ETFs & Mutual Funds: How Tax Drag Highlights Stark Differences

By: Mark Bivens, Product Manager at Nitrogen

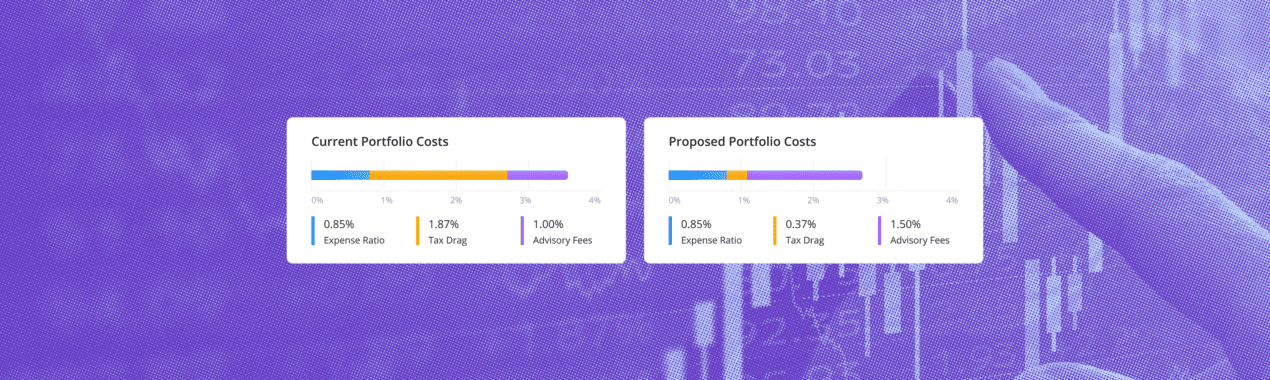

Earlier this year, our team rolled out Tax Drag, an entirely new way to win new business and prove your portfolios, models, and proposals are built in the most tax-efficient manner.

Tax Drag is defined as the reduction of a portfolio’s annualized return due to taxes. It’s the tax liability triggered by distributions and capital gains in a non-qualified account.

