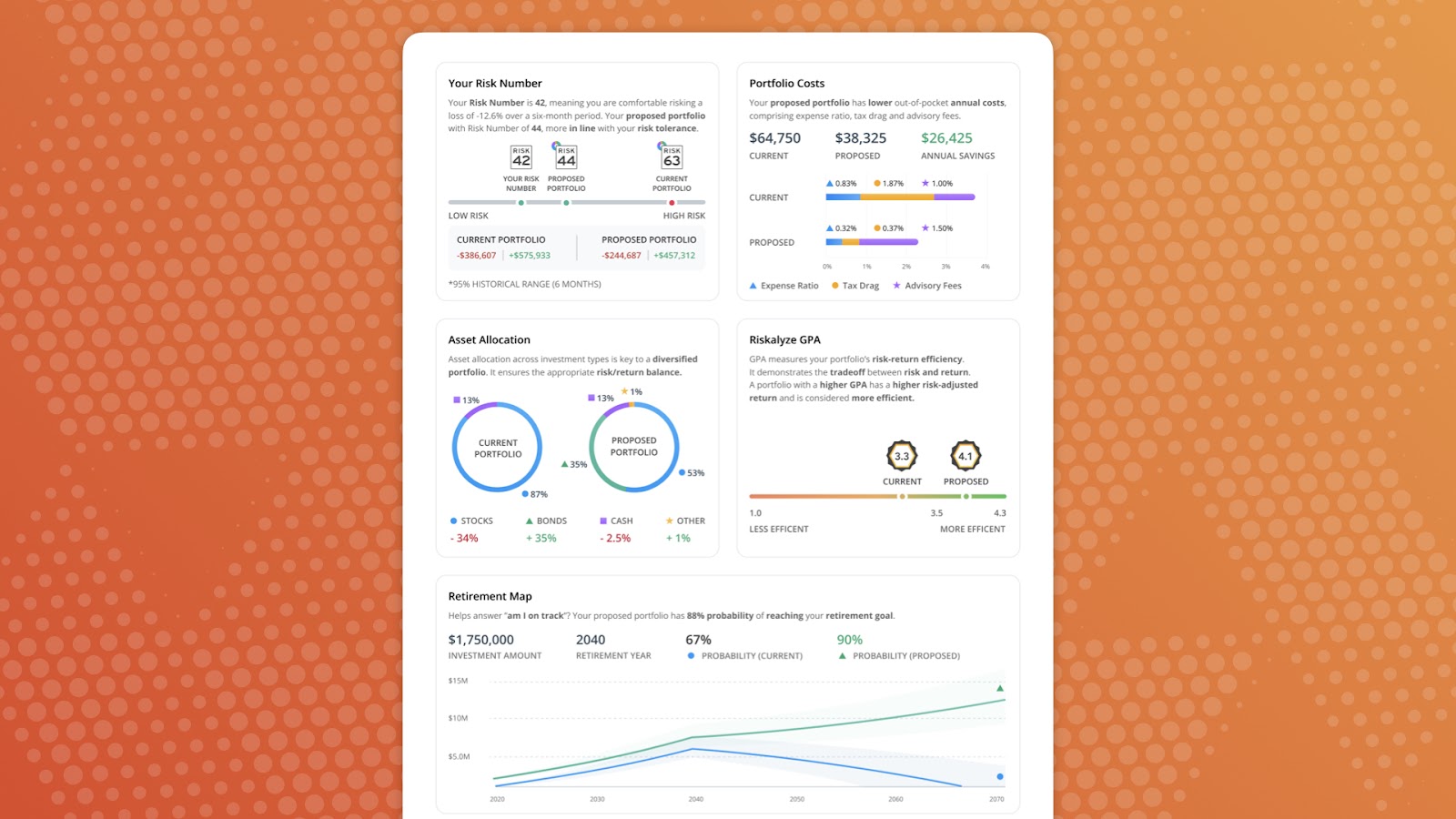

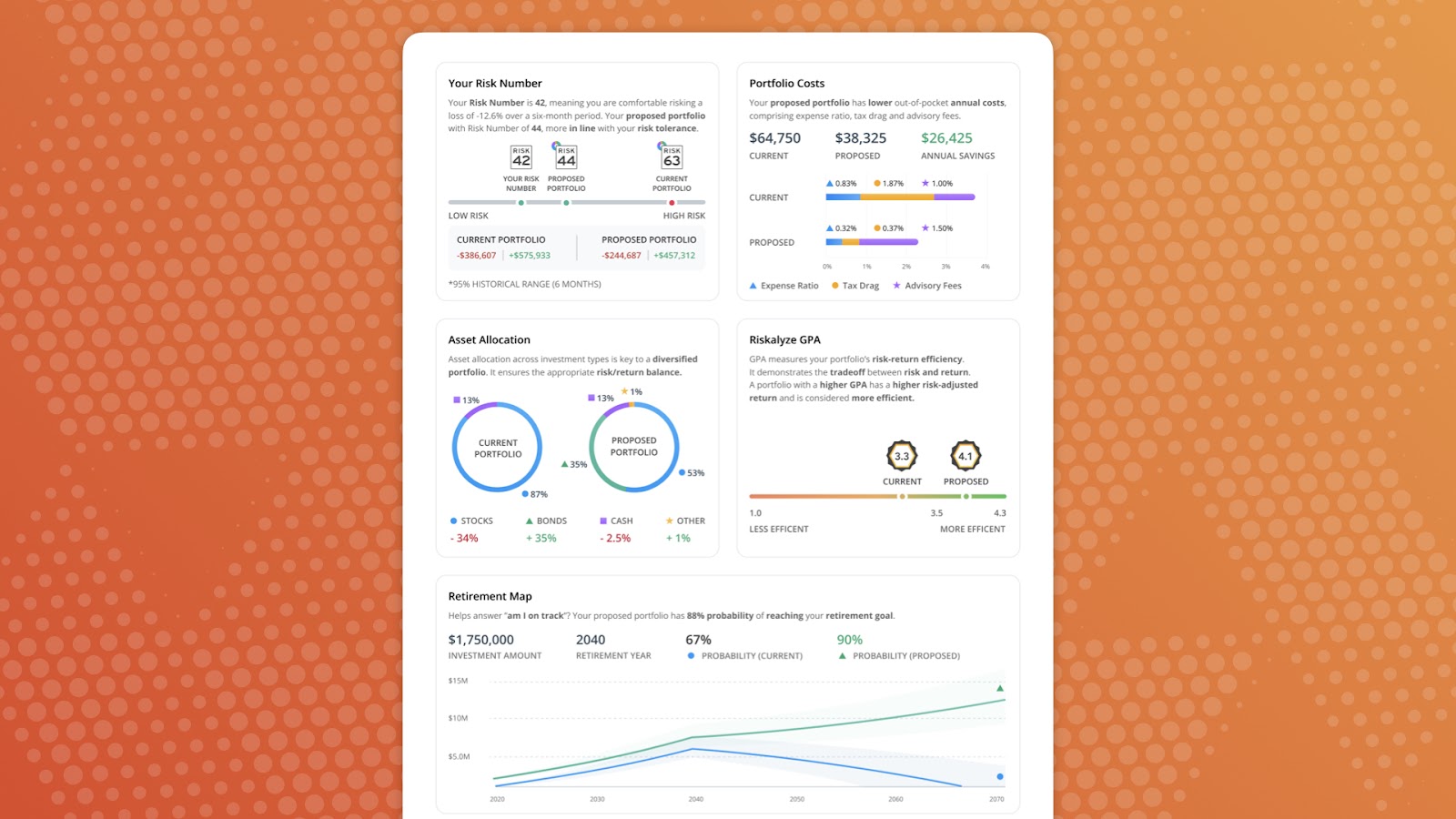

Over the last few years, advisors have been using GPA to answer that question. GPA is an easy-to-understand metric that illustrates how much return a portfolio is typically delivering in exchange for its risk.

GPA is a relative metric, and we like to say that you can be proud of any portfolio with a GPA of 3.5 or higher. There can be good reasons to put low-GPA funds into a portfolio, particularly if you think something about the future — in an asset class, a sector, or a geo — is going to be different than it has performed in the past.

Many advisors leverage GPA to say “hey, your current portfolio may have a Risk Number close to yours, but you are in a 2.9 GPA portfolio when the typical solution I’ve constructed for clients is a 3.6. That’s going to give us a better chance for upside, and maximize the return you get in exchange for the risk you need to take.” The GPA is a concept clients can easily connect with, and understand that at a baseline level, the higher the GPA, the better performance the portfolio.

But let’s say that the prospect’s risk is in line, and their GPA isn’t too shabby either. Do we give up? Is this just not a client we should expect to win?

Wouldn’t it be great if we had a third lever to drive a good comparison and create the opportunity for a win?

