How Nitrogen’s Analytics Help Advisors Reduce Tax Drag

The two best ways to show your value to clients?

- Generate more income

- Reduce their expenses

But most of us don’t have a crystal ball to foresee market conditions, and making promises about returns to prospects or clients is generally frowned upon (to put it mildly).

For many advisors, the next best thing – behind developing sudden psychic abilities – is to provide tax optimization services that can help uncover money-saving opportunities for clients.

In this overview, we’re exploring how Nitrogen’s Tax Drag capabilities allow you to optimize client returns, differentiate your firm and enhance due diligence processes.

Back to the Basics: What is Tax Drag (and Why is it Important)?

“Tax Drag” is an umbrella term for the negative impact of taxes on a client’s returns, usually triggered by distributions and capital gains in non-qualified accounts.

Tax Drag is often considered a loss of income and a financial burden to clients, although the specific Tax Drag a client experiences will depend on their income, debts, accounts, and other factors. A recent SEI report on Tax Drag notes that “just about every change you make to your portfolio – an allocation adjustment, or even a distribution – can generate harmful side effects: taxes.”

For advisors that want to grow their book of clients and maintain a high level of service, manually optimizing Tax Drag is out of the question – it would simply be too complex and time-consuming.

Turning Tax Burdens into Client Benefits

Nitrogen is changing that equation. With our securities and portfolio-level analytics, your firm has access to the Tax Drag within each individual holding of a portfolio or proposal. In just a few clicks, you can ensure your client has the most tax-efficient portfolio possible.

Let’s explore a few of the key benefits Nitrogen’s Tax Drag provides:

1. You can enhance your due diligence process

As an advisor, it’s critical that you have due diligence processes in place to ensure your clients are receiving recommendations best suited for their needs. However, researching information surrounding a particular recommendation (and then finding a way to clearly present your findings to clients) can be time-consuming.

With Nitrogen’s Tax Drag, you have nearly instantaneous access to the potential tax implications of different investment options, displayed side-by-side with client insights.

