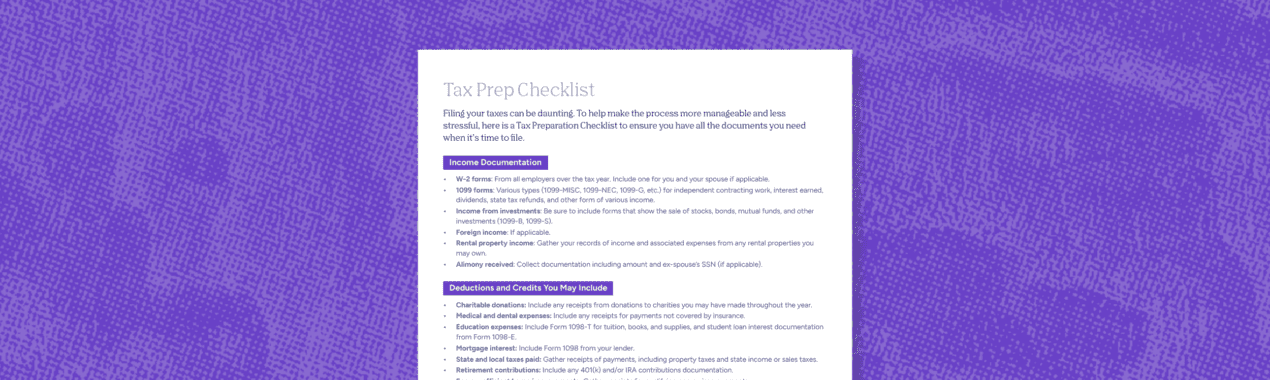

The Ultimate Tax Prep Checklist To Send To Your Clients

Taxes can be a daunting task for both the client and the advisor filing on their behalf. To help make the process more manageable and less stressful, we created this Tax Prep Checklist you can send to your clients to make sure they’re well prepared to file and help make your job a bit easier.

Income Documentation

- W-2 forms: From all employers over the tax year. Include one for you and your spouse if applicable.

- 1099 forms: Various types (1099-MISC, 1099-NEC, 1099-G, etc.) for independent contracting work, interest earned, dividends, state tax refunds, and other form of various income.

- Income from investments: Be sure to include forms that show the sale of stocks, bonds, mutual funds, and other investments (1099-B, 1099-S).

- Foreign income: If applicable.

- Rental property income: Gather your records of income and associated expenses from any rental properties you may own.

- Alimony received: Collect documentation including amount and ex-spouse’s SSN (if applicable).

Deductions and Credits You May Include

- Charitable donations: Include any receipts from donations to charities you may have made throughout the year.

- Medical and dental expenses: Include any receipts for payments not covered by insurance.

- Education expenses: Include Form 1098-T for tuition, books, and supplies, and student loan interest documentation from Form 1098-E.

- Mortgage interest: Include Form 1098 from your lender.

- State and local taxes paid: Gather receipts of payments, including property taxes and state income or sales taxes.

- Retirement contributions: Include any 401(k) and/or IRA contributions documentation.

- Energy-efficient home improvements: Gather receipts for qualifying energy improvements.

Records of Taxes Paid

- State and local income taxes: From the previous year if not already deducted or refunded.

- Estimated tax payments: Records of estimated federal and state tax payments made during the year.

Previous Year’s Tax Return

- Last year’s tax return: This can be useful for reference and for information that may carry over to this year’s return.

Miscellaneous

- Childcare expenses: Include records of payments to childcare providers, daycare expenses etc., including their tax ID numbers.

- Records of business income and expenses: Be sure to include any applicable income and documentation associated with your company if you’re self-employed or own a business.

- Educational scholarships or fellowships: If you’ve received any monetary rewards for your education, you may want to include any applicable documentation you have associated with it.

- Health Insurance: Include Form 1095-A if you enrolled in an insurance plan through the Marketplace.

Want to share this checklist with your clients? Download a copy of the Ultimate Tax Prep Checklist!

Share This Story

Related Resources