Underneath the hood of many ETFs, mutual funds, SMAs and other investment solutions lies a massive factor that can create a very meaningful difference in an investor’s actual return, particularly when you consider the impact of compounding.

Leveraging this factor as a competitive advantage creates a massive opportunity for you to stand out, and deliver superior returns compared to your competition.

What is Tax Drag?

Tax drag is defined as the reduction of return in a portfolio due to taxes. Now we’re not talking about the basic concept of “buy something in a taxable account and the client will owe capital gains when it gets sold.” That one is pretty obvious.

With tax drag, we’re looking at the relative efficiency of how the investment solutions you use in your portfolio are managed by the asset manager. Just like high internal expense ratios drag down returns, inefficient tax management of fund holdings can have a massive impact on the ultimate returns your client realizes. Tax drag illustrates this beautifully.

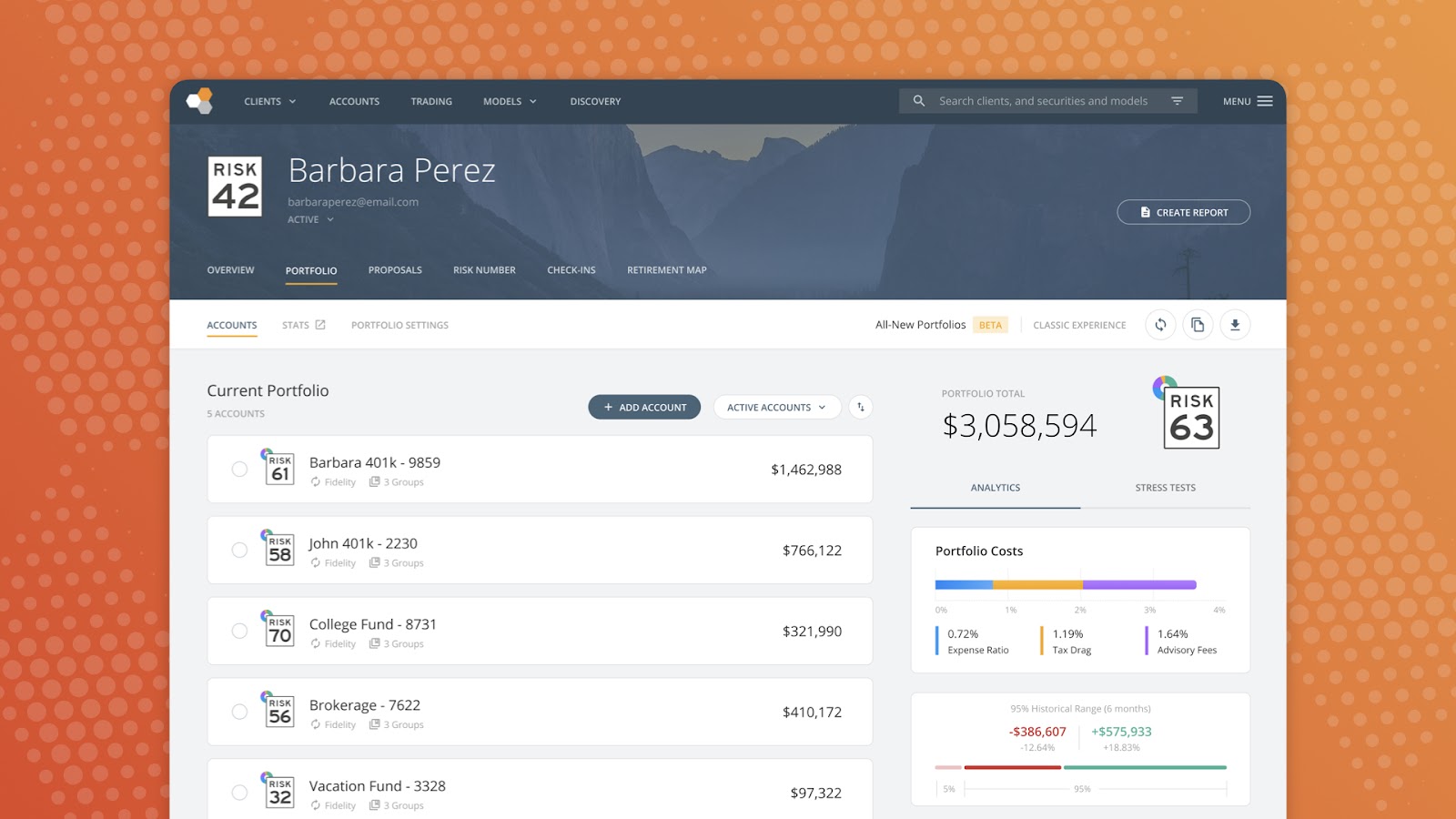

But, we didn’t just put tax drag on the portfolio screen. We designed a brand new Portfolio Snapshot report, which advisors can print on a standalone basis, or as a part of the proposal or IPS that Nitrogen generates.

