“What’s ‘normal’ for my portfolio?”

Continue reading “Expected Return of Portfolio: How to Discuss with Investors”

“What’s ‘normal’ for my portfolio?”

Continue reading “Expected Return of Portfolio: How to Discuss with Investors”

Losing clients can be discouraging at best, but…it happens. Even the best of advisors can’t keep everyone for the long haul. How are we supposed to keep those favorite clients around? Whether you’re looking to grow your business or become elite at retention, it’d be wise to ask and answer a simple question:

Financial Advisor Magazine conducted a study of nearly 1,400 advisors to discover the most common explanations clients gave for firing their previous advisor. Here are the top five documented reasons financial professionals get dumped.

Promoting your value by touting returns is old-school. Traditionally, we’d say something like, “We’re targeting an 8% return with this portfolio.” The investor doesn’t consider your long-term perspective, and only hears “8%.” Oops. We’ve locked in expectations. The market has only hit its own average once in about 25 years, and that’s a tough risk to take.

Number four is a logical progression of number five. If you paint a target that’s nearly impossible to hit, you shouldn’t be surprised when you miss it. If performance ends up anything lower than the expectations you’ve cast, you’ll hear, “Why aren’t I getting my returns?” And when things are looking up? “Why is the market beating my portfolio?” It’s a lose-lose. You’re fired.

We’ve all experienced the phone ringing off the hook. The best solution (beyond leaning into your CRM and a finely-tuned schedule) is to curtail the volume of voicemails you’re receiving by coaching your clients effectively. While no advisor could (or should) eradicate inbound inquiries completely, the best behavioral coaches receive the least amount of frantic calls spurred on by investment drama on CNN.

It seems like a wealth management 101 topic, doesn’t it? Of course you should demonstrate a crystal-clear understanding of your client’s retirement objectives and investing goals. So, why do half of all former clients feel they’ve been misunderstood? It certainly sounds like a by-product of The Best Interest Economy. Investors are more aware of the fiduciary standard they want from their advisor, and if you’re not on the same page, they’ll feel empowered enough to show you the door.

Great news — The number one reason clients fire their advisor is the simplest one to address. Imagine a client engagement process where communication is a two-way street. Proactive advisors develop a plan to check in with clients regularly and gauge their sentiment about their financial future. They then systematize their client engagement process inside their favorite CRM or other software.

The verdict is in: clients stick around if they’ve received clear, realistic expectations and are then proactively coached by their advisor. We’ve found that investors who receive little communication about their wealth make unfortunate, short-term decisions.

“How far can a portfolio fall within a fixed period of time before the investor will capitulate and make an emotionally-charged, poor investing decision?”

All of our research points to a simple truth: while investors should be focused on the long term, they react to risk in the short term, and emotional reactions to risk are the number one killers of long-term financial goals and results. So keep communicating, keep coaching your clients behaviorally, and keep them around for the long haul.

By: Caitlin Coker

Relationship Manager, Nitrogen

Continue reading “Educating Investors with Retirement Plans”

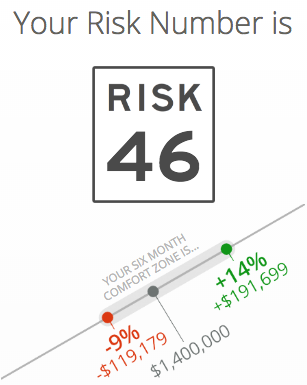

The Risk Number® is an objective, quantitative measurement of an investor’s true risk tolerance and the risk in a portfolio. Our patented technology calculates a “risk score” on a scale from 1-99, utilizing a scientific framework that won the Nobel Prize for Economics. As you can see, we’ve shaped it like a speed limit sign, so a higher Risk Number means a higher level of risk and potential return.

Thousands of firms have found it to be a far more efficient way to discuss risk with a client than subjective terms like “moderate” and “aggressive,” and the Risk Number also removes the danger of stereotyping investors based on age (young and aggressive, old and conservative). The subjectiveness of those terms is the most dangerous part of the equation; you could have an investor, an advisor, and a portfolio all labeled as aggressive, but they all could mean very different things by that term.