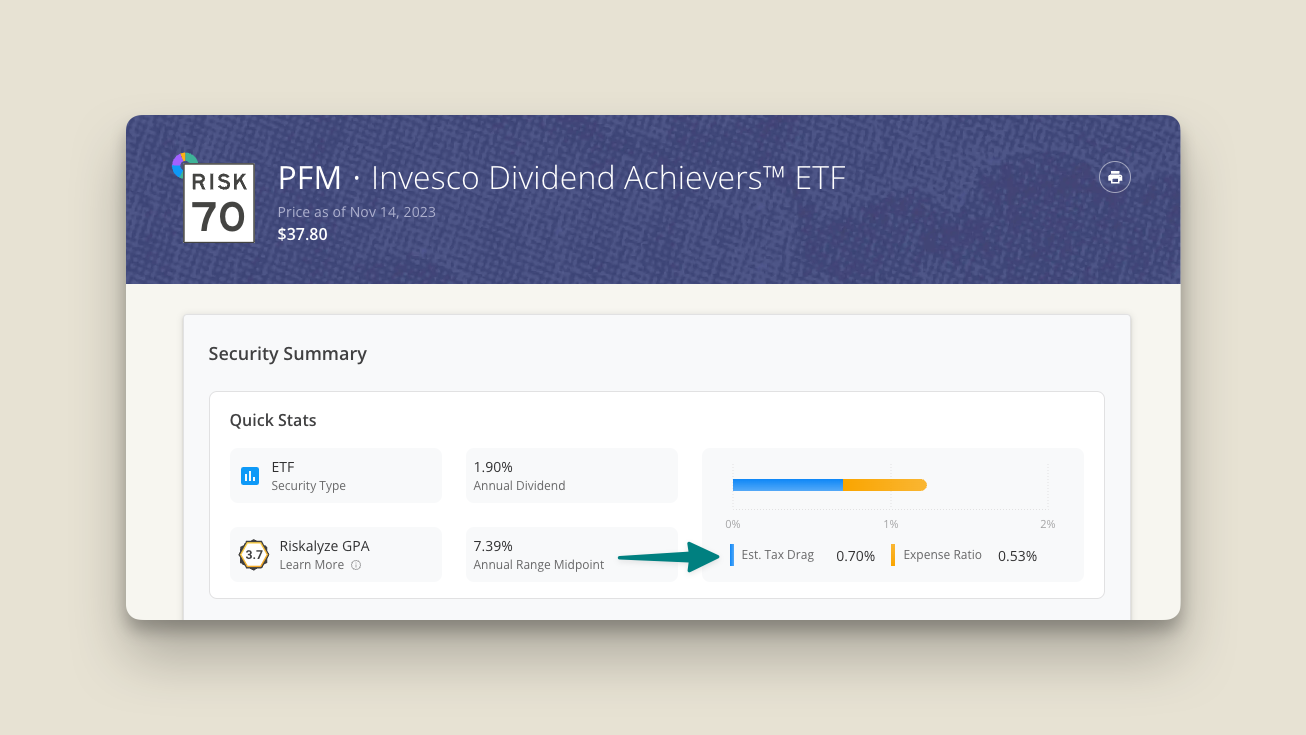

With the addition of Tax Drag to the portfolio screen, Individual Security Analysis, and Detailed Portfolio Stats, advisors now have an easy-to-understand metric to explain the taxable implications of owning a specific security to clients.

Now, advisors can easily show the tax implications—and erosion of gains—through a security’s distributions and dividends.

We wanted to learn more about how Tax Drag is affecting client portfolios, so we challenged our Risk & Analytics Team to look into the data from 2023.

After crunching the numbers, our team found a stark difference between mutual funds and ETFs. With the recent market turbulence, ETF fund managers have generally been able to maintain lower tax drag across their funds by a wide margin compared to their mutual fund counterparts.

Take a look at the data:

| Average Tax Drag as of Nov 1, 2023 | |

| Top 10 Growth ETFs | .39% |

| Top 10 Growth Mutual Funds | 6.69% |

September top 10 funds lists from Yahoo finance and Morningstar for top growth funds. Mutual funds – BCSIX, CIPMX, CIPSX, FDGRX, LSGRX, MPEGX, MSEQX, NWSAX, POAGX, POGRX. ETFs – IWP, IVW, SPYG, IWF, VUG, SCHG, ARKK, MGK, QQQ, QQQM*. *No coverage

The data is clear—we’re seeing a large reduction in tax liability for clients holding ETFs rather than their equivalent mutual funds.

This stark difference in Tax Drag is due to the ETF’s ability to absorb capital gains distributions through in-kind distribution. When an authorized participant wants to create or redeem shares, the ETF issuer can deliver them through actual shares of the underlying investments in the ETF. This passes the capital gains distribution to the authorized participant and shields the end investor from the taxable burden.

On the other hand, when an authorized participant wants to create or redeem shares in a mutual fund, the issuer must sell those shares prior to delivering cash, directly passing the taxable implication to the investor who holds the shares of the mutual fund. This takes away most of the compounding effect of holding the investment.

In a volatile market, like we’ve seen this year, many mutual fund issuers will take profits from their larger positions to hedge against further downside. While this protects fund managers, investors lose due to the additional market volatility and larger than usual tax bills due to capital gains distributions.

Unfortunately, the investor doesn’t even have to participate in the gains of holding the shares! If you are purchasing shares of a mutual fund today, and the issuer redeems shares or takes a capital gain distribution tomorrow, the client is on the hook for that distribution of gains that may have culminated long before their ownership in the fund.

While there are tax advantages to choosing ETFs over mutual funds, they are not always the right choice for every client. There may be reasons when clients need active management through mutual funds.

Regardless of which type of holdings you put into your client portfolios and proposals, the Nitrogen Growth Platform can help you articulate how clients should be investing.

If you’d like to get a demo of Tax Drag and all of the other powerful features in the platform, sign up for a demo here. We’d love to show you around.

Thanks as always for empowering the world to invest fearlessly.