Unlocking Growth: Harnessing AI in Wealth Management

Will AI replace financial advisors?

It’s a question that’s been making rounds in the wealth management industry as advancements in artificial intelligence continue at a breathtaking pace. There’s an air of uncertainty, even apprehension, as we contemplate a future where advanced algorithms and AI automation hold sway. But as we delve deeper into this issue, we find a more nuanced reality.

Rather than being a harbinger of obsolescence for human advisors, AI is poised to be a powerful assistant, a tool that complements our human capabilities and enhances the overall effectiveness of financial advisors. AI doesn’t herald the end of human, financial advising; instead, it signals the dawn of a new era of partnership between technology and human expertise.

So where do financial advisors start? We recommend with OpenAI’s ChatGPT. OpenAI is a leading research organization for AI, and created ChatGPT. It offers Data Analysis, including the ability to communicate complex financial data, and is a helpful in training scenarios, helping wealth management professionals and their clients learn about various financial topics through interactive conversation.

Once you’re ready to begin, the best use of your time will be understanding how to write prompts. Writing prompts for ChatGPT are essentially instructions or questions that guide what kind of response you want from the AI. They can be straightforward requests or more complex queries, depending on what you’re aiming to achieve.

When crafting a prompt, clarity is key. Make sure your instruction or question is well-defined so that the AI can generate a useful and relevant response. For best results, provide as much context as you can to guide the AI’s response.

Here are a few prompts financial advisors could use with GPT-4 to help them in their roles:

- “What are the key financial considerations when starting a small business?”

- “Create a brief summary of the impact of rising inflation rates on a balanced investment portfolio.”

- “Write an email to a client explaining the advantages and disadvantages of investing in index funds.”

- “Outline a strategy for diversifying an investment portfolio to limit international exposure.”

- “How would economic indicators like GDP, inflation, and unemployment rates impact the bond market?”

- “Draft a retirement savings guide for a client in their 50s who started saving late.”

- “Generate an analysis of the potential impacts of the current tax legislation changes on a high-income earner.”

- “What are some financial planning strategies for individuals approaching retirement during an economic downturn?”

- “Create a simple explanation of dollar-cost averaging for a new investor.”

- “Write a script for a meeting with a client to discuss their portfolio’s underperformance.”

- “How to structure a 529 college savings plan for a client with a newborn baby?”

These prompts are just the beginning, and this is an area to unleash your creativity.

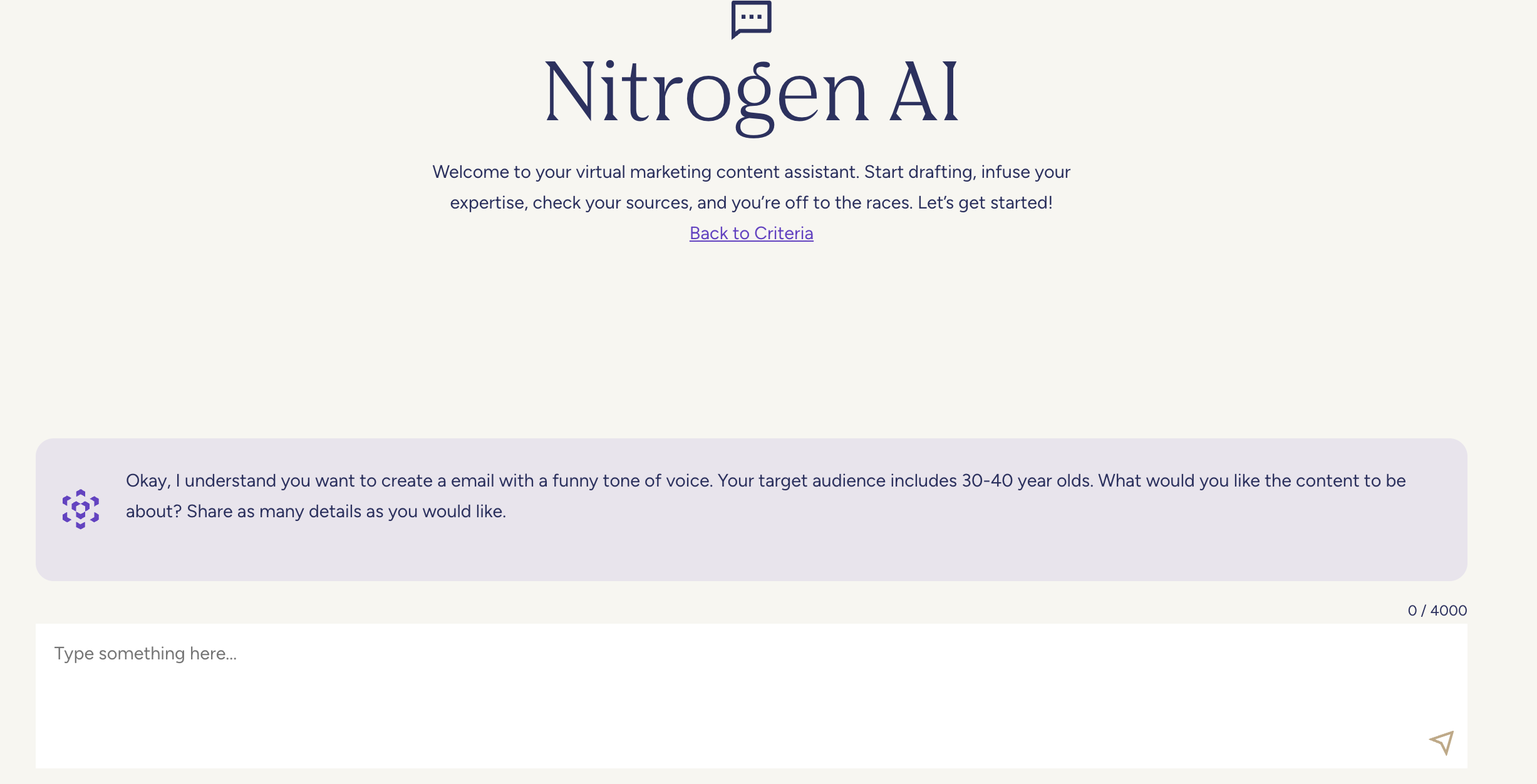

If you’re looking for a way to seamlessly introduce AI into your firm, we recommend starting with Nitrogen AI, available in the Nitrogen Marketing Kit. It is a leading AI tool for financial advisors and in practical terms, here’s what Nitrogen AI can do for wealth management firms:

- Client Communication

-

-

- Email Drafting: Nitrogen AI can help financial advisors draft responses or create first drafts of emails to clients, answering routine queries or providing regular updates.

- Report Writing: Nitrogen AI can assist in writing parts of financial reports, such as the summarization of data or initial drafting of analytical findings.

- Preparing Meeting Agendas: Use Nitrogen AI to help create structured meeting agendas, keeping discussions focused and productive. This is a leading use case with AI for financial advisors

- FAQs: Nitrogen AI can be used to compile Frequently Asked Questions (FAQs) for clients, saving time for the advisors.

-

- Content Generation

-

-

- Blog Posts: Nitrogen AI can generate outlines or even full drafts of blog posts on a variety of financial topics, helping to maintain an active online presence.

- Newsletters: Use Nitrogen AI to create engaging newsletters, providing clients with updates on financial news, the performance of their investments, or changes in the financial landscape. This speeds up what used to take hours and is an effective client communication tool.

- Social Media Content: Nitrogen AI can help draft informative and engaging social media posts for financial planners to reach a broader audience.

- Whitepapers: While more complex, you can use Nitrogen AI to help create initial drafts or outlines of whitepapers, providing in-depth information on specific financial topics.

-

- Research

-

- Concept Summaries: Use Nitrogen AI to summarize and explain complex financial concepts or trends in an easily understandable format.

- News Updates: Nitrogen AI can generate summaries of financial news articles, keeping advisors updated on the latest industry developments.

Remember, while Nitrogen AI can provide excellent information, and the tool wrote this post, it should be used in conjunction with human intelligence and industry-specific expertise. AI doesn’t replace the need for human financial advisors but can complement their work and enhance their effectiveness. To learn more about Nitrogen and using Nitrogen AI in your firm, schedule a demo here.