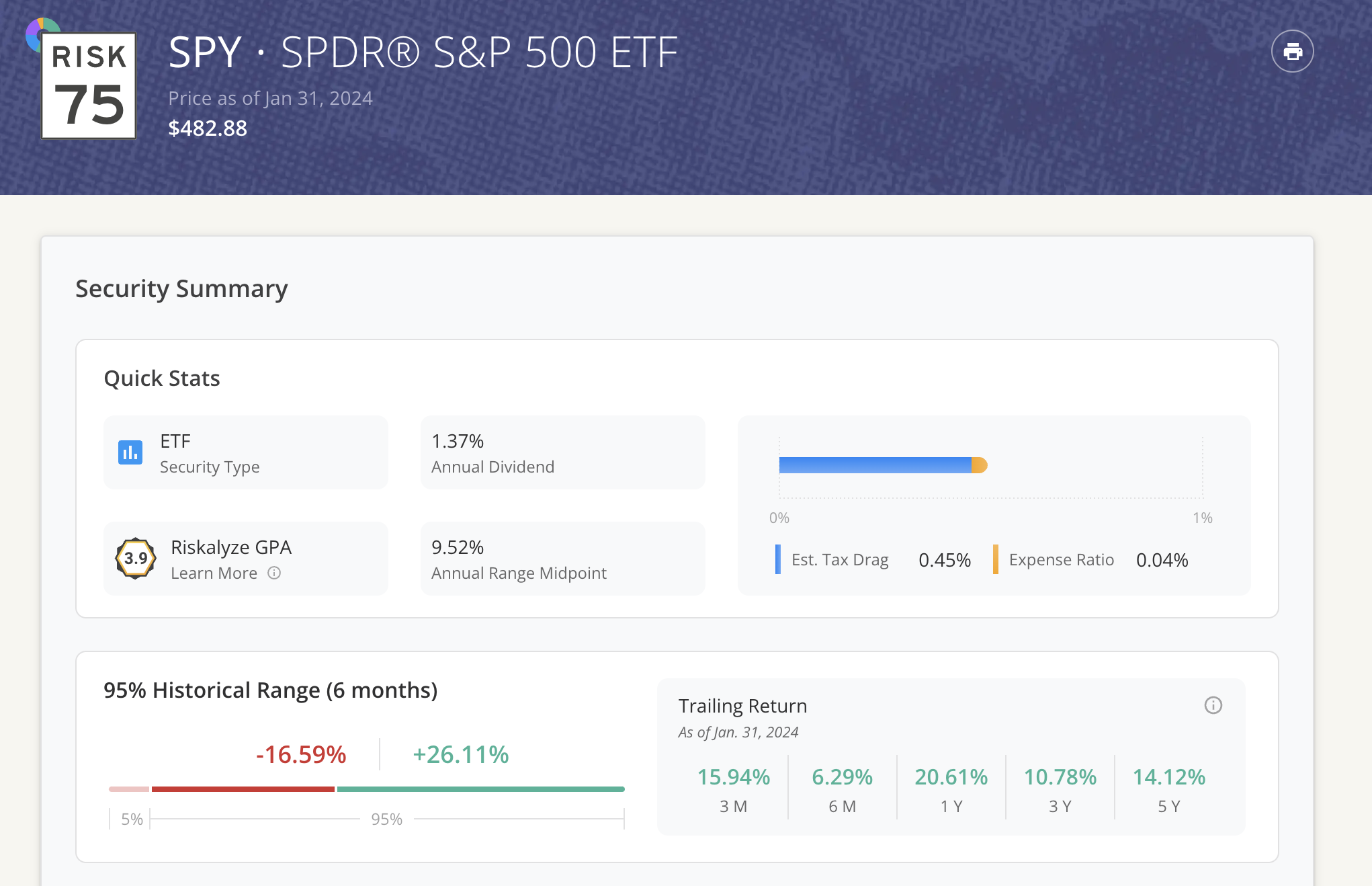

Below is an example screen of what it may look like when you click into an individual holding. Notice how the estimated Tax Drag is shown alongside other key information like the GPA and 95% Historical Range data.

With that data in hand, you can consistently select investments that are more tax-efficient for the client and better communicate the overall risks and returns within their portfolio.

2. You can speak your clients’ language and attract more prospects

When used correctly, numbers can tell a powerful story. In all likelihood, your clients may not even be aware of the money they’re losing out on due to Tax Drag.

By translating the impact of Tax Drag into real, tangible numbers, you demonstrate your commitment to their financial well-being and foster stronger relationships built on trust and transparency.

Plus, did you know that happy clients may actually lead to more clients? One recent study found that “advisors attribute about 88% of their new business to referrals from existing clients.”

Related: Win Prospects Faster with Tax Drag

3. You can uncover opportunities for portfolio optimization

Lastly, Nitrogen’s Tax Drag capabilities allow you to optimize your client portfolios for more savings. It goes beyond traditional return metrics, revealing hidden tax inefficiencies within individual securities and the portfolio as a whole.

Additionally, money saved through a reduction of tax liabilities can stay invested for long-term impact. Every penny saved is more than earned – it’s a penny compounded.

In the long run, smart tax strategies can translate to a significant boost in your clients’ wealth potential.

Related: How Tax Drag Highlights Stark Differences Between ETFs & Mutual Funds

Crunch the Numbers with Nitrogen

To start calculating Tax Drag within Nitrogen, you’ll need to set the taxable status of your new or existing account. For new accounts, you will be prompted to enter that information during the initial setup. For existing accounts, you can set the status by clicking the three-dot Menu, selecting Setting and clicking Tax Status.

Note that accounts set to “non-taxable” will not include Tax Drag data.

Calculating Securities-level Tax Drag vs. Portfolio-level Tax Drag

Nitrogen calculates Tax Drag in two primary ways: at the securities level and portfolio level.

For portfolios, Tax Drag is represented by the weighted average of the Tax Drag for each security within the portfolio, assuming a constant portfolio composition of at least three years.

Related: Explore our Detailed Portfolio Stats

At the securities level, you can calculate Tax Drag for stocks, mutual funds and ETFs. Nitrogen divides the after-tax return by the pre-tax return for a specific holding, with the assumption that the client pays the maximum federal rate on capital gains and ordinary income rate.

Tax Drag = [1 – ((1+AT) / (1+PT))] x 100, where AT = 3-Year Annualized Distribution After-Tax Return and PT = 3-Year Annualized Return (Pre-Tax).

Note that the after-tax return reflects the after-tax distribution return, meaning it does not include any assumptions or consideration for the tax consequences incurred for selling or liquidating positions. Additionally, any state and local tax liabilities are not included in the calculation.

You may not be able to see the future, but with Tax Drag you can reveal hidden tax inefficiencies and fuel growth. By embracing tax optimization and leveraging powerful tools like Nitrogen’s Tax Drag, your firm can better connect with clients and solidify your position as their trusted advisor.

Get Started with Nitrogen Tax Drag

Ready to uncover tax-saving opportunities for your clients? Click here to explore our quick guide on setting taxable statuses for new and existing accounts.

To see Nitrogen’s Platform in action, schedule a free demo today.