Advisors can quickly access a side-by-side comparison of the advisory fee, internal expense ratios, and tax drag inherent in these portfolios. In this case, we’ve even modeled that the advisory fee is higher than the prospect’s current advisor, but it pays for itself by reducing tax drag!

There’s just something magical that happens when you can save clients money on taxes. It’s one of the most powerful things you can do as a financial advisor.

Where can I find Tax Drag?

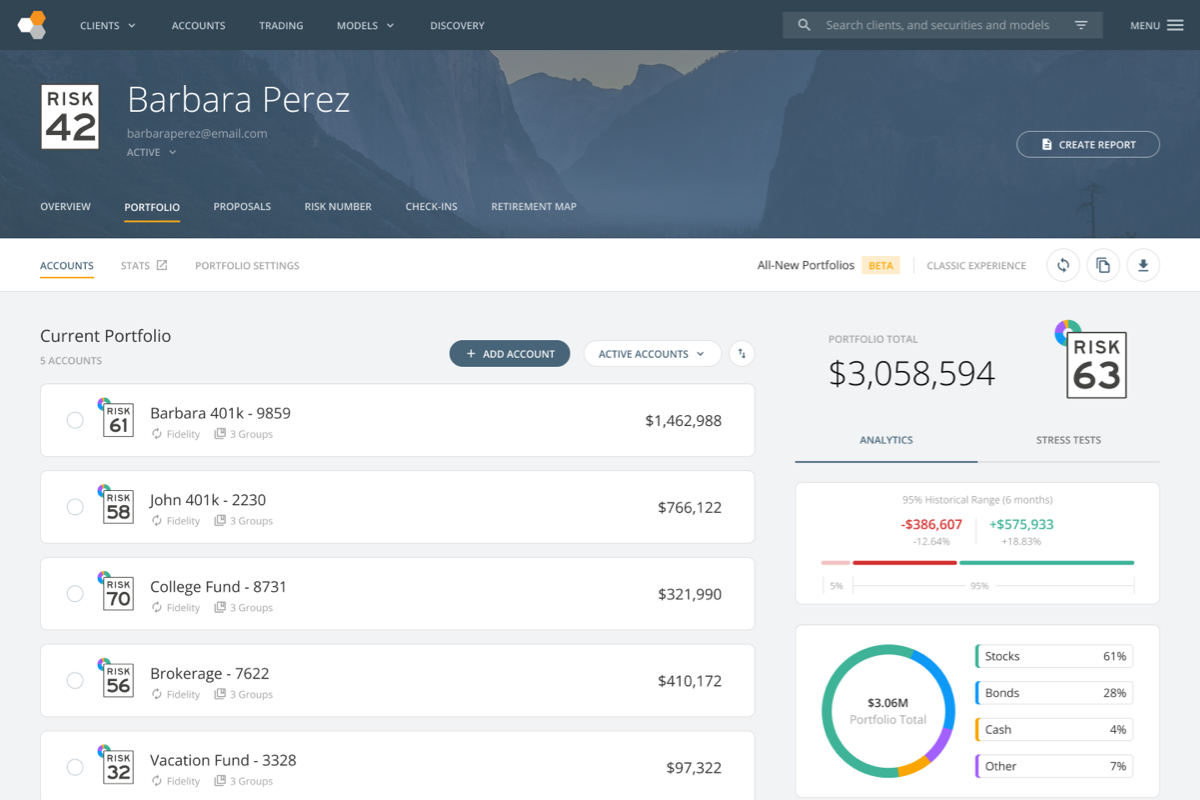

Tax Drag is coming later this year! We’ll first add it to Individual Security Analysis, Detailed Portfolio Stats, the Portfolios screen, and finally the new Snapshot report.

Subscribe to Nitrogen updates to get the latest announcements on tax drag and other product features. Join Nitrogen Labs to get an insider’s view of how you can turn fearful investors into fearless investors with our proprietary growth platform.