Understanding the Risk Number is simple, which makes it an invaluable resource for advisors. Clients get frustrated and confused when bombarded with standard deviations, Sharpe ratios, and scatter plots. It’s not that clients have too little information; the problem is that clients are overwhelmed. The Risk Number boils that complexity down into understandable terms—it is a simple way to communicate what percentage of potential downside risk a client is comfortable with over a six-month period.

We know that generalizing client risk tolerance doesn’t work. Investors view risk through their own, unique lens to gauge risk and return tradeoffs. The speed limit metaphor helps instill an understanding of that risk. Sometimes it’s prudent to slow down depending on weather conditions—the same is true of risk.

Much of the impetus of Nitrogen is centered in these questions to articulate a simple, objective measure for investors and advisors to deepen communication. Advisors orient conversations around how much risk investors can handle over the short term to hit their long-term objectives.

Here are a few examples of the relationship between downside risk and Risk Number:

| Potential Downside Risk | Risk Number |

|---|---|

| 0.00% | 1 |

| -1.50% | 20 |

| -5.50% | 35 |

| -9.50% | 50 |

| -15.00% | 70 |

| -20.00% | 85 |

| -25.00% | 90 |

| -35.00% | 95 |

| -40.00% | 97 |

| -55.00% or lower | 99 |

To determine a client’s Risk Number, advisors either use Nitrogen’s risk assessment, or they simply set a risk target if they already know the client well. Once an advisor has determined an investor’s Risk Number, they can choose one of our Risk Number model portfolios to match, import one of their own model portfolios, or build a unique strategy for the client. By building a portfolio whose aggregate downside risk potential aligns with the client’s risk tolerance, an advisor can set clear expectations and serve as a behavioral coach during market volatility.

Most people don’t know exactly how much risk is in their existing portfolio, which is why the Risk Number can be such a powerful tool for lead generation and getting new clients over the line. An advisor using Nitrogen can review an investor’s current investment portfolio, calculate its Risk Number, and compare it to that investor’s personal Risk Number. Often, we find a significant difference between the amount that investors are willing to risk and the amount of risk they are actually taking. This creates a powerful “seal the deal” moment where the advisor is to be able to speak well about the value they provide and how they’ll be able to help their clients maximize their satisfaction with their investment lineup. And for existing clients, it’s a way to be up-front and drive alignment between the risk the client has, wants, and needs.

The beauty of the Risk Number is how it empowers investors to stay the course during the short term so they don’t lose sight of the long term. We believe all long-term investors are made one short-term decision at a time, which is what makes our six-month historical range so effective. Every time an advisor designs a portfolio for a client, Nitrogen calculates a range (e.g. –7% to +12%) that constitutes a 95% probability for that portfolio’s outcome, six months from then. Put another way: A portfolio with a range that matches the client’s comfort zone therefore has a 95% probability of staying within the client’s risk tolerance. When the market dips, the Risk Number reminds a nervous client that they’re still within their risk tolerance.

Equipped with the Risk Number, advisors can focus the conversation on the client’s biggest fear—suffering losses—and turn that into the confidence needed to make the right decisions. It builds and deepens client-advisor relationships, and creates a common language that helps remove ambiguity. The Risk Number also empowers fearless investing by quantifying something as complex as an investor’s unique emotional reaction to risk and presenting it with the simplicity of a single number.

We’re such firm believers in the Risk Number that we’ve built an entire wealth management platform around this very concept. Nitrogen allows advisors to pinpoint how much risk their clients can handle, and aligns a client’s portfolio to match. Our robust financial advisor software provides tools for analyzing investment risk, automated trading, retirement planning, and building and implementing investment portfolios, all using our proprietary Risk Number® to help quantitatively measure investor risk tolerance, risk capacity, and portfolio risk on a scale from 1 to 99.

Here are just a few ways our core features align to the Risk Number:

If you’re looking to drive better alignment between your clients and their portfolios (and eliminate a lot of manual work and speculation in the process), you can book a demo of Nitrogen today. Our product experts will walk you through exactly how our platform will boost your productivity, protect your valuation, attract new clients, and help them understand how you’re looking out for their best interests.

Interested in digging into the Risk Number a bit more? Here are a few of our all-time favorites: